Create a Reward Points Calculator That Drives Sales

A reward points calculator is a simple, interactive tool that instantly shows customers two things: how many points they'll get for a purchase and what those points can buy. It cuts through the confusion and translates your loyalty program rules—like 10 points for every dollar spent—into a real, tangible value. That clarity is what gets customers to come back.

Why You Need a Reward Points Calculator on Your Site

Think of a points calculator as more than just a handy feature; it's a core part of your loyalty strategy. This isn't just about doing the math for your customers. It's about psychology. When people can see exactly how close they are to their next reward, it creates a powerful urge to bridge that gap. This is how you start turning first-time buyers into genuine fans of your brand.

By getting rid of any guesswork, the calculator builds a ton of trust. Customers aren't left wondering what their points are actually worth. Instead, you're giving them a clear, simple path to savings, which has a direct impact on their decision to buy from you again.

Turning Loyalty Points into Real Revenue

A well-designed loyalty program isn't just a nice-to-have for customers; it's a serious engine for growth. The numbers back this up. The global loyalty programs market is exploding, projected to hit $93.79 billion in 2025—a huge jump from $80.92 billion in 2024. This trend underscores just how critical reward systems have become, especially when you consider that over 90% of companies now offer some kind of loyalty program. You can discover more insights about the growing loyalty market and see where things are headed.

The main takeaway? A transparent calculator does more than just show a number. It highlights the value of the customer's relationship with your brand, making them feel seen and giving them a compelling reason to stick around.

The Strategic Edge a Calculator Gives You

Putting a points calculator front and center on your site delivers some clear advantages that you'll see in your sales numbers:

- Drives Repeat Purchases: It adds a fun, game-like element to shopping. Customers are often nudged to add one more item to their cart to hit that next reward level.

- Increases Customer Lifetime Value (CLV): When customers come back more often, the total amount they spend with you over time naturally goes up. It's a simple and effective way to grow CLV.

- Improves the User Experience: It gives customers instant answers, which means fewer support tickets and emails asking how your points system works.

Tools like Toki are designed to make this easy. The goal is to give every merchant the ability to build an engaging experience that makes customer relationships stronger and more profitable.

Designing a Points System That’s Both Profitable and Appealing

The heart of any great loyalty program isn't just about giving things away; it's about striking the right balance between customer generosity and business sustainability. Before you even touch a line of code for a calculator, you need to nail down the economics. The goal is to create a system that feels genuinely rewarding to your customers without eating into your margins.

A fantastic and widely used starting point is the 1% rule. It’s simple: for every dollar a customer spends, they get one cent back in value. This framework is easy for everyone to understand and gives you a solid foundation to build upon.

Setting Your Earning and Redemption Rates

Alright, let's get into the mechanics. The first piece of the puzzle is your earn rate—how many points a customer racks up for every dollar they spend. To make the numbers feel more substantial and motivating, I’ve found that most brands steer clear of a simple 1-point-per-dollar setup.

For instance, offering 10 points for every $1 spent just feels better to a customer than offering one point. It's a small psychological nudge that makes the process of earning rewards feel faster and more exciting.

Next up is the redemption value, which is what those points are actually worth when a customer wants to cash them in. Sticking with our 1% model, it would look something like this:

- Earn Rate: 10 points per $1 spent.

- Redemption Value: 1,000 points = $10 discount.

This structure gives customers a clear and achievable goal. Someone who spends $100 earns 1,000 points, which they can then use for a $10 discount on their very next purchase. You’ve created a simple loop where your effective discount rate stays at a very manageable 1%. For a deeper look at the nuts and bolts, you can explore more on building a points-based loyalty program that keeps customers coming back.

Tailoring the System to Your Margins

Here’s where you have to be honest with yourself about your numbers. There is no one-size-fits-all points system. Your profit margins are the single most important factor, and your program has to be designed around them to stay in the black.

A business with high margins, like a beauty or cosmetics brand, has a lot more wiggle room. They could easily offer a more generous reward rate, maybe 2% or even 3%, to really drive those repeat purchases. On the flip side, a business with tighter margins, like an electronics store, needs to be more conservative. Sticking closer to that 1% rate is a smart move to protect their bottom line.

To give you a clearer picture, here are a few common models you can adapt to fit your business goals.

Sample Point Earning and Redemption Models

This table shows three different loyalty program models, illustrating how you can adjust earn rates, redemption values, and effective discount rates for different business goals.

| Model Type | Points Earned per $1 | Points Needed for $10 Reward | Effective Discount Rate | Best For |

|---|---|---|---|---|

| Standard (1%) | 10 Points | 1,000 Points | 1% | Businesses with standard margins, looking for a simple and sustainable starting point. |

| Generous (2%) | 20 Points | 1,000 Points | 2% | High-margin businesses (e.g., cosmetics, fashion) aiming for rapid customer engagement. |

| Conservative (0.5%) | 5 Points | 1,000 Points | 0.5% | Low-margin businesses (e.g., electronics) that need to manage costs carefully. |

As you can see, a few small tweaks to the numbers can completely change the feel and financial impact of your program.

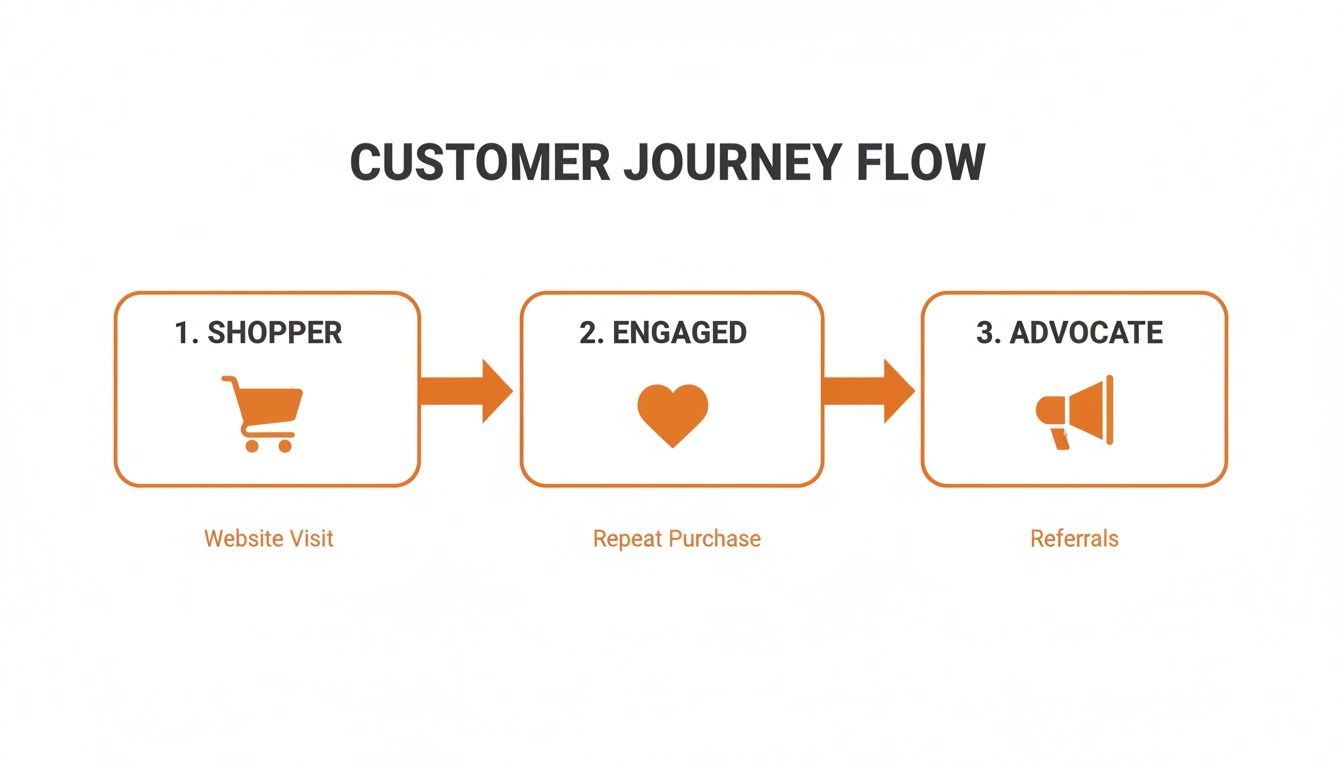

This is exactly how a well-designed program can transform a one-time buyer into a loyal brand advocate.

Think of your points system as the engine that powers this journey, moving customers from a simple transaction toward genuine brand loyalty.

Get Your Point Structure Down on Paper

Once you've settled on your rates, write them down. Seriously. This internal document becomes your program's bible, ensuring everyone from marketing to customer service is on the same page. Nailing this part is fundamental to understanding how to build a customer loyalty program that actually works.

Your documentation should clearly outline:

- The Core Earn Rate: How many points are earned per dollar (e.g., 10 points / $1).

- Redemption Tiers: The specific rewards customers can get (e.g., 1,000 points for $10 off, 2,500 points for $25 off).

- Bonus Actions: Points earned for things other than spending money, like creating an account, signing up for your newsletter, or a birthday bonus.

Having this framework locked in is absolutely essential. It eliminates confusion, empowers your team to confidently answer customer questions, and gives you the exact logic you need to build a reward points calculator that functions perfectly. Without it, you're just flying blind.

Modeling Your Loyalty Program ROI

Alright, you've figured out your points structure. Now for the fun part—forecasting the financial impact. Modeling your return on investment (ROI) isn't just a number-crunching exercise. It’s about getting a clear picture of how your loyalty program will actually shift customer behavior and fuel real growth.

The whole point is to predict the lift you'll see in core metrics like how often people buy and how much they spend. And a well-designed reward points calculator is the key that unlocks this, by making the value of your program crystal clear to your customers.

Forecasting Changes in Customer Behavior

To get started, let's ditch the abstract theories and create a couple of simple customer personas. This makes the whole concept of ROI much more real because you can ground it in what people actually do.

Let's imagine two of your typical shoppers:

- "The Occasional Shopper": We'll call her Sarah. She buys from you maybe twice a year, spending about $50 each time. Her current annual value to your business is $100.

- "The Brand Loyalist": This is Alex. He's already a fan and shops five times a year, with an average order of $80. His annual value is a solid $400.

Now, picture Sarah and Alex using your new rewards calculator. Sarah sees she’s just a few dollars away from a $10 reward and decides to add one more item to her cart. Alex realizes he can snag a free product on his next purchase if he buys this month instead of waiting.

See how that works? A calculator directly influences their decisions. It’s a visual nudge that motivates them to close the gap to their next reward, boosting both their immediate spending and how often they come back.

Calculating the Lift in Customer Lifetime Value

Ultimately, the true test of your program is its effect on Customer Lifetime Value (CLV). By giving people a reason to return, you turn one-off buyers into a predictable source of revenue.

Let's run the numbers. If your program gets Sarah, our occasional shopper, to make just one extra purchase per year and nudges her average order up to $60, her annual value skyrockets from $100 to $180. That’s an 80% increase from just one customer becoming a bit more engaged.

The data here is pretty convincing. Research shows that 73% of consumers will actively change their spending to get more loyalty benefits. Customers who redeem personalized offers can end up spending 4.5 times more each year, and their lifetime value can be 6.3 times higher than shoppers who don't engage. If you want to dive deeper into this crucial metric, you can learn more about the retention value formula and what goes into it.

These stats really drive home the point that a functional rewards calculator is much more than a gimmick; it's a powerful conversion engine. It delivers the transparency and motivation needed to turn passive window shoppers into active, loyal customers—which means higher profits for you. You can find more compelling loyalty program statistics that back this up.

Going through this modeling process helps you build a rock-solid business case for investing in a proper loyalty platform. When you can walk into a meeting with concrete projections for increased AOV, purchase frequency, and CLV, the value of the program speaks for itself.

How to Embed Your Calculator on Shopify

You've designed the perfect points system and modeled the ROI. Now for the fun part: getting your reward points calculator live on your storefront. The technical side of this might sound daunting, but trust me, modern loyalty apps are built to make this process incredibly simple, especially on a platform like Shopify.

Using a dedicated app like Toki takes all the guesswork out of the equation. Forget about hiring a developer or wrestling with code you don't understand. You can get a sleek, professional calculator up and running in minutes, all through a dashboard designed for merchants, not programmers.

Let's get your calculator live so it can start engaging customers and boosting your sales.

Activating and Customizing the Widget in Toki

The first move is to simply activate the loyalty program feature inside your Toki dashboard. Once you flip that switch, you’ll unlock all the widget customization settings. This is where you get to make the calculator truly yours.

You have full control over the little details that matter:

- Colors and Fonts: Tweak these to match your store’s branding perfectly. You want it to look like it belongs there.

- Placement and Triggers: You decide where it shows up and what makes it appear.

- Text and Language: Fine-tune the copy to reflect your brand's unique voice and tone.

This level of control is what makes the calculator feel like a core part of your website, not some tacked-on, third-party tool. That seamless integration is what builds trust and gets people to actually use it.

Generating and Placing the Embed Code

After you’ve styled the widget to your liking, Toki will hand you a simple embed code snippet. This little piece of code is all you need to add to your Shopify theme to make the calculator appear on your site. No need to understand how the code works—just where it needs to go.

The real key here is placing the calculator where it will have the biggest impact on buying decisions.

Where you place your calculator is everything. Don't just bury it on some forgotten loyalty program page. Put it right in the middle of the action where customers are making decisions. It should be a sales tool, not just a gimmick.

Think about these high-impact locations:

- On Product Pages: This is my personal favorite. As a customer is looking at a product, the calculator can pop up and show them exactly how many points they’ll earn for that purchase. It’s a powerful, immediate nudge to add that item to their cart.

- In the Customer Account Area: This is a no-brainer for logged-in members. They can see their current balance and calculate just how close they are to their next reward, which is a great way to encourage that next purchase.

- As a Floating Widget: A small, clickable icon that sits in the corner of the screen is a fantastic option. It makes the calculator accessible from anywhere on your site without ever getting in the way.

For those who want to go the extra mile and have a developer on hand, you can always explore using Toki's API for a fully custom loyalty program integration. This route gives you total freedom for a deeply unique implementation. But for most stores, the ready-to-use widget strikes the perfect balance between simplicity and impact.

Writing UX Copy That Actually Converts

You can build the most accurate, data-driven rewards calculator on the planet, but it won't move the needle if the words surrounding it are dry and confusing. Good UX copy is what turns a neat feature into a powerful sales engine. It’s what makes a customer actively add one more item to their cart just to hit that next reward tier.

The key is to keep your copy clear, concise, and laser-focused on the value for the customer. Ditch the internal jargon like "point accrual" or "redemption velocity." Instead, speak your customer's language with simple, exciting words that show them exactly what's in it for them.

Nailing Your Headlines and CTAs

Your headlines and calls-to-action (CTAs) are your front-line soldiers. They have one job: grab a shopper's attention and instantly communicate the benefit. A boring headline like "Points Calculator" is a massive wasted opportunity.

Instead, frame it from the user's perspective. What are they trying to do? Earn rewards. Save money. Get something cool. Your copy should reflect that.

Here are a few practical examples that I've seen work well:

- For a general calculator: "See What Your Points Are Worth"

- On a product page: "Earn 250 Points with This Purchase"

- In the shopping cart: "Calculate Your Rewards on This Order"

Notice how each one is specific and relevant to where the customer is in their journey. This makes the reward feel real and within reach, not some abstract concept.

Here's a pro tip I always share: lead with the benefit. Don't say, "Use the calculator to see your points." Instead, try, "See how much you can save with your points." That tiny shift—from the tool's function to the customer's gain—makes a world of difference in how people engage.

Tailoring Copy for Different Shoppers

A one-size-fits-all message rarely works. A first-time visitor needs a completely different kind of encouragement than a loyal member who’s just a few points away from a big reward. Smart segmentation makes the experience feel personal and much more persuasive.

Let's break down two common scenarios.

Scenario 1: The New Visitor (Logged-Out)

This person knows nothing about your program. Your goal is to make a great first impression and highlight the immediate value of joining.

- Headline: "Join Our Rewards Family & Start Earning!"

- Sub-copy: "Create an account to get 200 bonus points on the spot. See what you can earn on your first order!"

- CTA: "Sign Up & Earn"

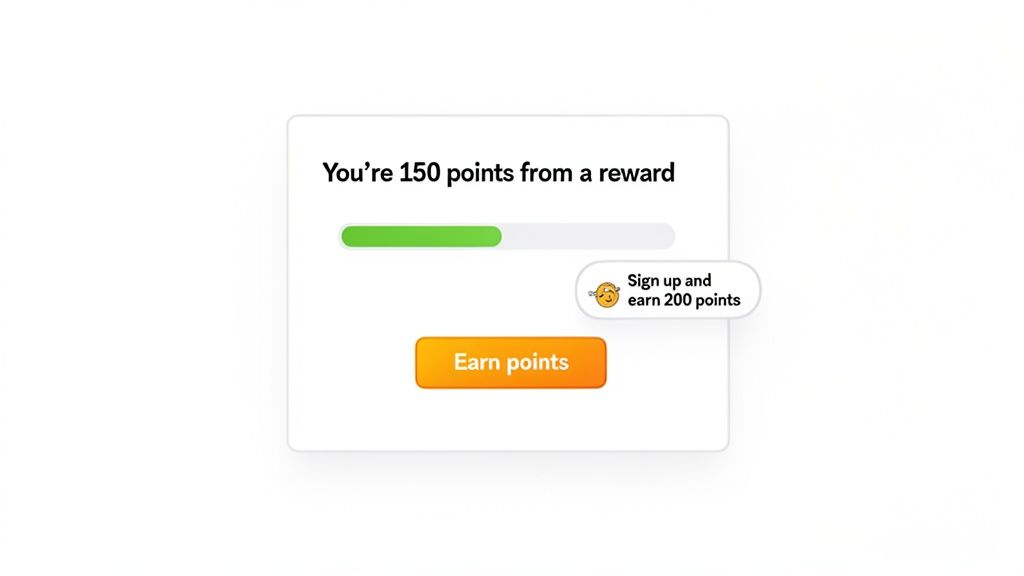

Scenario 2: The Returning Member (Logged-In)

This customer is already on board. Now, your job is to motivate them by showing their progress and creating a little FOMO (fear of missing out).

- Headline: "You're So Close, [Customer Name]!"

- Sub-copy: "You have 850 points. That's just 150 points away from a $10 reward!"

- CTA: "Find Your Next Favorite"

This kind of personalized, goal-oriented messaging shows customers that you see them and their loyalty. It gives them a clear, achievable target that makes that next purchase feel irresistible.

How to Test and Optimize Your Loyalty Program

Getting your reward points calculator launched is a fantastic first step, but the real work starts now. The best loyalty programs aren't static; they're dynamic tools that you constantly tweak and improve based on how your customers are actually using them. Think of this as an ongoing conversation, not a one-time setup.

Before you flip the switch and go live, you absolutely have to run through a pre-launch checklist. This isn't optional. Create a few test accounts and walk through the entire customer journey.

- Can a new customer sign up and see their welcome points instantly?

- Does a test purchase add the correct number of points?

- And the big one: can they redeem those points for a discount at checkout without a hitch?

Finding and fixing a bug now will save you a mountain of headaches and support tickets down the road.

Tracking Performance and Gathering Insights

Once your program is live, your Toki analytics dashboard is your new best friend. To truly understand if your program is driving results, you need to become obsessed with a few key performance indicators (KPIs).

Here’s what I always keep a close eye on:

- Enrollment Rate: What percentage of your customers are bothering to sign up? If this number is low, your call-to-action might not be visible or compelling enough.

- Redemption Rate: Are people actually cashing in their points? A low redemption rate is a huge red flag that your rewards aren't exciting or attainable enough.

- Purchase Frequency: This is the ultimate test. Are your members buying more often than your non-member customers?

This data-first mindset is essential. The loyalty management market is projected to explode to $41.21 billion by 2032, and a staggering 90% of companies are already planning to overhaul their programs. To stay competitive, you have to be willing to adapt.

Don't be afraid to experiment based on what the data tells you. If you see engagement start to dip, why not run a "double points weekend"? It's a great way to generate some buzz and drive a quick sales lift. Or, if you notice a lot of customers are stuck just below a reward threshold, consider adding a smaller, easier-to-reach reward to keep them in the game.

This cycle of testing and refining is what separates a mediocre program from a high-performing one. For a deeper dive into improving your program's effectiveness, check out these proven website conversion rate optimization strategies.

Your reward points calculator isn't just a static feature on your site. It’s your direct line to understanding what motivates your customers. Listen to what the data is telling you, and you'll build a program that keeps them coming back again and again.

Got Questions? We've Got Answers

Even the best-laid plans can bring up a few questions. When you're in the trenches building out a new loyalty program, it's normal for things to pop up. Here are some of the most common questions we get from merchants designing their first reward points calculator.

What’s a Good Starting Point for a Points-to-Dollar Ratio?

If you're looking for a solid, no-fuss starting point, aim for an effective cashback rate of 1% to 5%.

A simple 1% reward is often the sweet spot. You could structure it as 10 points for every $1 spent, where 1,000 points can be cashed in for a $10 discount. Customers get this instantly, and it provides tangible value without eating into your margins too much.

Of course, this isn't set in stone. If you're in a high-margin industry, bumping that up to 2% can give you a nice competitive edge. For businesses with tighter margins, sticking closer to 1% is a smarter move. You can always adjust later based on how your customers respond.

Can I Give Points for Things Besides Purchases?

Yes, and you absolutely should! This is how you turn a simple discount program into a genuine community-building tool. It's about rewarding engagement, not just transactions.

Modern loyalty platforms like Toki are built for this. You can easily award points for all sorts of valuable actions, such as:

- Creating a new store account

- Signing up for your email newsletter

- Leaving a product review

- Following your brand on social media

Think of it this way: these actions deepen the relationship a customer has with your brand. They're the little things that transform a one-time buyer into a long-term advocate.

How Do I Stop People From Gaming the System?

That's a smart question, and the answer lies in setting clear, automated rules from the get-go. A good loyalty platform will let you build in guardrails that protect your program without making it feel restrictive for your honest customers.

Your goal isn't to create a fortress of complex rules that might penalize your best customers. It's to build a transparent system that rewards genuine loyalty. Simplicity is your best defense against abuse.

With a tool like Toki, you can easily put these safeguards in place. For instance, you can set point expiration dates to encourage people to actually use them, put a cap on how many points can be earned from non-purchase actions, and exclude points from being earned on things like shipping fees or taxes.

Ready to build a loyalty program that customers love and that drives real growth? Toki makes it easy to create, manage, and optimize your reward system. Start building lasting customer relationships today.