Master the Customer Retention Rate Calculation Formula

The customer retention rate calculation formula is a pretty simple equation, but it tells a powerful story: what percentage of your customers stuck with you over a certain timeframe. Think of it as a vital health check for your e-commerce brand, showing you just how well your products and overall experience are building real, lasting loyalty.

Why Retention Is Your Most Powerful Growth Lever

It’s easy to get caught up in the chase for new customers. So many merchants pour their budgets into ads and outreach, constantly trying to bring new people in the door. While that's obviously important, focusing only on acquisition is like trying to fill a bucket with a hole in the bottom.

Sustainable, long-term growth comes from plugging that hole and making sure the customers you’ve already worked so hard to win actually decide to stay.

This isn't just about playing defense; it’s a powerful growth strategy in its own right. We've all heard that it's cheaper to keep a customer than to find a new one, but that’s just the beginning of the story. Your loyal, repeat customers are the true economic engine of a healthy online store.

The Real Impact of Loyal Customers

Over time, your retained customers become your most profitable group. Their lifetime value (LTV) just keeps climbing with every repeat purchase, and they often come back to buy without you needing to spend a dime on expensive ad campaigns to persuade them. That’s a direct boost to your marketing efficiency and your bottom line.

But their value goes way beyond just the money they spend.

These customers become incredible sources of honest, actionable feedback. They know your brand inside and out and can guide everything from product development to service improvements. They’ll be the first to tell you about a friction point in your checkout process you might have missed, helping you smooth out the journey for everyone.

Loyal customers are your best marketers. Their authentic word-of-mouth recommendations and glowing reviews build social proof that is far more powerful and trustworthy than any paid ad you could ever run.

From Metric to Strategy

Getting a handle on the customer retention rate calculation formula is your first step. It moves retention from being just a number you track to a core part of your business strategy. The rate itself gives you a baseline, but the real magic happens when you start digging into what’s driving that number up or down.

This is where smart strategies come into play. Things like well-designed customer loyalty programs can give your retention a serious boost by creating a compelling reason for shoppers to return. When you start exploring the various loyalty program benefits, you'll uncover new ways to build those crucial, lasting relationships.

At the end of the day, a strong retention rate is a sign of a resilient business—one that can handle market shifts and build a true community of brand advocates who will fuel its success for years to come.

How to Calculate Your Customer Retention Rate

Figuring out how loyal your customers are isn't about guesswork; it's about a simple, powerful formula. Your customer retention rate (CRR) gives you a hard number—a percentage of customers who stuck with you over a specific time.

What I like about this metric is that it purposely filters out new customers. This gives you a pure, unfiltered look at how well you're satisfying the people who are already in your ecosystem.

The formula looks like this:

CRR = ((E - N) / S) x 100

I know, it might give you flashbacks to algebra class, but each of those letters represents a simple number you can easily pull from your business data. Let's walk through it.

Breaking Down the CRR Formula Variables

To get your retention rate, you just need to find three pieces of data for a specific time frame, whether it's a month, a quarter, or a year.

| Variable | What It Means | How to Find It |

|---|---|---|

| S | Starting Customers | The total number of customers you had on day one of your chosen period. |

| E | Ending Customers | The total number of customers you had on the very last day of that period. |

| N | New Customers | The number of brand-new customers you acquired during that same time frame. |

The logic here is pretty simple. You take your total customers at the end of the period (E) and subtract the new ones you gained (N). This isolates the exact number of customers who were with you from the start and decided to stay. That's the group we really care about for this calculation.

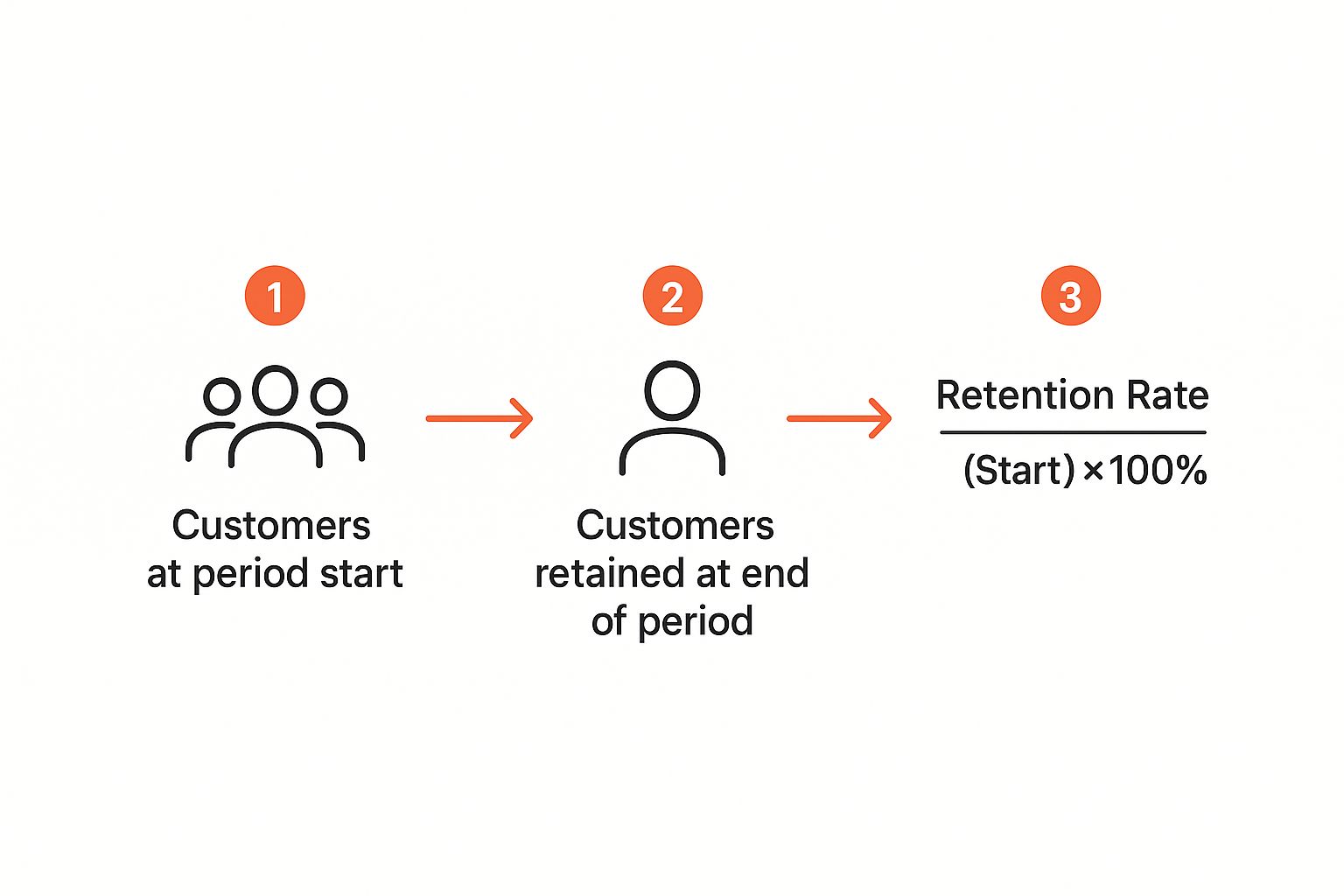

This visual helps illustrate how the formula hones in on that core group of retained customers.

As you can see, it's all about focusing on the people you started with. This is what makes CRR such a true measure of loyalty.

Putting the Formula to Work: A Real-World Example

Let’s run through a practical scenario. Imagine you run an e-commerce store selling subscription coffee boxes. You want to figure out your customer retention for the second quarter (Q2), from April 1st to June 30th.

First, you’ll need to pull your numbers for that period.

- You started Q2 with 1,000 active subscribers (S).

- By the end of Q2, you had a total of 1,150 active subscribers (E).

- Over those three months, you brought in 250 brand-new subscribers (N).

Now, we just plug these numbers into our formula:

CRR = ((1,150 - 250) / 1,000) x 100

Let's do the math step-by-step:

- First, find the number of retained customers: 1,150 - 250 = 900. This tells you that of the original 1,000 subscribers, 900 of them were still active at the end of the quarter.

- Next, divide that by your starting customer count: 900 / 1,000 = 0.90.

- Finally, convert that to a percentage: 0.90 x 100 = 90%.

Your customer retention rate for Q2 is 90%. This is a fantastic result—it means you kept nine out of every ten customers you had at the start of the quarter. A number like that is a strong signal that your customers are happy and see value in your service.

This single metric is one of the most vital signs for your business's health. If you're looking for other ways to measure customer loyalty, we have a complete guide on customer retention KPIs that you'll find useful.

By calculating your CRR regularly, you can start to benchmark your performance, spot trends over time, and make smarter decisions that keep your best customers coming back for more.

Moving from Customer Counts to Revenue Health

While your customer retention rate is a solid starting point for gauging business health, it only gives you part of the picture. It’s a headcount, not a measure of revenue. For any business with tiered plans, add-ons, or subscription models—especially in SaaS—that distinction is crucial.

Think about it: a high CRR looks great on paper, but what if the customers you're keeping are all on your cheapest, entry-level plan? You're treading water, not growing. This is where we need to shift the conversation from simply holding onto customers to actively growing the value they bring to your business.

Introducing Net Dollar Retention

To really understand your financial trajectory, you need a more sophisticated metric: Net Dollar Retention (NDR). Sometimes called Net Revenue Retention, this KPI tells you how much your recurring revenue from a specific group of customers has grown or shrunk over time.

Unlike CRR, which treats a $10/month customer the same as a $1,000/month one, NDR digs into the financial reality. It accounts for all the subtle (and not-so-subtle) shifts within your existing customer base:

- Expansion Revenue: This is the good stuff—money from upsells (customers upgrading to a pricier plan) and cross-sells (customers buying more products or features).

- Contraction Revenue: This is the revenue you lose when customers downgrade to a less expensive plan. It’s not a total loss, but it’s a step in the wrong direction.

- Churned Revenue: This is the monthly recurring revenue (MRR) that vanishes completely when a customer cancels their subscription.

NDR neatly packages all these movements into a single percentage that reveals the true momentum of your company.

Why NDR Can Exceed 100 Percent

Here’s where it gets really interesting. NDR can actually go above 100%. That might sound like funny math, but it's a very real—and very powerful—indicator of a healthy business.

It happens when the revenue you gain from your existing customers upgrading and expanding their services is greater than the revenue you lose from downgrades and cancellations.

A Net Dollar Retention rate over 100% means your business is growing even without acquiring a single new customer. It's the ultimate sign of a healthy, scalable business model where your existing customers are becoming more valuable over time.

For SaaS companies, in particular, this is a make-or-break metric. The formula, NDR = ((Starting Revenue + Upgrades – Downgrades – Churn) / Starting Revenue) × 100, directly reflects your ability to grow with your customers. If you want to dive deeper into the nuances, idomoo.com offers some great insights on how this calculation reveals true growth.

A Practical NDR Example

Let’s walk through a real-world scenario. Imagine you run a SaaS company providing project management software.

At the start of the year, your Monthly Recurring Revenue (MRR) from your existing customer base is $100,000. Over the next 12 months, a few things happen:

- Expansion: Several of your happy clients upgrade to the enterprise plan to get more features, adding $50,000 in new MRR.

- Contraction: A couple of smaller teams downgrade their plans after a big project wraps up, causing a $20,000 drop in MRR.

- Churn: A handful of customers cancel their subscriptions entirely, leading to a $10,000 loss in MRR.

So, where do you stand? Let's calculate the NDR.

- Starting MRR: $100,000

- Ending MRR (from that same group): $100,000 + $50,000 (upgrades) - $20,000 (downgrades) - $10,000 (churn) = $120,000

Now, let's plug those numbers into the simplified formula:

NDR = ($120,000 / $100,000) x 100 = 120%

Even though you lost some customers and saw others spend less, your Net Dollar Retention is an incredible 120%. This tells a powerful story to investors, stakeholders, and your own team: your business isn't just retaining customers, it's making them more valuable over time. That's the engine for sustainable, compound growth.

The Hidden Impact of Compounding Churn

One of the most common—and dangerous—forecasting mistakes I see businesses make is how they think about customer churn. They'll look at a 5% monthly churn rate and assume it's a simple, linear problem. "Okay," they think, "5% a month times twelve... we'll lose 60% of our customers this year."

Unfortunately, that math is dead wrong. It completely misses the compounding nature of churn.

The truth is, each month you aren't losing 5% of your original customer base. You're losing 5% of whoever is left. This might sound like a small distinction, but its effect on your long-term growth is massive. Getting this right is absolutely essential for accurate financial planning and setting realistic goals.

If you don't account for compounding churn, you end up with a skewed picture of your business's health. It creates a false sense of security and can lead you to underestimate just how much effort you need to put into retaining the customers you have.

How Compounding Churn Really Works

Let's walk through a quick example to see this in action. Picture a business starting the year with 1,000 customers and a steady 5% churn every month.

- Month 1: You lose 50 customers (5% of 1,000), leaving you with 950.

- Month 2: The churn is still 5%, but now it's calculated on your new, smaller base. You lose 48 customers (5% of 950), and you're down to 902.

- Month 3: The pattern continues. You lose another 45 customers (5% of 902), ending the month with 857.

Notice how the number of customers you lose each month actually goes down, but your total customer count is shrinking right along with it. The percentage is constant, but the base it applies to gets smaller and smaller. This is the core idea you need to grasp when you're doing any serious customer churn analysis.

"The true danger of churn isn't the single-month loss; it's the cumulative, compounding erosion of your customer base. A small leak, left unchecked, can sink a large ship over time."

The Correct Formula for Annual Churn

To get an accurate annual churn rate from a monthly figure, you can't just multiply by twelve. You need a formula that respects this compounding effect.

Here’s the right way to calculate it:

Annual Churn Rate = 1 – (1 – Monthly Churn Rate)^12

Let's plug in our 5% monthly churn (which is 0.05 as a decimal) to see how it works out.

Annual Churn = 1 – (1 – 0.05)^12 Annual Churn = 1 – (0.95)^12 Annual Churn = 1 – 0.54 Annual Churn = 0.46, or 46%

That seemingly innocent 5% monthly churn doesn't lead to a 60% annual loss—it’s actually a 46% loss. While that number is better than the simple (and wrong) calculation, it still represents losing nearly half your customer base in a single year.

This is why even tiny improvements in your monthly retention can have such a dramatic impact on your annual numbers. Getting a handle on this math is the first step toward building more resilient financial forecasts and truly understanding the long-term value of keeping your customers happy.

Common Retention Calculation Mistakes to Avoid

A formula is only as good as the numbers you plug into it. While the math for customer retention seems straightforward, it’s surprisingly easy to make small mistakes that give you a distorted view of your business's health.

Getting this wrong can lead you to celebrate false wins or, even worse, panic over problems that don’t actually exist. To make sure your metrics are truly actionable, let's walk through some of the most common traps I've seen merchants fall into over the years.

Confusing Customer Counts with Revenue Health

One of the biggest mix-ups is treating Customer Retention Rate (CRR) and Net Dollar Retention (NDR) as the same thing. They're not. CRR is purely a headcount—it tells you how many individual customers stuck around. NDR, on the other hand, tracks the revenue from those customers.

Think about it: a high CRR looks great on paper, but if your highest-spending customers are the ones leaving, your revenue could still be shrinking. You might be retaining lots of small, infrequent buyers while the big fish swim away. Always look at both metrics together to get the full story.

Choosing the Wrong Time Frame

The period you choose for your calculation matters—a lot. There's no one-size-fits-all answer here; it has to align with your business model. A subscription box service with monthly billing should absolutely track retention monthly. An e-commerce store that sells seasonal ski gear, however, would find a quarterly or even annual calculation far more insightful.

Here’s a quick guide to help you land on the right cadence:

- Monthly: This is perfect for SaaS, subscriptions, or any business where customers are expected to buy frequently. It gives you fast feedback on any changes you make.

- Quarterly: This is a solid middle ground for most e-commerce businesses. It smooths out the random noise of a slow week while still being responsive enough to spot trends.

- Annually: Best for brands with long purchase cycles, like furniture or luxury electronics, where a repeat purchase within a few months is rare.

Your calculation period should mirror your customer's natural re-engagement cycle. If you don't align the two, you're measuring your business against an arbitrary timeline, not real customer behavior.

Ignoring Customer Segmentation

This is probably the most critical mistake of all: relying on a single, blended retention rate for your entire customer base. This "one number to rule them all" approach averages out your best and worst customers, hiding the very insights that could transform your business.

For instance, a blended rate of 80% might seem solid. But what if you dig deeper and find that customers acquired through your blog have a 95% retention rate, while those from paid social ads have a rate of only 60%? Suddenly, you have a powerful insight telling you exactly where to double down on your marketing budget.

You can uncover these stories by segmenting your data. Break down your retention rate by:

- Acquisition Channel: Which channels bring in the stickiest customers?

- First Product Purchased: Do people who buy Product X first stick around longer than those who buy Product Y?

- Customer Cohort: How does the retention of customers acquired during Black Friday compare to those who joined in a quiet July?

By sidestepping these common errors, you move from just calculating a number to generating real business intelligence. Accurate, segmented retention data is the foundation for making smarter decisions that drive sustainable growth.

Tackling Your Top Retention Questions

Even with the formula in hand, you're bound to run into some questions when you start crunching your own numbers. That's perfectly normal. Getting your customer retention rate right is a big deal, so let's clear up some of the most common head-scratchers we hear from merchants.

Think of this as the practical advice that goes beyond the basic math—the kind of stuff you figure out after doing this a few times.

What Is a Good Customer Retention Rate?

This is the million-dollar question, and the honest answer is... it depends. A good retention rate for a fast-fashion brand is going to look completely different from one for a store selling custom-built PCs. It's all about context.

But, to give you a ballpark idea, here are some general industry benchmarks:

- Retail: Tends to hover around 63%. Competition is fierce.

- E-commerce: Usually lands somewhere between 30% and 60%, since hopping to a competitor is just a click away.

- SaaS/Subscription: This is where you see the high numbers, often 75% to 85%, thanks to the recurring revenue model.

Don't get too hung up on hitting a specific number you saw online. What matters most is your own trend line. Is it going up? If you're improving quarter-over-quarter, you're on the right track. That upward climb is the real indicator of a healthy, growing business.

How Often Should I Calculate My Retention Rate?

The cadence of your calculation should really match the natural buying rhythm of your customers. If you measure it too frequently, you'll just be tracking noise. But if you wait too long, you could miss a critical drop-off.

For most e-commerce brands, looking at this quarterly is the sweet spot. It's frequent enough to see if your efforts are paying off, but long enough to smooth out any random weekly spikes or dips. On the other hand, if you're running a monthly subscription box, you'll definitely want to calculate this every month to stay on top of churn.

The most important thing is consistency. Pick a timeframe that fits your business, and then stick to it. That's how you build a reliable baseline to measure against.

Should I Include Inactive Customers in My Calculation?

Good question. The answer is a hard no. To get a truly meaningful retention rate, you should only be looking at customers who are actually active.

What's "active"? That's for you to define, but a good rule of thumb is anyone who has purchased within a reasonable timeframe, like the last year.

If you include customers from three years ago who haven't bought anything since, you’re just muddying the waters. They were never really in the running to be "retained" this period anyway. Including them in your "Starting Customers" count will artificially tank your retention rate and make your performance look worse than it is. Clean your list first—you want to measure the loyalty of the people who are actually engaged with your brand.

Ready to turn these insights into action? Toki provides the tools you need to build a powerful loyalty program that keeps your best customers coming back. Start boosting your retention rate today by visiting the Toki website.