A Guide to Customer Churn Prediction for E-Commerce Growth

Customer churn prediction is all about using data to spot the customers who are on the verge of leaving. By looking at what they've done in the past—or what they haven't done—you can get a pretty good idea of what they'll do next. The real magic is stepping in before they walk away, turning a potential loss into a long-term fan.

The Hidden Threat Eroding Your E-Commerce Revenue

Most e-commerce brands are obsessed with acquisition. It’s all about pouring new customers into the top of the funnel. But what about the ones quietly slipping out the back door? That silent drain is customer churn, and it’s like trying to fill a leaky bucket. No matter how much you pour in, you're always losing valuable revenue from the bottom.

This isn't just a minor drip. It's a serious financial bleed. We all know the old adage, but it holds true: acquiring a new customer costs five times more than keeping an existing one. If you ignore churn, you're not just losing customers; you're torching your marketing budget to replace business you should have never lost in the first place.

The Staggering Scale of E-Commerce Churn

The numbers are pretty sobering. In today's crowded market, churn rates are shockingly high, turning what could be loyal shoppers into one-and-done buyers. A detailed 2025 analysis of over 2,200 merchants revealed the average monthly churn for subscription e-commerce is 3.4%. That doesn't sound too bad, until you realize it compounds to a massive 70%+ annually.

High churn eats away at your customer lifetime value (CLV), especially when you consider that retained customers spend 67% more on average than new ones. You can discover more insights about these e-commerce retention metrics and see just how deeply they cut into profits.

This constant bleeding forces brands into a desperate, reactive loop, throwing last-ditch discounts at customers who have already emotionally checked out. All the effort and money spent to win them over vanishes the second they decide not to come back.

Churn is more than just a metric; it's a direct reflection of your customer experience. A high churn rate is a clear signal that your brand is failing to build real relationships, turning valuable assets into missed opportunities.

Shifting from Reactive to Proactive Retention

This is exactly where customer churn prediction changes everything. Instead of waiting for customers to disappear, you can use data to see who is at risk and figure out why. It’s the tool you need to finally plug the leaks in your revenue bucket.

Anticipating churn allows you to be strategic. You can:

- Deploy surgical interventions: Send a personalized offer, a bonus loyalty reward, or some exclusive content to a specific at-risk customer.

- Optimize marketing spend: Stop wasting money on mass discounts and focus your retention budget on the customers who actually need a nudge.

- Enhance the customer experience: Treat churn signals as direct feedback to improve your products, shipping, or overall service.

This guide is about making that shift—from putting out fires to building a fire-proof business. We'll walk through how to use customer churn prediction to lock down your revenue and grow a truly loyal community.

Understanding Customer Churn Prediction and Its Value

Let's be clear: customer churn prediction isn't some mystical, overly academic exercise confined to a data science department. Think of it as an early-warning system for your customer relationships. It sifts through past customer behavior—things like how often they buy, what they browse, and if they've contacted support—to flag who’s most likely to stop buying from you.

Imagine you could get a heads-up that a customer is unhappy before they ghost you for a competitor. That’s the core idea. This foresight allows you to move from making reactive apologies to having proactive conversations that can genuinely save the relationship. It completely flips the script on how you approach customer retention.

The real magic of customer churn prediction is how it directly boosts your bottom line. When you know who might leave, you can be incredibly precise with your retention efforts, saving you from throwing money away on generic discounts that barely move the needle.

From Mass Marketing to Surgical Strikes

Without these predictive insights, retention campaigns are often just a shot in the dark. You might blast a 20% off coupon to your entire email list, hoping to reel in the few who were considering leaving. The problem? You're also giving that discount to die-hard fans who were going to buy anyway, which eats directly into your profit margins.

Churn prediction lets you swap that wide net for a surgical scalpel. You can group customers by their churn risk and tailor your response to each one. This is where the true value emerges.

U.S. companies lose an astounding $136.8 billion per year due to avoidable consumer churn. Predictive analytics gives brands the power to reclaim a significant portion of that revenue by intervening at the perfect moment.

Instead of guessing, you act with data-backed confidence. A high-risk customer might get a surprise bundle of loyalty points, while a happy, low-risk customer could get a fun invitation to join your referral program. This targeted strategy makes every dollar in your retention budget work harder, delivering a much higher return.

The True Business Value of Knowing the Future

To put it in perspective, let's compare the old way of doing things with a proactive, predictive approach. The difference isn't just a minor improvement; it's a fundamental shift in strategy and financial outcome.

Business Impact of Proactive Churn Prediction

| Metric | Reactive Approach (Without Prediction) | Proactive Approach (With Prediction) |

|---|---|---|

| Retention Strategy | Mass-market discounts sent to everyone after churn has occurred. | Targeted, personalized offers sent to at-risk segments before they leave. |

| Marketing Spend | High cost due to untargeted, broad campaigns and wasted discounts. | Highly efficient, as budget is focused only on customers who need intervention. |

| Customer Experience | Impersonal and often too late; feels like a generic attempt to win them back. | Proactive and thoughtful; shows you value the relationship and are paying attention. |

| Profit Margin | Eroded by unnecessary discounts given to loyal, full-price buyers. | Protected, as discounts are used strategically to save high-value relationships. |

| Customer Lifetime Value | Lower, as preventable churn shortens the customer lifecycle. | Higher, as more customers are retained for longer periods. |

As the table shows, investing in a predictive model isn't just about plugging a leak; it's about building a stronger, more resilient ship. The "why" behind churn prediction is all about creating a more profitable and customer-focused brand.

Here’s what that looks like in practice:

- Increased Customer Lifetime Value (CLV): By keeping customers around who would have otherwise walked away, you naturally extend their purchasing journey and increase their total worth to your business.

- Improved Marketing Efficiency: Your marketing spend becomes far more effective when you aim it at specific, high-impact groups, maximizing ROI and cutting out the waste.

- Enhanced Customer Relationships: Reaching out proactively shows you're paying attention. Solving a potential problem before it escalates builds incredible trust and can turn at-risk shoppers into your biggest fans.

Ultimately, this is about evolving from reactive problem-solving to proactive relationship-building. It re-frames churn from an unavoidable business cost into a manageable metric you can actively improve.

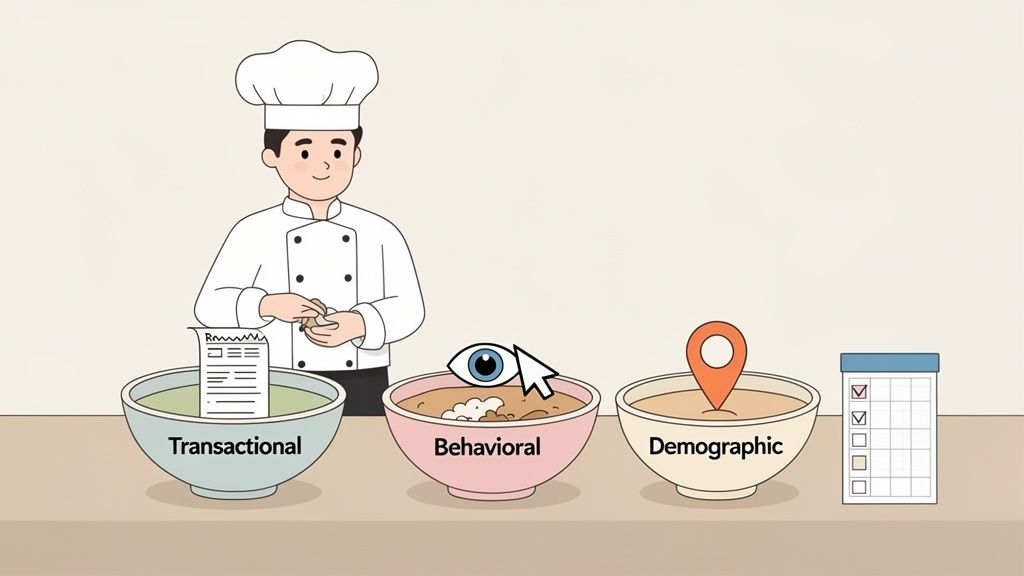

Gathering the Right Ingredients for Accurate Predictions

Any prediction model is only as smart as the data you feed it. Think of it like a chef crafting a signature dish—the outcome hinges entirely on the quality of the ingredients. To get a reliable forecast of who might be about to leave your store, you first need to gather the right "ingredients" from your customer data.

This isn't just about grabbing every bit of information you have on file. It's about strategically selecting the data points that truly tell the story of a customer's journey with your brand. For an e-commerce business, this story is usually told through three main types of data.

Transactional Data: The What and When

This is your foundation. Transactional data lays out the hard facts of your customer relationships—what they buy, how much they spend, and how often they do it. It's the most direct measure of their commitment to your brand.

For a Shopify store, you’d want to look at:

- Purchase Frequency: Is someone a weekly regular or a once-a-year holiday shopper? A customer who typically buys every month but suddenly goes quiet for three is a classic churn signal.

- Average Order Value (AOV): Are they consistently making large purchases or just picking up small items? A sudden drop in spending from a high-AOV customer is a major red flag.

- Last Purchase Date (Recency): This is one of the most powerful predictors. How long has it been since they last bought something? The longer the gap, the higher the risk.

Behavioral Data: The How and Why

If transactional data tells you what happened, behavioral data gives you clues about why. It tracks how customers interact with your store beyond just hitting "buy," revealing their actual engagement and interest level.

This includes things like:

- Website Visits: How often do they pop onto your site, even if they're just window shopping?

- Product Views: Are they repeatedly checking out the same product or browsing a specific category?

- Cart Abandonment: Do they fill up their cart only to leave it behind? This can hint at everything from price sensitivity to a clunky checkout process.

Understanding this digital body language is critical. For instance, global e-commerce data shows that a mind-boggling 75.5% of mobile shopping carts are abandoned, making it a huge source of potential churn. With 78% of online traffic now coming from smartphones, spotting these patterns can help you find frustrated customers before they're gone for good. You can see more of these e-commerce trends on Kaggle.

Demographic Data: The Who and Where

Finally, demographic data adds context. It helps you understand who your customers are as people—their location, age, gender, and other attributes. While it’s rarely the strongest predictor on its own, it adds another layer of detail to the story you're building from their actions and purchases.

A customer churn prediction model doesn’t guess; it calculates. By combining transactional, behavioral, and demographic data, you create a complete profile that allows the model to connect past actions to future outcomes with remarkable accuracy.

Before you can start predicting, though, you need to make sure your data is clean. Simple issues like missing location information or inconsistent entries can throw off your entire model. Taking the time to properly prepare and unify your data isn't just a suggestion—it's a mandatory first step. To get this right, check out our guide on customer data integration best practices. This initial cleanup ensures your predictive "recipe" gives you the most reliable results.

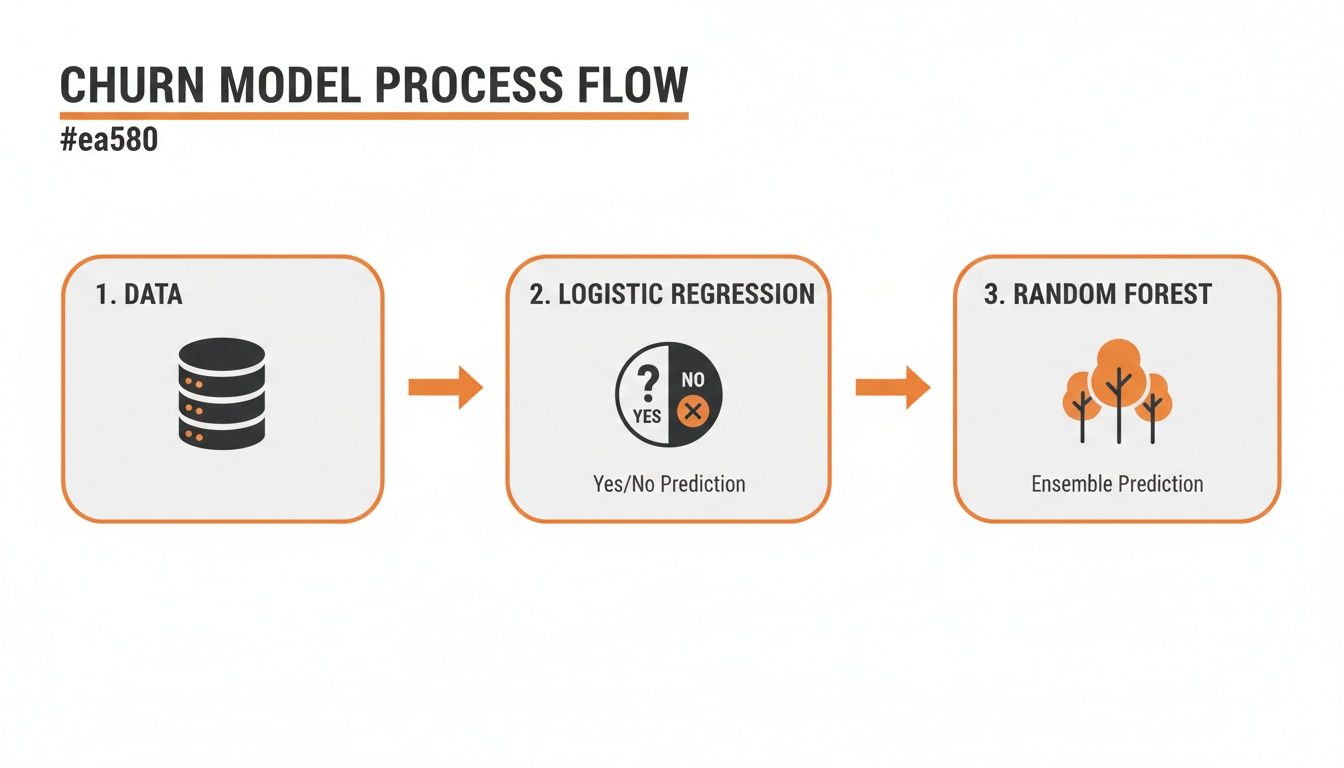

Common Churn Prediction Models Explained Simply

Once your data is in place, it's time to choose a model to put it to work. This part can sound a bit technical, but you really don't need a data science background to understand the main ideas. At the end of the day, any customer churn prediction model is just trying to look at all your customer data and spit out a churn probability score for each person.

Think of these models as different kinds of detectives, each with a unique style for figuring out "who's about to leave?" Some are methodical, by-the-book investigators, while others are more like a whole task force of specialists. Let's walk through two of the most popular and effective approaches you'll encounter.

Logistic Regression: The Straightforward Classifier

First up is Logistic Regression, probably the most common starting point for churn prediction. It's a classic for a reason.

Imagine you have a stack of customer files and two bins: one labeled "At-Risk of Churning" and the other "Likely to Stay." Logistic Regression acts like a detective who examines one clue at a time—say, the date of their last purchase or how often they abandon a cart—and then decides which bin the file goes into.

It works by giving a "weight" to each piece of customer data based on how strongly it's linked to churn in the past. A long time between purchases might get a heavy "churn" weight. Frequent logins? That gets a heavy "loyal" weight. The model then adds up these weights for every customer and gives you a final probability.

This model is a fantastic choice for a few reasons:

- It's fast and efficient, which makes it a great first step for any e-commerce business.

- It’s easy to understand. You can see exactly which factors (like purchase frequency or email opens) are pushing the prediction one way or the other.

- It gives you a clear probability score, like a 75% chance of churning, which is simple to act on.

Because it’s so straightforward, Logistic Regression is brilliant at giving you a clear, almost "yes/no" style prediction. This is perfect if you need a quick, understandable way to segment customers into basic risk groups.

Random Forest: The Committee of Experts

If Logistic Regression is a single detective, a Random Forest model is a committee of expert investigators. Instead of relying on one single judgment, this model builds hundreds—sometimes thousands—of individual "decision trees" and lets them all vote on the final prediction.

Each decision tree is basically a simple flowchart. It asks a series of yes/no questions about a customer: "Did they make a purchase in the last 30 days?" If yes, follow this path. "Did they open our last marketing email?" If no, follow that path. Every tree runs through its own unique set of questions until it lands on a conclusion: "This customer is churning" or "This customer is staying."

The real magic is in the "forest" itself. By collecting the votes from all these different decision trees, the model creates a final prediction that's far more accurate and reliable. A single tree might get it wrong, but it’s much less likely for an entire forest of them to make the same mistake. This approach is great at smoothing out quirks in your data and spotting more complex customer patterns.

A Random Forest model taps into the wisdom of the crowd. By averaging the predictions of many individual decision trees, it avoids the risk of a bad prediction based on one flawed viewpoint, resulting in more robust and accurate churn scores.

This model really shines when you have lots of different types of data. It's exceptionally good at figuring out which customer attributes actually matter without you having to tell it. For merchants wanting to dig into the subtle behaviors behind churn, understanding what is behavioral analytics can supply the kind of rich data that makes a Random Forest model so powerful.

Ultimately, picking the right model comes down to what you need—whether you value simplicity and speed or prefer accuracy and deeper insights. The important thing to remember is that these aren't mysterious black boxes. They're just logical tools designed to turn your raw data into intelligence you can actually use.

Putting Predictions into Action with a Loyalty Platform

Getting a churn score for each customer is a huge step forward, but the score itself doesn't save anyone. It’s like a weather forecast—knowing it might rain is useful, but it’s grabbing an umbrella that keeps you dry. The real value of customer churn prediction gets unlocked when you use those insights to take specific, proactive, and personalized action.

This is where a modern loyalty platform becomes your most powerful tool. Instead of just reacting to a customer leaving, you can build automated, targeted campaigns that get ahead of the problem. By connecting predictive scores to tangible rewards and experiences, you transform raw data into stronger relationships.

Segmenting Customers by Churn Risk

The first move is to slice your customer base into clear, actionable tiers based on their churn probability scores. This lets you put your retention budget and energy where they’ll have the biggest impact, focusing the most resources on customers who are genuinely on the fence.

A simple yet incredibly effective way to do this involves three core groups:

- High-Risk (Churn Score > 70%): These are your most vulnerable customers. They’ve shown clear signs of drifting away and are on the verge of leaving for good. This group needs an immediate, high-value reason to stick around.

- Medium-Risk (Churn Score 40%-70%): This group is sitting on the fence. They might not be actively unhappy, but their loyalty is wavering. The goal here is to re-engage them and give them a compelling reminder of why they chose you in the first place.

- Low-Risk (Churn Score < 40%): These are your loyal fans and brand advocates. The strategy here isn't about saving them from churning; it's about nurturing that loyalty and empowering them to spread the word.

Once you know who is at risk, the next step is taking action. You can find plenty of proven, actionable tactics to reduce customer churn that pair perfectly with this kind of segmented approach.

Mapping Loyalty Actions to Each Risk Segment

With your segments defined, you can now design specific retention campaigns tailored to the mindset of each group. A platform like Toki lets you automate these campaigns to trigger based on a customer's churn score, making sure the right action happens at exactly the right time.

High-Risk Customers: The Rescue Mission

For folks in this segment, you need to make a bold, compelling offer. Something that grabs their attention and gives them a reason to act right now. The goal is to create a moment of positive surprise and undeniable value.

- Targeted Bonus Points: Send an email offering a significant number of bonus loyalty points—say, 500 bonus points—that they can use on their next purchase. This creates a powerful, tangible reason to come back.

- Exclusive Badges or Achievements: Gamify their return. Offer a special "Welcome Back" badge in their loyalty profile after they make a purchase, which could unlock even more exclusive rewards.

Medium-Risk Customers: The Re-Engagement Nudge

This group doesn't necessarily need a costly rescue offer. What they need is a gentle nudge—a reason to deepen their investment in your brand’s ecosystem. The goal is to make them feel like a valued part of a community, making it that much harder to switch.

- Tiered Membership Invitations: Invite them to join a higher tier in your loyalty program. You can frame it as an exclusive opportunity to unlock better perks, like free shipping or early access to new collections.

- Personalized Challenges: Create a simple challenge within your loyalty program, like "Make 2 purchases this month to earn a special reward." It gives them a clear, achievable path back to active engagement.

This is where the predictive models come to life, turning raw data into the insights that fuel these smart retention strategies.

The flow from raw data to a sophisticated model like a Random Forest is what allows for the nuanced predictions you need to power these targeted loyalty campaigns effectively.

Low-Risk Customers: The Advocacy Program

For your happiest, most loyal customers, the focus shifts from retention to amplification. These advocates are your most credible and cost-effective marketing asset.

- Referral Program Enrollment: Automatically invite them to join your referral program. Offer a compelling reward, like $10 in points, for every new customer they bring in. You’ll turn their loyalty into a growth engine.

- Community Ambassador Roles: Acknowledge their special status by inviting them to become "Brand Ambassadors," giving them a unique title and early access to new products.

By integrating churn scores directly into a loyalty platform, you create a dynamic, self-improving retention system. To see how different platforms stack up, you might want to explore a comparison of top loyalty platform providers to find the best fit for your e-commerce store.

A churn score is a diagnosis, not a final verdict. The "treatment" is a personalized, relevant experience delivered through your loyalty program. This is how you systematically turn at-risk customers into retained, high-value members of your brand community.

FAQ: Getting Real About Customer Churn Prediction

Even with a solid game plan, stepping into predictive analytics can feel a little daunting. How reliable is this stuff, really? Do I need a PhD in data science to make it work? What’s the actual price tag? Let's tackle the most common questions e-commerce merchants have about predicting customer churn, with straightforward answers to help you move forward.

How Accurate Are Customer Churn Prediction Models?

This is usually the first question on everyone's mind, and the honest answer is: it depends. The accuracy of any customer churn prediction model is a direct reflection of the quality and depth of your data. A model that can see detailed purchase histories, browsing behavior, and customer demographics will always outperform one running on fumes.

But here’s the thing—you don’t need a perfect crystal ball to get incredible value. Even a model that’s 70-80% accurate is a massive leap forward from gut feelings or guesswork. Think of it this way: if you can correctly flag seven out of ten customers who are about to leave, you’ve just created seven chances to win them back that you wouldn’t have had otherwise.

When people talk about a model's performance, they usually bring up two key ideas:

- Precision: Asks, "Of all the customers we flagged as 'at-risk,' how many actually left?" High precision means your retention efforts are hitting the right targets, not being wasted on happy customers.

- Recall: Asks, "Of all the customers who did leave, how many did our model catch beforehand?" High recall means you're not letting too many at-risk customers slip through the cracks.

The real goal is to find the sweet spot between the two. A model with perfect precision that only identifies two at-risk customers a month isn't very helpful. Neither is a model with amazing recall that flags half your customer base, blowing up your marketing budget. A good model gives you a focused, actionable list of customers who need your attention right now.

Do I Need a Data Scientist to Implement Churn Prediction?

Not anymore. A few years ago, this was absolutely true. Building a custom churn model from scratch was a heavy lift that required deep expertise in machine learning. But that's all changed. Today, powerful and user-friendly tools have brought this capability out of the lab and into the hands of everyday e-commerce merchants.

The question is no longer about whether you can afford a data scientist. It’s about whether you can afford to ignore the predictive insights that are now just a few clicks away. Modern platforms have made data science an accessible strategy for any brand looking to grow.

Here’s how the options break down today:

- Custom-Built Models: This is the traditional path. You hire a data scientist or a specialized agency to build a model from the ground up, tailored specifically to your business. It offers the most control and can produce fantastic results, but it’s a serious investment of time and money.

- Integrated Platforms: This is the real game-changer. Many e-commerce tools, especially loyalty solutions, now come with predictive analytics baked right in. A platform like Toki, for instance, can handle the churn analysis for you, letting you segment at-risk customers and trigger retention campaigns without writing a single line of code.

- No-Code AI Tools: A new wave of tools allows you to build simple machine learning models using a visual, drag-and-drop interface. They require a bit more setup than a fully integrated solution but are a great middle ground for those who want a little more customization without the high cost.

For most Shopify and DTC brands, an integrated platform is the way to go. It offers the perfect mix of power, ease of use, and affordability, letting you focus on acting on the insights, not on the complex math behind them.

How Much Does It Cost to Start Predicting Churn?

The cost can be anything from a few dollars to tens of thousands, and it all comes down to the route you choose. The great news is there are entry points for businesses of every size, so you can start small and scale your efforts as you grow.

Let’s look at the different levels of investment:

- Built-In Platform Features: You might be surprised to learn you already have some basic predictive tools. Many e-commerce and marketing platforms, including Shopify’s own analytics or a loyalty app like Toki, offer customer segmentation based on risk factors. This is easily the most affordable starting point, as the cost is often just part of your existing subscription.

- Third-Party Analytics Apps: App marketplaces for platforms like Shopify are loaded with great analytics tools that specialize in churn prediction. These typically run on a monthly subscription, costing anywhere from $50 to $500 per month, depending on your store's traffic and data volume. They offer a fantastic balance of advanced features without the price tag of a custom build.

- Hiring a Freelancer or Agency: For a truly tailored solution, you can bring in a freelance data analyst or a specialized e-commerce agency. This usually involves a one-time project fee or an ongoing retainer, which could range from $5,000 to $25,000+. It’s a significant investment, but for larger brands with complex data, the highly customized insights can be well worth it.

Ultimately, the right investment comes down to your immediate needs and future goals. The key takeaway is that cost is no longer a barrier to entry. By starting with an accessible, integrated tool, you can quickly prove the ROI of churn prediction and justify bigger investments down the road.

Ready to turn churn prediction into your secret weapon for growth? With Toki, you can seamlessly integrate predictive insights with powerful loyalty and retention tools. Identify at-risk customers and automatically engage them with targeted rewards, memberships, and referral programs to build a brand they'll never want to leave. Start building unbreakable customer loyalty today.