Unlocking Profit with the Retention Value Formula

At its heart, the simplest way to calculate retention value is with this formula:

(Average Revenue Per User × Customer Lifetime) – Retention Costs

This little equation does a big job. It shows you the net profit you actually earn from keeping an existing customer, which is an absolutely essential metric for any e-commerce or subscription business to track.

Why the Retention Value Formula Matters

Think of your business like a garden. You could spend all your time and money finding new patches of dirt to plant single-season seeds (that’s customer acquisition). It's a constant, expensive effort.

The alternative? Nurture the perennial plants you already have. With a little care, they grow stronger and yield more and more each year. That’s customer retention. The retention value formula is the tool that tells you the exact financial payoff of nurturing those existing plants.

This isn't just a numbers game; it represents a fundamental shift in strategy. Instead of constantly chasing expensive new leads, you focus on cultivating profitable, long-term relationships that drive sustainable growth. Understanding this metric helps you make smarter decisions about where to put your marketing and customer service dollars.

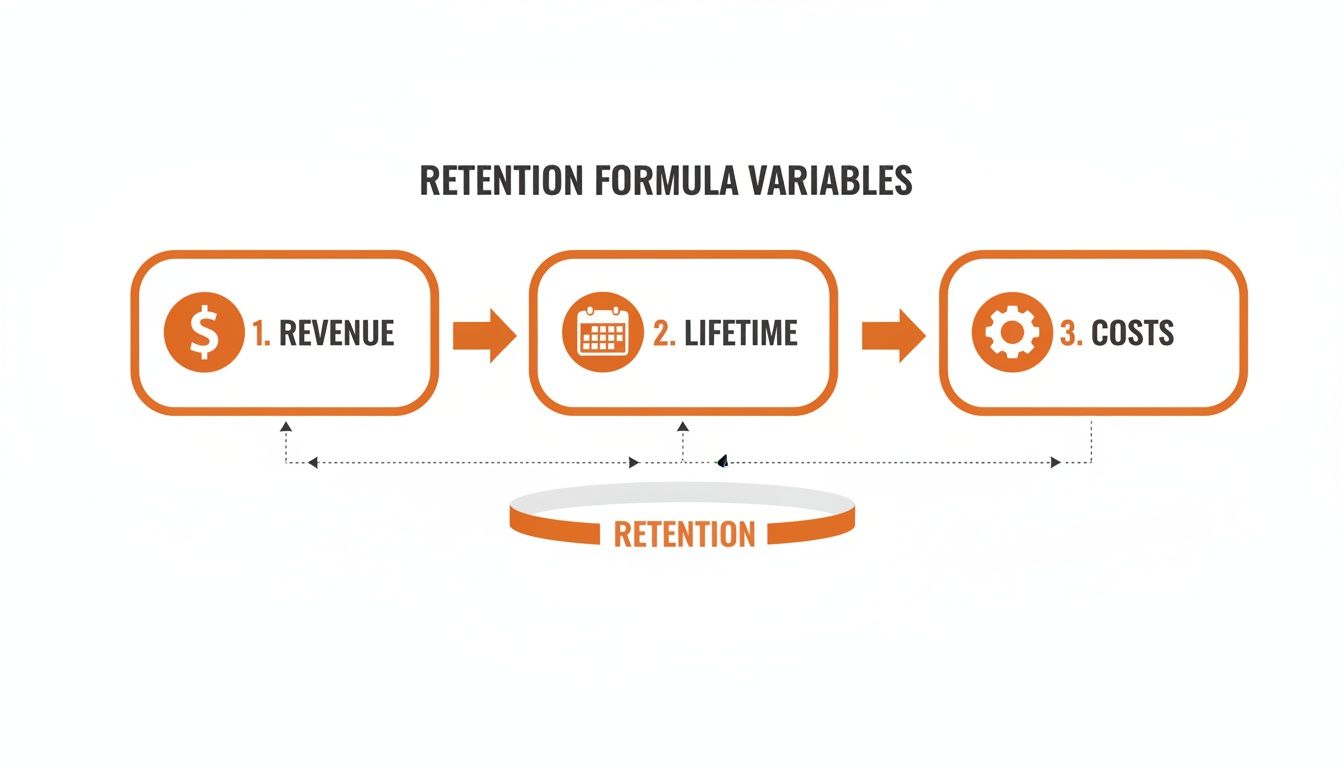

The Core Components of the Formula

To get a reliable retention value, you need to understand the three key ingredients in the formula. Each piece tells part of the story about your customer relationships and how well your retention efforts are working. Getting these numbers right is the first step toward unlocking some powerful insights.

Let's break down what goes into the calculation.

| Core Components of the Retention Value Formula | ||

|---|---|---|

| Component | What It Measures | Why It's Important |

| Average Revenue Per User (ARPU) | The average amount of money each active customer spends with you over a set period. | This represents the direct financial contribution from your loyal customer base. |

| Customer Lifetime | The total length of time a customer continues to buy from you. | A longer lifetime means more chances for repeat purchases and deeper engagement. |

| Retention Costs | All expenses tied to keeping your existing customers happy and engaged. | This includes everything from loyalty program discounts to support team salaries and targeted marketing campaigns. |

By bringing these elements together, the formula does more than just track revenue. It gives you a net profitability figure that accounts for the real costs of doing business.

This is why the retention value formula has become a cornerstone for businesses—especially in subscription-heavy markets like SaaS and e-commerce—that want to quantify the true profitability of keeping customers longer. You can find more about its importance in various leading industry analyses.

Key Takeaway: Retention value isn't just about how much customers spend. It’s about the net profit you generate from your loyalty-building efforts after all associated costs are subtracted.

Ultimately, this formula helps you answer a critical question: "Are our efforts to keep customers actually paying off?" It separates the high-value, profitable customer segments from those that might be costing you more to retain than they're worth. That clarity allows you to fine-tune your strategy, reallocate resources, and build a more resilient, profitable business from the inside out.

A Closer Look at Each Piece of the Formula

To get a retention value that actually means something, you have to trust the numbers you're plugging in. Think of it like a recipe—if your measurements are off or you grab salt instead of sugar, the result will be a disaster. Here, we'll put each variable under the microscope to make sure you’re sourcing the right data.

Even a small mistake in one variable can throw off the whole calculation, giving you a completely skewed view of your business's health. Let's break down each component so you can gather your data with confidence.

Average Revenue Per User (ARPU)

First up is your Average Revenue Per User (ARPU). This is simply the average amount of money one customer spends with you over a set period, like a month or a year. In the formula, this is the engine driving your revenue.

To get this right, you need to look beyond just the sticker price of your products. Make sure you include all the direct revenue your customers generate.

That means accounting for:

- Subscription Fees: Any recurring payments from memberships or subscriptions.

- One-Time Purchases: The classic product sales from your online store.

- Upsells and Cross-sells: Extra cash from add-ons or those "you might also like" recommendations.

- Service or Support Fees: Charges for things like premium support, installation, or special services.

When you add all these up, you get a much clearer picture of what a typical retained customer is actually worth to your top line.

Customer Lifetime

Next, we have Customer Lifetime. This tells you, on average, how long a customer sticks around. It's a direct measure of how good you are at building relationships and is tied directly to your churn rate.

In fact, Customer Lifetime is just the inverse of your churn rate. The math is straightforward:

Customer Lifetime = 1 / Churn Rate

So, if you have a monthly churn rate of 5% (or 0.05), your average customer lifetime is 20 months (1 / 0.05). A lower churn rate means a longer customer lifetime, which gives your retention value a massive boost. Getting a handle on churn is key, so for a deeper dive, check out our guide on customer retention rate calculation to really nail this fundamental metric.

Retention Costs

This is where a lot of people trip up. Retention Costs include every dollar you spend specifically to keep your current customers happy, engaged, and buying from you again. It’s a huge mistake to overlook these costs, as it artificially inflates your retention value and makes your strategy look more profitable than it really is.

These expenses go way beyond just a line item for marketing. They include both direct and indirect spending.

-

Direct Costs:

- Discounts and credits you give out through loyalty programs.

- The money spent on email campaigns targeting existing customers.

- The costs of running a referral program.

-

Indirect Costs:

- A percentage of your customer support team's salaries.

- Subscription fees for your tools, like marketing automation or a loyalty platform like Toki.

- The time and resources your team spends creating content just for your current customers.

Getting this number right is crucial. The proper way to calculate it is to divide your total retention spending by the number of customers you actually retained in that period. For example, if a brand spends $1 million on loyalty discounts, personalized emails, and support, and keeps 10,000 customers because of it, their per-customer retention cost is $100. Using your total customer count here would give you a deceptively low number and completely distort the true net value of your efforts.

By carefully sourcing accurate figures for ARPU, Customer Lifetime, and all your Retention Costs, you build a solid foundation. Only then can you trust that your retention value calculation is giving you real, actionable insights.

Crunching the Numbers: A Real-World Retention Value Example

Theory is a great starting point, but let’s get our hands dirty and see how the retention value formula works in the real world. We'll walk through a practical example using a fictional e-commerce store called 'Urban Apparel.' By starting with some simple, clean data, you can see exactly how the inputs flow together to produce a meaningful, actionable score.

The whole process boils down to balancing what customers bring in against what it costs to keep them around.

As you can see, retention value isn't just one number; it’s the net result of revenue, customer lifespan, and your investment in keeping those customers happy.

Step 1: Gathering the Data for Urban Apparel

Before we can plug anything into a formula, we need the raw numbers. Let's assume we've pulled the following data for Urban Apparel over the past year:

- Average Revenue Per User (ARPU): On average, their customers spend $50 per month.

- Monthly Churn Rate: The business loses about 4% of its customers every month.

- Annual Retention Costs: They’ve invested $180,000 over the year in things like loyalty discounts, targeted email campaigns, and the slice of customer support salaries dedicated to serving 1,500 retained customers.

These three numbers are our building blocks. Each one tells a different part of the story: what customers spend, how long they stick around, and what it costs to convince them to stay.

Step 2: Calculating Customer Lifetime

Our first calculation is to figure out the average customer lifetime. As you might guess, this is tied directly to the churn rate. The formula is refreshingly simple.

Customer Lifetime = 1 / Churn Rate

For Urban Apparel, the monthly churn rate is 4%, or 0.04 as a decimal. So, the math looks like this:

Customer Lifetime = 1 / 0.04 = 25 months

This tells us that the average customer stays loyal to Urban Apparel for just over two years. That 25-month window is the entire period where that customer is generating revenue.

Step 3: Finding the Per-Customer Retention Cost

Next up, we need to drill down from the total retention spend to the cost per customer. Knowing the big-picture number is useful, but we need to understand the investment on an individual level to see if it’s paying off.

The calculation is straightforward:

- Total Annual Retention Costs: $180,000

- Number of Retained Customers: 1,500

Per-Customer Annual Retention Cost = $180,000 / 1,500 = $120

So, Urban Apparel spends $120 each year to keep a single customer engaged. This number is the counterweight to the revenue each customer brings in. It’s also helpful to see how this compares to your acquisition costs—you can get a clearer picture using a customer acquisition cost calculator.

Step 4: Putting It All Together

We've done the prep work. Now it's time to assemble the pieces and find our final retention value.

Here's what we have:

- ARPU (Monthly): $50

- Customer Lifetime: 25 months

- Per-Customer Annual Retention Cost: $120

First, let's calculate the total revenue we can expect from one customer over their entire time with the brand.

Lifetime Revenue = $50/month × 25 months = $1,250

Next, we need the total cost to retain that customer over the same period. The annual cost is $120, which breaks down to $10 per month.

Total Retention Cost = $10/month × 25 months = $250

With both sides of the equation ready, we can solve for retention value:

Retention Value = $1,250 (Lifetime Revenue) – $250 (Total Retention Costs) = $1,000

A positive $1,000! This is great news. It confirms that Urban Apparel's retention strategy is turning a healthy profit.

The Power of Segmentation: A VIP Example

But what happens if we slice the data a bit thinner? Not all customers are the same. Let's look at Urban Apparel's 'VIP Members' tier.

- VIP ARPU: $120 per month

- VIP Churn Rate: 2% per month

- VIP Retention Cost: $20 per month (to cover exclusive perks)

Let's run the numbers for this high-value group:

- Customer Lifetime: 1 / 0.02 = 50 months

- Lifetime Revenue: $120/month × 50 months = $6,000

- Total Retention Cost: $20/month × 50 months = $1,000

- VIP Retention Value: $6,000 – $1,000 = $5,000

The difference is staggering. A VIP member's retention value is five times higher than an average customer's. This is why segmentation is a game-changer. Getting this kind of clarity often requires sifting through complex datasets, which is where expert marketing data analysis services can uncover these hidden, profit-driving insights. When you know which customer segments deliver the most value, you can stop guessing and start focusing your resources where they’ll make the biggest impact.

How to Interpret Your Retention Value Score

You've run the numbers and now you have a score. So what? What does that number actually tell you about the health of your business? Interpreting your retention value is where the data comes to life. It’s how you turn a simple metric into a story about your customer relationships and whether your growth is truly sustainable.

Think of it this way: a single number can tell you if your retention efforts are a profit center or a money pit. Let's break down what your score really means.

Decoding Your Score: Positive, Negative, or Break-Even

Your retention value score is like a quick health check for your entire customer loyalty strategy. Each result—positive, negative, or somewhere in the middle—paints a distinct picture and points you toward a very different set of actions.

A positive retention value is what we're all aiming for. It means the revenue a customer brings in over their lifetime is comfortably higher than what you spend to keep them around. This is a fantastic sign. It tells you that your loyalty programs, customer support, and engagement strategies aren't just working—they're actively adding to your bottom line.

A break-even score, hovering around zero, is a neutral but urgent signal. You're essentially treading water. While you aren't losing money on retention, you aren't making any either. This often happens when your retention costs are just a bit too high, or the lifetime value of your customers is just barely enough to cover those expenses. It's a call to optimize, fast.

Finally, a negative retention value is a major red flag. This is the danger zone. It means you are spending more money to keep a customer than they will ever spend with you. This model is completely unsustainable and is actively draining profits from your business. It demands an immediate, serious look at your retention spending and who you're spending it on.

The Big Picture: A positive score validates your strategy, a break-even score demands optimization, and a negative score requires a complete overhaul. Your score isn't just a grade; it's a guide for action.

Benchmarking Your Performance

Knowing your score is one thing, but how does it stack up against everyone else? Industry benchmarks provide crucial context. They help you understand if your "good" score is actually great, or if it's just table stakes in your industry.

The standards for e-commerce and Software-as-a-Service (SaaS) businesses, for instance, can be worlds apart because of their fundamentally different business models. E-commerce often deals with lower average revenue per user but can win with high purchase frequency. SaaS companies, on the other hand, live and die by high-value recurring subscriptions and have almost zero tolerance for churn.

So, how do you know if your numbers are healthy for your specific business?

The table below breaks down the typical ranges you might see for key metrics in both e-commerce and SaaS. This can help you frame your own retention value and see where you might have room to improve.

| E-commerce vs. SaaS Retention Value Benchmarks | |||

|---|---|---|---|

| Metric | Typical E-commerce Range | Typical SaaS Range | Notes |

| ARPU (Monthly) | $25 - $150 | $50 - $500+ | SaaS ARPU is often higher due to recurring subscription models. |

| Churn Rate (Monthly) | 3% - 10% | 1% - 5% | Lower churn is critical for SaaS growth and valuation. |

| Retention Costs | Lower (automated emails, discounts) | Higher (customer success teams, onboarding) | SaaS often requires more hands-on, expensive retention efforts. |

| Resulting Retention Value | Moderately Positive | Highly Positive | A successful SaaS model should yield a very strong positive value. |

Looking at these numbers, it’s clear that "good" is relative. A 5% monthly churn rate might be acceptable for an e-commerce brand but would be a serious problem for a SaaS company. Context is everything.

Going Deeper with Net Dollar Retention

To get an even sharper picture of your retention health, especially if you run a subscription business, it's worth looking beyond the basic retention value formula. One of the most powerful complementary metrics you can track is Net Dollar Retention (NDR).

NDR answers a more nuanced question: are the customers who stick around becoming more valuable over time? It measures revenue growth from your existing customer base by factoring in not just churn, but also upgrades and downgrades. The Net Dollar Retention (NDR) rate is indispensable for business leaders, using the formula: ((Starting Recurring Revenue + Upgrades – Downgrades – Churn) / Starting Revenue) × 100.

An NDR over 100% is the gold standard. It means your existing customers are spending more with you (through upgrades and expansion) than you're losing from the customers who leave. It’s a powerful sign of a healthy, growing business with a sticky product that customers love. For example, elite firms like Snowflake have hit an incredible NDR of 123%, proving their revenue grows even after accounting for churn. You can dig deeper into this metric over on Zendesk's blog.

Pairing your retention value score with NDR gives you a complete, multi-dimensional view of both customer loyalty and business momentum.

Actionable Strategies to Boost Your Retention Value

Alright, you've calculated your retention value. Now for the fun part: making it grow. Think of your score as a compass. A positive number means you're headed in the right direction and should press on, while a negative number is a clear signal to rethink your strategy.

This isn't just theory. We're going to break down proven tactics you can put into practice today. We’ll look at this from two angles, mirroring the formula itself: how to get more revenue from each customer, and how to spend less to keep them happy.

Let's dive into some real-world strategies that turn your retention insights into actual profit.

Elevate ARPU and Extend Customer Lifetime

The quickest way to pump up your retention value is to get customers to spend more and stick around longer. This isn’t about hard-selling them. It's about creating an experience so valuable they want to buy more and stay loyal. Get this right, and you'll see a powerful compounding effect on your bottom line.

Here are three high-impact ideas to get the ball rolling.

-

Implement a Tiered Loyalty Program A basic, one-size-fits-all rewards program is easy for customers to ignore. But a tiered system? That turns loyalty into a game. It gives customers a reason to consolidate their spending with you to unlock juicier perks, which directly drives up ARPU and builds a sense of belonging.

- Example: Imagine a coffee subscription brand. They could have a "Silver" tier for free shipping, a "Gold" tier for early access to new blends, and a "Platinum" tier that includes a free bag of high-end coffee every quarter. It creates a clear ladder for customers to climb, motivating them to bump up their order size or frequency.

-

Launch a Paid Membership Got a core group of die-hard fans? A paid membership program is the perfect way to cater to them while creating a predictable, recurring revenue stream. By bundling exclusive benefits—like a permanent discount, members-only products, or priority support—you're creating a segment of super-loyal customers who are far less likely to churn.

- Example: An online clothing store could launch a "$50/year VIP Club." Members get an instant 15% discount on everything, free express shipping, and access to a curated "members-only" collection. It immediately increases what they can afford to spend and locks in their business for the next year.

-

Personalize Upsell and Cross-sell Offers Nobody likes a generic, irrelevant product recommendation. But when an offer is based on your past purchases and feels like it was picked just for you? That’s not selling; that's being helpful. This is the secret to increasing your average order value without feeling pushy.

- Example: A skincare brand sees a customer just bought moisturizer for dry skin. Instead of showing them a random bestseller, their system recommends a complementary hydrating serum. That targeted cross-sell just feels right, and it's way more likely to convert.

Key Insight: The real goal here is to make every customer feel seen and valued. Whether you do it with tiered rewards or hyper-relevant product suggestions, creating a premium experience is the most reliable way to increase the lifetime gross profit you earn from each person.

For a deeper dive, our guide on improving customer lifetime value is packed with more ideas to keep your customers coming back.

Drive Down Retention Costs Efficiently

Now for the other side of the retention value formula: your costs. Lowering retention costs isn't about slashing your customer service budget or killing your loyalty program. It's about being smarter and more efficient, making sure every dollar you spend on keeping customers is working as hard as it possibly can.

This is about working smarter, not cheaper.

Automate Your Engagement Workflows

So much of customer communication is predictable. Automating these repetitive touchpoints frees up your team to handle the complex, high-value interactions that genuinely need a human touch.

- Welcome Series: Set up an automated email flow for new customers. Introduce your brand story, share tips, and maybe offer a small discount on their next purchase to get the relationship started on the right foot.

- Win-Back Campaigns: If a customer hasn't bought anything in 90 days, automatically send them a friendly "we miss you" email with a special offer to lure them back.

- Post-Purchase Follow-ups: After an order arrives, trigger an automated email asking for a review or sharing tips on how to use the product. It reinforces their decision and builds a sense of community.

Optimize Your Support Channels

Let's be honest: not all support questions are created equal. A live phone call is expensive and should be saved for complex, urgent issues. For the simple stuff, you can steer customers toward more efficient, self-serve options.

- Build a Robust Knowledge Base: Create a killer FAQ or help center that answers the top 80% of your most common questions. This will deflect a massive number of support tickets before they're ever created.

- Implement a Chatbot: A simple chatbot can handle the easy, first-line questions like "Where's my order?" or "What's your return policy?" It gives customers instant answers and frees up your human agents for the tricky problems.

Putting these strategies into play can dramatically lower your per-customer retention cost without making your customers feel like you're cutting corners. The magic is in balancing smart efficiency with a genuinely helpful experience. Of course, to get the full picture of profitability, you also need to know what it cost to get that customer in the first place. A good customer acquisition cost calculator will help you balance that side of the equation for truly sustainable growth.

Answering Your Questions About Retention Value

Even the clearest formula can spark a few questions when you start putting it into practice. Let's tackle some of the most common ones that pop up when teams begin working with retention value.

Think of this as a quick-reference guide to help you sidestep common hurdles and use this metric with confidence.

How Often Should I Calculate Retention Value?

For most e-commerce brands, hitting the sweet spot means calculating retention value on a quarterly basis. This rhythm is frequent enough to catch important trends without getting lost in the noise of small, monthly sales blips.

That said, if your business runs on subscriptions or operates in a particularly fast-paced market, switching to a monthly calculation might give you the more immediate feedback you need. The most important thing? Consistency. Whatever timeline you choose, stick with it. That’s the only way to get reliable, comparable data over the long haul.

Is It Possible for Retention Value to Be Negative?

Yes, it absolutely can be—and it's a massive red flag. A negative retention value is a clear signal that you’re spending more to keep a customer than they will ever generate in revenue for you.

Simply put, it’s an unsustainable model. This usually happens with customer segments that have razor-thin margins or require costly, hands-on support. If you find a group with a negative value, you need to rethink your strategy for them, and fast. The only way forward is to either slash your retention costs for that segment or find a way to increase what they spend with you.

How Is This Different from Customer Lifetime Value (CLV)?

They're related, but they tell you different things. Think of them as close cousins. Customer Lifetime Value (CLV) is all about the total gross revenue or profit a customer brings in over their entire relationship with you. The retention value formula, on the other hand, is a specific net calculation that zooms in on the cost of your retention marketing and service efforts.

Here’s a simple way to frame it: CLV tells you what a customer is worth. Retention value tells you the net profit you’re making from the specific things you do to keep that customer around. It’s all about the direct ROI of your retention strategy.

What Tools Can Help Me Track This Data?

Getting an accurate retention value score usually means pulling data from a few different places. The key is to bring it all together.

Here’s where you’ll find the puzzle pieces:

- Average Revenue Per User (ARPU): This number lives in your e-commerce platform, like Shopify, or your payment processor, like Stripe.

- Customer Lifetime: You'll calculate this from churn data, which you can usually find in your CRM or subscription management software.

- Retention Costs: This one can be tricky. It requires you to tally up expenses from your accounting software, marketing automation platforms (for email and SMS campaigns), and customer support tools.

A central analytics dashboard or a business intelligence (BI) tool is your best bet for combining these sources into one clear picture. Of course, platforms built specifically for loyalty and retention are designed to track these figures for you automatically.

Ready to put these ideas into motion? Toki is an all-in-one loyalty platform that helps you improve every part of the retention value equation. From increasing ARPU with tiered memberships to automating the engagement that keeps your costs down, it’s all there. Discover how Toki can help you build lasting customer relationships and drive repeat sales.