Customer Retention vs Customer Acquisition The Definitive Guide

Every business owner eventually faces the same big question: should we pour our energy into finding new customers or focus on keeping the ones we already have? The truth is, you can't have sustainable growth without doing both. Customer acquisition is your growth engine, while customer retention builds the profitable, stable foundation you need to last.

Understanding the Core Debate

The conversation around customer retention vs. customer acquisition isn’t about picking a winner. It’s about understanding their unique roles and knowing where to put your resources at the right time. Each strategy hits a different part of the customer journey and delivers very different outcomes.

Defining the Two Pillars of Growth

Customer acquisition covers all the things you do to turn strangers into first-time buyers. Think marketing campaigns, social media ads, and lead generation—anything that builds awareness and drives that initial sale.

Customer retention, on the other hand, is all about nurturing the relationships you've already built. The goal here is to encourage repeat business and create real loyalty, maximizing the value of every customer you've worked so hard to win. This is how you build reliable, recurring revenue and even turn happy customers into brand advocates. Nailing this balance is the core of any solid eCommerce growth strategy.

Because their focus is so different, the costs, tactics, and metrics for each are worlds apart.

While acquisition fills the top of your funnel, retention is what stops your business from being a leaky bucket. It's the secret to long-term profitability and predictable revenue.

A Quick Comparison

To kick things off, let's look at these two critical functions side-by-side. We’ll dive much deeper into each of these areas, but this gives you a high-level view of how they stack up.

| Aspect | Customer Acquisition | Customer Retention |

|---|---|---|

| Primary Goal | Attract and convert new customers. | Encourage repeat purchases and build loyalty. |

| Target Audience | Prospects and leads who have not yet purchased. | Existing customers who have made at least one purchase. |

| Typical Cost | High; often 5-25 times more expensive. | Low; focused on engagement and relationship building. |

| Key Metrics | CAC, Conversion Rate, Lead Velocity. | CLV, Churn Rate, Repeat Purchase Rate. |

| Strategic Focus | Brand awareness, lead generation, first purchase. | Customer satisfaction, loyalty programs, personalization. |

Analyzing the Financial Impact of Each Strategy

When you get down to the brass tacks of customer retention versus acquisition, the numbers tell a compelling story. Everyone’s heard the old adage that keeping a customer is cheaper than finding a new one, but the real magic is in the compounding value and superior return on investment (ROI) that a solid retention strategy delivers over time.

Acquisition is, of course, the fuel for your business—an essential upfront investment. This is where you spend big on ads, content, sales efforts, and those tempting first-purchase discounts. The goal is to grab attention and secure that initial sale, and your success is measured by Customer Acquisition Cost (CAC).

Retention, on the other hand, runs on a much leaner budget. The costs here are tied to things like loyalty programs, great customer service, and other initiatives designed to nurture the relationship you’ve already built. It's just inherently more efficient because the trust is already there.

The True Cost of Growth

So, what’s the real difference in cost? The most common stat you'll see is that acquiring a new customer can cost anywhere from five to 25 times more than retaining an existing one. That’s not just a nice marketing line; it’s a financial reality. It’s the difference between trying to introduce yourself to a stranger in a crowded room versus simply continuing a conversation with a friend.

To get a real handle on this, it’s critical to have a clear picture of what you’re spending. A great starting point is understanding Cost Per Acquisition (CPA). Once you nail that down, the lower cost of retention becomes glaringly obvious.

An over-reliance on acquisition without a strong retention plan is like constantly pouring water into a leaky bucket. You might keep it full, but the effort and expense are unsustainable in the long run.

Return on Investment The Retention Multiplier

The financial gap gets even wider when you look past the initial cost and focus on ROI. Retention doesn’t just save you money; it makes you more.

A tiny 5% increase in customer retention can boost your profits by a massive margin—far more than the same investment in acquisition. Why? Because loyal customers simply spend more. On average, they spend 67% more than new customers, and their value grows with every repeat purchase.

This compounding effect is what transforms your customer base from a simple revenue stream into an appreciating asset.

The Financial Impact at a Glance

Let's break down how these two strategies stack up financially. The table below offers a straightforward comparison of the key economic differences.

Financial Impact Acquisition vs Retention

| Metric | Customer Acquisition | Customer Retention |

|---|---|---|

| Initial Cost | High (ad spend, sales, marketing) | Low (loyalty programs, service) |

| ROI | Lower, often negative on first sale | Higher, typically 5x that of acquisition |

| Profitability | Delayed, requires multiple purchases | Immediate and compounding |

| Customer Spend | Lower initial transaction value | Spends 67% more on average over time |

| Revenue Stream | Unpredictable, transaction-based | Predictable, relationship-based |

As you can see, while acquisition is necessary to bring people in the door, retention is what builds a profitable, long-term business.

Building a Sustainable Financial Model

A healthy e-commerce business runs on a simple principle: the lifetime value of a customer needs to be much higher than the cost to acquire them. Pouring all your resources into acquisition, especially as ad costs climb, can quickly drain your margins.

A balanced approach works best. Use acquisition to fill the top of your funnel, but have a rock-solid retention plan ready to engage those new customers from day one. The first step is to get a firm grip on your numbers. Properly https://www.buildwithtoki.com/blog-post/calculating-cost-of-customer-acquisition is crucial for building a growth engine that's not just powerful, but truly profitable.

Key Metrics for Measuring Growth and Loyalty

If you want to truly master the balance between customer retention and acquisition, you need to look beyond your gut feelings and dive into the data. Strong strategies are always built on a foundation of solid measurement. Without the right Key Performance Indicators (KPIs), you’re just guessing whether your hard work is paying off.

These metrics aren't just numbers on a screen; they tell the story of your business's health and point directly to your biggest growth opportunities.

It's a common mistake to treat acquisition and retention metrics as two separate dashboards. The real magic happens when you see how they influence one another, painting a complete picture of your customer journey and, ultimately, your profitability.

Key Metrics for Customer Acquisition

When your primary goal is to bring new customers through the door, your metrics should all be about efficiency. These KPIs tell you if your marketing dollars are being spent wisely and how effectively you're expanding your customer base.

- Customer Acquisition Cost (CAC): This is your total sales and marketing spend divided by the number of new customers you brought in over a set period. A high CAC isn't necessarily a dealbreaker, but it has to be sustainable in the long run.

- Conversion Rate: This one’s straightforward—it's the percentage of visitors or leads who take a desired action, like completing a purchase. It’s a direct reflection of how compelling your marketing message and website experience are.

- Lead Velocity Rate (LVR): LVR tracks the month-over-month growth of your qualified leads. Think of it as a crystal ball for future revenue, showing you whether your sales pipeline is expanding, shrinking, or holding steady.

Key Metrics for Customer Retention

Once a customer makes that first purchase, the game changes. Your focus shifts from growth to loyalty. Retention metrics help you gauge customer happiness, forecast revenue from your existing base, and spot trouble before it leads to mass churn.

The real purpose of retention metrics is to measure the strength of your customer relationships. Low churn and high repeat purchase rates are undeniable signs that you're delivering real value, long after the initial sale.

Here are the core metrics every e-commerce merchant should have on their radar:

- Customer Lifetime Value (CLV): This is the total revenue you can realistically expect from a single customer over the entire course of their relationship with you. It’s arguably the single most important metric for building a sustainable business.

- Churn Rate: Simply put, this is the percentage of customers who leave your brand over a specific period. Even a tiny uptick in churn can have a devastating impact on your bottom line.

- Repeat Purchase Rate (RPR): This calculates the percentage of customers who have come back to buy from you more than once. It’s a clean, simple measure of both loyalty and satisfaction.

- Net Promoter Score (NPS): NPS gets a read on customer loyalty by asking one simple question: "How likely are you to recommend our brand to a friend?" Based on their answer, customers are sorted into Promoters, Passives, and Detractors.

How Acquisition and Retention Metrics Work Together

The most successful brands get it: these two sets of metrics are deeply connected. They don't operate in vacuums; they constantly inform and justify each other. The relationship between CLV and CAC is the perfect example.

Your CLV tells you exactly how much you can afford to spend on your CAC. Let’s be honest, acquiring new customers is expensive—often 5 to 25 times more than keeping an existing one. A healthy business model generally needs a CLV:CAC ratio of at least 3:1. This means the value a customer brings in should be at least three times what you paid to get them.

It's a virtuous cycle. A low churn rate directly increases your CLV, which gives you more budget to pour back into acquisition channels. A high repeat purchase rate proves your acquisition efforts are attracting the right kind of customers—the ones who will stick around.

Building a dashboard that tracks these interconnected KPIs is non-negotiable. To get started, check out our guide on the top metrics for eCommerce. This holistic view is what allows you to make smart, data-driven decisions and build a business that’s truly built to last.

When to Pour Your Energy into Acquisition (and Not Retention)

The whole "retention vs. acquisition" debate isn't about picking a side and sticking with it forever. It's about knowing which lever to pull, and when. A solid business needs a healthy mix of both, but your focus should shift depending on your company's age, the market you're in, and what you need to achieve right now. Figuring out when to hit the gas on bringing in new customers is a make-or-break decision for your growth.

Going all-in on acquisition isn't a strategy you can run forever, but sometimes, it's the only way to get off the ground and build momentum.

You're the New Kid on the Block (Startup & Launch Phase)

When you first open your doors, you have a grand total of zero customers to retain. Your one and only job is to build a customer base from the ground up. At this point, acquisition isn't just important—it's everything.

Your time and money should go directly into anything that gets your name out there and drives those first, crucial sales. You need to invest in channels that can reach people who have never even heard of you.

- You need a footprint: Your first goal is simply to exist in the market. Without new customers walking through your virtual door, your brand is invisible.

- You need proof: Those initial sales are the ultimate reality check. They prove people actually want what you're selling and give you priceless feedback to tweak your products and messaging.

- You need cash: Let's be honest, you need money to keep the lights on. A steady stream of new customers brings in the revenue you need to operate and fund your next big move.

Don't be surprised if your Customer Acquisition Cost (CAC) is sky-high during this phase. You might even lose money on each of the first few customers. That's okay. The goal here isn't instant profit; it's about laying the foundation for a business that can last.

Breaking New Ground (New Markets or Products)

Even if you're a well-established brand, you have to switch back to an acquisition-first mindset whenever you step into a new arena. This could be expanding into a new country, targeting a completely different type of customer, or launching a product that's a total departure from your usual stuff.

In these moments, you’re basically a startup all over again. Your loyal customers might not be the right fit for this new venture, meaning you have to find a brand-new audience from scratch. Think about a brand famous for its women's running shoes suddenly launching a line of men's formal wear—they can't just market to their existing email list. They have to go out and acquire a completely new set of customers.

Shifting to acquisition isn't a permanent change in strategy. It's a calculated, short-term push to build enough momentum to get the retention engine humming in a new market.

Other Times to Focus on Finding New Customers

Beyond a big launch, a few other scenarios demand that you put acquisition on the front burner. Knowing how to spot these moments helps you put your resources where they'll make the biggest impact.

1. There’s a Wide-Open Market If you’re in a new and growing industry where nobody has a dominant slice of the pie, the game is all about speed. Your top priority is to grab as much market share as you can before your competitors do. It’s a land grab, pure and simple.

2. Your Business Is Built on One-Off Purchases For companies selling things people don't buy often—think mattresses, cars, or high-end furniture—the opportunities for repeat business are few and far between. While you should still encourage referrals, your business model fundamentally depends on a constant flow of new buyers.

3. Investors Are Watching Your Growth Numbers In the venture capital world, nothing gets investors more excited than explosive user growth. If you’re a young company with outside funding, you'll likely be pushed to prioritize acquisition to show that your business can scale. This isn't always about short-term profit; it's about proving your potential to secure the next round of investment.

Actionable Playbooks for Acquisition and Retention

Knowing the difference between customer acquisition and retention is one thing. Actually putting that knowledge to work is a whole different ball game. To help you get started, let’s walk through two distinct playbooks—one for bringing new customers in the door and another for making sure they stick around.

These playbooks aren’t an either/or proposition. The most successful brands have both running at the same time, creating a powerful growth engine that grabs new market share while getting the most value out of every single customer relationship.

The Modern Acquisition Playbook

When growth is the name of the game, you need a smart, multi-channel strategy that builds awareness and actually drives sales. Here’s a breakdown of the tactics that are really moving the needle for e-commerce brands today.

- Targeted Performance Marketing: Forget just "boosting a post." We're talking about using platforms like Meta (Facebook and Instagram) and Google Ads to reach hyper-specific audiences based on their demographics, what they're interested in, and their online behavior. The secret sauce here is relentless testing—tweaking ad creative, copy, and audience segments until you drive your Customer Acquisition Cost (CAC) as low as it can go.

- SEO-Driven Content: Start creating high-value blog posts, guides, and videos that answer the exact questions your ideal customers are typing into search engines. This isn't just about getting free organic traffic; it's about positioning your brand as a trusted authority, which makes the final sale that much easier.

- Affiliate and Influencer Partnerships: Why not team up with creators and publications your target audience already follows and trusts? These partnerships deliver powerful social proof and can send highly qualified leads straight to your store, often with a much more predictable ROI than old-school advertising.

The best acquisition strategies aren’t about casting the widest net possible. They’re about precision—finding the right people, on the right channels, with a message that hits home and inspires that crucial first purchase.

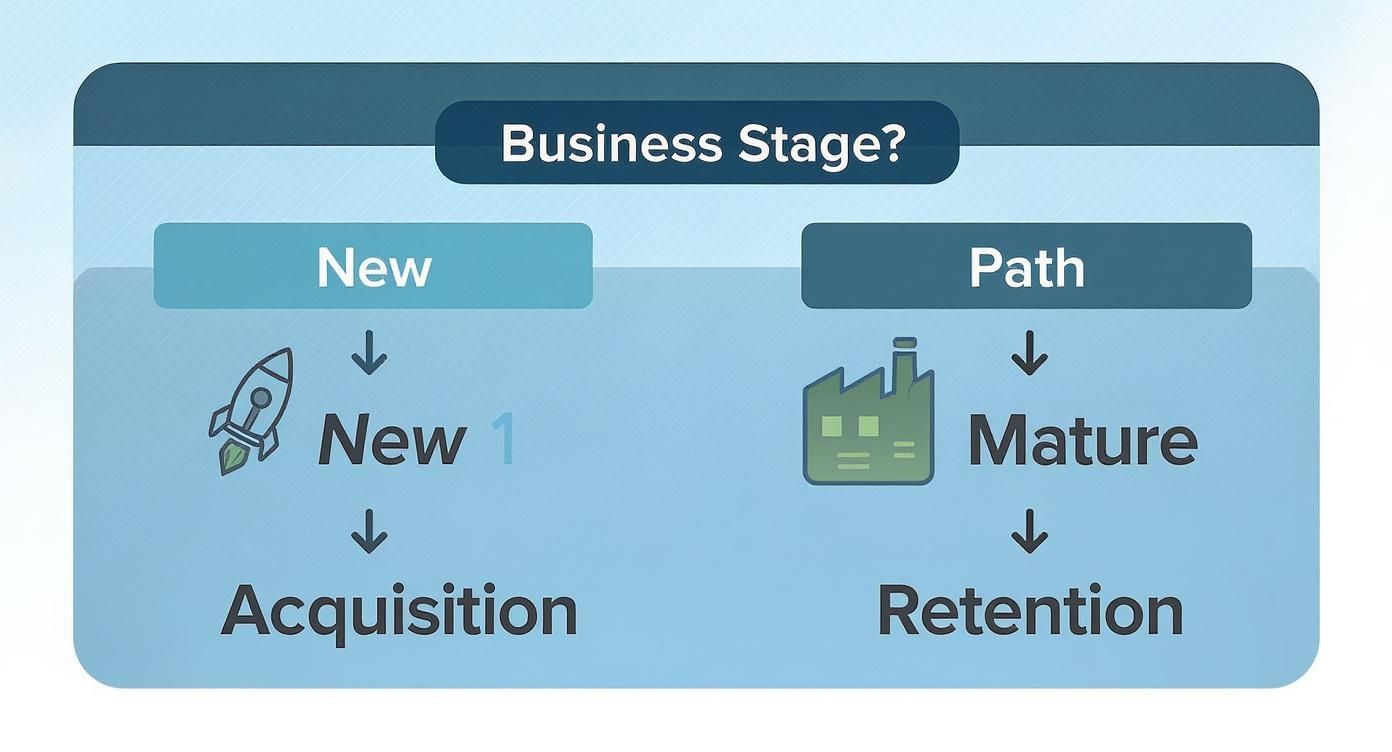

This decision tree shows how a business's maturity—whether it's a brand new startup or an established company—should shape its focus.

As you can see, new businesses have to prioritize acquisition just to build a customer base. On the other hand, mature businesses find much more leverage by focusing on keeping the customers they already have.

The Powerful Retention Playbook

Once you’ve made that first sale, the game changes. You’re no longer focused on a transaction; you’re building a relationship. The goal now is to build real loyalty and maximize Customer Lifetime Value (CLV).

This isn’t just a theory. A full 94% of sales leaders report giving equal priority to both acquisition and retention. To make it happen, 59% see loyalty programs as their most effective retention tool, and 48% swear by personalized outreach to get results.

If you want to dig deeper into fostering that kind of lasting loyalty, exploring specific customer retention management strategies can give you crucial insights for building unbreakable customer relationships.

Here’s how modern e-commerce brands are doing it, often using platforms like Toki to pull it all together seamlessly.

- Points-Based Loyalty Programs: Reward customers for everything—purchases, reviews, social shares, you name it. This simple gamification encourages repeat business by giving customers a real, tangible reason to come back to you instead of a competitor.

- Referral Systems: Turn your happiest customers into your best advocates. By offering them a kickback for successful referrals, you not only get new customers at a lower cost but you bring in people who already have a high level of built-in trust from day one.

- Paid Memberships: Create an exclusive club with perks, discounts, or early access to new products through a membership program. This builds a predictable, recurring revenue stream and gives your biggest fans a real sense of community.

- Personalized Communication: Use your customer data to send messages that are actually relevant. This is about more than just using their first name. It means sending a birthday reward, a gentle nudge about an abandoned cart, or product suggestions based on what they've bought before.

Tools like these bring all your retention efforts under one roof, making it surprisingly easy to run sophisticated tactics like points programs, referrals, and exclusive memberships from a single dashboard.

Frequently Asked Questions

When you're in the trenches, balancing customer retention and acquisition brings up some real-world questions. Here are a few common ones we hear from business owners and marketers trying to get that strategic mix just right.

How Should a New Business Split Its Budget?

If you're just launching, your main job is to get people in the door. That means your budget will lean heavily toward acquisition—think an 80/20 split, with 80% going to acquisition and 20% to retention.

But don't ignore that 20%. It’s your foundation. Use it to build good habits from the very beginning, like creating an incredible post-purchase experience with personalized thank-you emails or having a surprisingly helpful customer service process. This early groundwork is what turns those first hard-won customers into loyal fans later on.

A classic startup mistake is throwing 100% of the budget at acquisition. You end up with a "leaky bucket," constantly spending to replace customers who have no reason to stick around. That makes growth exhausting and expensive.

As your brand finds its footing and builds a solid customer base, you’ll want to start evening things out. A more established business might aim for a 50/50 split or even shift more resources toward retention, depending on what the market looks like and where you want to grow next.

What Is the Role of Customer Service in Retention?

Customer service isn't just a department for fixing problems—it's one of the most powerful retention tools you have. Every time a customer reaches out, you have a chance to either cement their loyalty or push them toward a competitor. Great service can turn a disaster, like a messed-up order, into a moment that actually builds trust.

Here’s why it’s so critical:

- It builds trust. When your support is fast, friendly, and actually solves the problem, it shows customers you care about them as people, not just as a transaction.

- It’s a feedback goldmine. Your support team is on the front lines, hearing exactly what frustrates customers or what they wish your product could do. This is priceless information for improving your entire business.

- It gets people to buy again. A fantastic support experience makes customers feel safe buying from you. They know that if anything goes wrong, you'll have their back.

How Can Small Businesses Balance Both on a Tight Budget?

When you’re a small business, it can feel like you have to choose between finding new customers and keeping the ones you have. The trick isn't to pick one, but to find smart, low-cost tactics that do both at the same time.

A referral program, for instance, is the perfect example. It taps into your happy, loyal customers (retention) to bring in new ones (acquisition) for a fraction of the cost of traditional ads. Another great move is creating useful, SEO-friendly content. It draws in new people searching for solutions while also giving your current customers more value and reasons to stay engaged. Focus on these kinds of organic, relationship-focused strategies—they pay off over the long run without needing a huge budget.

Ready to turn first-time buyers into lifelong fans? Toki provides the all-in-one platform you need to launch powerful loyalty, referral, and membership programs that drive repeat sales and build a thriving community. Explore Toki’s features and start building lasting customer relationships today.