Unlocking Loyalty with Digital Wallet Passes

At its core, a wallet pass is simply the digital version of something you’d normally cram into your physical wallet. We're talking loyalty cards, coupons, event tickets, membership IDs, and even boarding passes, all living securely inside a smartphone in an app like Apple Wallet or Google Wallet.

What Are Wallet Passes and Why Should You Care?

Think about your customer's physical wallet for a second. It's probably stuffed with faded paper punch cards and crumpled coupons. Now, imagine replacing that entire mess with a single, smart item on their phone. That’s the magic of a wallet pass. They’re a huge leap from tangible, easy-to-lose paper and plastic to a convenient, always-on-hand digital format.

This isn't just some neat tech trick; it's a direct answer to how people live their lives today. Consumers expect maximum convenience, and digging around for a plastic card at the checkout line is quickly becoming an outdated frustration. A wallet pass lives on the one device your customers never leave home without, making your brand a constant, helpful presence in their day.

The Evolution from Physical to Digital

For years, the bond between a business and its regulars was a physical card. Whether it was for coffee stamps or a gym membership, that card was the tangible proof of the relationship. Wallet passes take that connection and put it on steroids.

Unlike a static piece of plastic, a digital wallet pass is a living communication channel. It can be updated in real time with new point balances, exclusive offers, or event details, keeping your brand relevant and top-of-mind.

This shift is part of a bigger trend toward seamless digital experiences. To really get why wallet passes are so important, you have to see where they fit within the wider world of modern mobile payment solutions. Just as paying with a phone has become second nature, accessing loyalty perks and tickets the same way is the new normal.

Forging a Direct Line to Your Customer

The real genius of a wallet pass is the direct, persistent connection it builds with your audience. As soon as a customer saves your pass, you’ve earned a spot on their most personal device. This opens up some powerful opportunities:

- Lock Screen Visibility: Got a customer walking past your coffee shop? A location-based notification can pop their loyalty pass right onto their lock screen. A boarding pass will automatically appear a few hours before a flight. It's incredibly timely and relevant.

- Zero Friction: Here's the best part: there’s no app to download. Apple Wallet and Google Wallet come pre-installed on billions of phones, so the barrier to entry is almost non-existent. A customer can add your pass with one tap from an email, a text message, or by scanning a QR code.

- Deeper Engagement: Dynamic updates keep the conversation going. Customers can watch their loyalty points grow, get a nudge about a coupon that’s about to expire, or see their flight's gate change—all without having to open a separate app or dig through their email.

By making the jump from a physical wallet to a digital one, you’re doing more than just saving your customers from carrying extra plastic. You’re weaving your brand into the fabric of their daily digital life, creating a smooth, convenient, and incredibly effective way to build loyalty that lasts.

The Real Business Value of Digital Wallet Passes

It’s easy to look at a digital pass and see a simple convenience. But if you stop there, you’re missing the bigger picture. The true power of wallet passes is how they fundamentally change your relationship with customers, paving a direct path to loyalty and repeat sales.

Think of it like getting premium placement for your brand. When a customer adds your pass to their phone, you're not just another lost email or a forgotten browser bookmark. You’ve secured a permanent spot inside their phone’s native wallet app, creating a "top-of-wallet" presence that keeps your brand visible and easily accessible.

Supercharge Customer Loyalty and Engagement

Let’s be honest: traditional loyalty programs can be a pain. Customers lose their physical cards, forget their points balance, and eventually just tune out. Wallet passes flip the script by making it completely effortless for people to see the value you offer.

A digital loyalty pass in Apple or Google Wallet keeps their status front and center, showing their point balance, tier level, and available rewards in real time. This constant visibility is a powerful reminder of why they shop with you. We dive much deeper into this in our guide on how to boost loyalty with Apple Wallet loyalty cards.

This isn't just about one-off sales. It’s about building a connection that lasts. By making customers feel seen and rewarded, you dramatically increase their long-term Customer Lifetime Value (CLTV) and make it far more likely they'll choose you over a competitor next time.

A Powerful Communication Channel

Here’s where wallet passes really outshine other channels. Forget the dismal 21% average open rate for emails. Notifications from a wallet pass pop up right on a user's lock screen, making them almost impossible to ignore.

And these aren't just spammy alerts. They are timely, contextual messages that genuinely help the customer and drive action.

- Balance Updates: Instantly let a customer know when they’ve earned new points or hit a new loyalty tier.

- Offer Alerts: Notify pass holders about an exclusive sale or a fresh coupon you’ve just added to their pass.

- Location-Based Reminders: A geofenced notification can trigger a reminder to use their pass when they're just around the corner from your store.

This communication channel cuts through the digital noise. It provides a direct line to your most engaged customers, delivering relevant information at the exact moment it's most useful.

This ability to communicate with such precision is a game-changer. For example, Google Wallet is rolling out field update notifications, allowing you to send an alert when a specific detail changes—like a point balance crossing a reward threshold. This transforms the pass from a static card into a living, breathing touchpoint with your brand.

Enhance Your Brand and Reduce Costs

Switching to wallet passes sends a clear signal: your brand is modern, in-tune with customer needs, and environmentally aware. But ditching paper and plastic isn't just for show; it has a real impact on your bottom line.

Think about all the hidden expenses tied to old-school loyalty programs:

- Printing Costs: The constant cycle of designing and printing thousands of plastic or paper cards.

- Distribution: The postage and logistics of mailing cards out and replacing lost ones.

- Environmental Impact: The waste from all those single-use paper coupons and plastic cards.

Digital wallet passes wipe these recurring costs off the books. You not only boost your profitability but also align your business with the growing number of consumers who actively prefer sustainable brands. It's a true win-win for your business and your customers.

How to Launch Wallet Passes for Apple and Google

Thinking about creating digital wallet passes might sound like you need a team of developers and a massive budget, but that’s a common misconception. The truth is, getting your own branded passes onto your customers' Apple and Google Wallets is surprisingly straightforward for businesses of any size.

You aren't building a complex new app from the ground up. Instead, you're tapping into the native Wallet apps already installed on billions of phones. This is a huge advantage—it eliminates the friction of getting customers to download yet another app and lets you show up where they're already active.

The journey from an idea to a pass on a customer’s phone is more about smart planning than heavy-duty coding. It’s about designing a great-looking pass and figuring out the best way to get it into their hands.

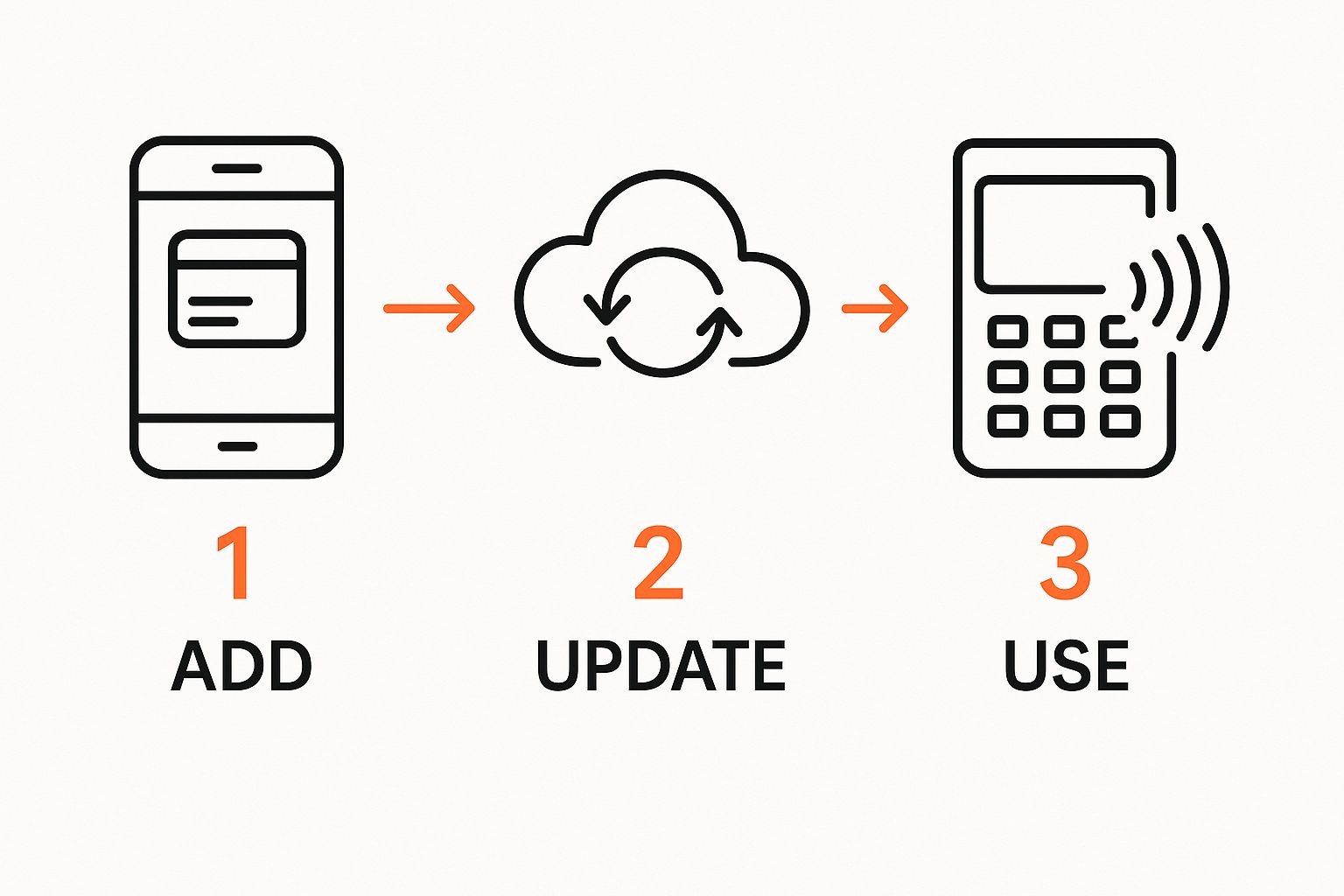

The image below breaks down the customer experience—from adding the pass to receiving updates and using it in the real world.

As you can see, it's a connected loop. A pass is added once, gets updated automatically from the cloud, and is ready to be scanned whenever the customer interacts with your business.

The Building Blocks of a Wallet Pass

Think of creating a wallet pass like putting together a digital kit. You don't need to be a programmer to get it done; you just need to decide what you want it to look like and what information it should hold.

Platforms like Toki handle all the technical heavy lifting, generating the files that work seamlessly with both Apple and Google Wallet. Your job is to focus on the design and content.

Here’s what goes into every pass:

- Template Design: This is the visual foundation. You'll pick your brand colors, upload your logo, and choose a layout that makes sense for the pass's purpose—be it a loyalty card, a coupon, an event ticket, or something else.

- Dynamic Fields: These are the living, breathing parts of your pass. A points balance on a loyalty card, the expiration date on a coupon, or the gate number on a boarding pass are all great examples. You can update these fields remotely long after the pass has been saved to a phone.

- Static Information: This is the information that doesn't change, like your company’s name, store locations, or the terms and conditions of an offer.

This mix of static and dynamic elements is what makes wallet passes so powerful. You create the branded shell, and the dynamic fields ensure the content stays fresh, relevant, and useful.

Getting Passes into Customers' Hands

Once you’ve designed your pass, the next crucial step is getting it to your customers. The goal here is simple: make it incredibly easy for someone to save your pass. Fortunately, you have plenty of channels to work with.

The most effective distribution methods meet customers where they already are. Integrating pass links into existing communication channels removes extra steps and dramatically increases adoption rates.

Here are a few of the most popular ways to distribute your passes:

- QR Codes: Put a QR code on in-store signage, receipts, or even product packaging. A quick scan with a phone’s camera can take a customer straight to the download.

- Email and SMS Links: Add a "Save to Wallet" link directly in your marketing emails or text messages. This is perfect for sending personalized loyalty cards or delivering event tickets right after a purchase.

- Website or App Banners: Use a call-to-action on your website or in your existing mobile app that invites users to add your store card or a special discount.

The real key is to make the process feel instant and intuitive. It should only take a single tap or scan. For a deeper dive into building a complete strategy around this, check out our guide on digital wallet marketing.

The massive consumer shift toward digital payments only reinforces how important this channel is becoming. By 2025, global spending through digital wallets is expected to skyrocket past $10 trillion—an 83% leap from 2020. This trend isn't just a number; it's a clear signal that customers are ready and waiting to use their digital wallets for much more than just tapping to pay.

Inspiring Examples of Wallet Passes in Action

Sure, a digital coffee card is a great start, but the real power of wallet passes shines through when you see how different industries are using them to solve their unique problems. This technology is incredibly flexible, acting like a digital key that unlocks both convenience for customers and new opportunities for businesses. These real-world applications show just how versatile this tool can be.

The timing couldn't be better. The explosion in mobile payments has laid the groundwork for this shift. The payment wallet market isn’t just growing; it's set to become a $158.01 billion industry by 2025. This surge is fueled by people who expect secure, easy ways to manage their lives from their phones, making it the perfect moment for businesses to jump in. You can dive deeper into this market trend at The Business Research Company.

Let's look at some inspiring examples of how businesses are putting these passes to work.

Seamless Journeys in Travel and Transit

In the travel world, wallet passes have gone from being a neat little trick to an absolute necessity. They smooth out some of the most stressful parts of traveling, creating a far better experience for millions.

Airlines were some of the earliest adopters, and for good reason. A digital boarding pass is the perfect use case:

- Real-Time Updates: It can instantly show gate changes, updated boarding times, or flight delays right on the pass.

- Lock Screen Access: The pass pops up on a traveler's lock screen a few hours before the flight, so there's no frantic searching.

- Automatic Linking: Airlines can now automatically add a boarding pass to a frequent flyer's wallet after they check in, making the whole process effortless.

Public transit systems are catching on, too. Instead of fumbling for a separate transit card, riders can simply tap their phone with a pass linked to their payment method. These passes can even display real-time train status, letting a commuter know if their ride is on time or delayed.

Unforgettable Experiences for Events and Entertainment

Event management is all about creating a fantastic experience from start to finish, and wallet passes are playing a starring role. They solve the age-old problem of lost paper tickets and add a whole new layer of engagement.

Think about a concert or a festival. A digital ticket in a wallet is so much more than just proof of entry—it’s an interactive guide.

- Pre-Event Hype: Organizers can send push notifications with event maps, schedules, and artist info to build excitement.

- Cashless Convenience: The pass can be tied to a cashless payment wristband or account, making it easy to buy food and merch.

- Post-Event Follow-Up: After the show, the pass can be updated with a link to buy merchandise or an early-bird offer for next year's event.

This transforms the ticket from a one-time entry tool into a lasting marketing asset. It keeps the conversation going long after the event has ended.

Modernizing Memberships and Access

For businesses that depend on repeat visits—like gyms, clubs, and libraries—wallet passes offer a dead-simple way to manage access. A digital membership card is always with the customer, making check-ins quick and painless.

Gyms, for example, can issue membership passes with a unique barcode for scanning at the front desk. This gets rid of plastic key fobs and streamlines the entire check-in process. The pass can also show membership status, expiration dates, and even send reminders when it's time to renew.

This same logic applies to a huge range of scenarios:

- Student IDs for getting into buildings and using campus services.

- Corporate IDs for building entry and security.

- Library Cards for checking out books with a simple scan.

Wallet Pass Applications Across Industries

To really see how adaptable wallet passes are, let's look at how different businesses can use them to hit specific goals.

| Industry | Wallet Pass Use Case | Primary Business Goal |

|---|---|---|

| Retail | Digital coupons, loyalty cards | Drive repeat purchases, increase customer lifetime value |

| Hospitality | Hotel room keys, event tickets | Enhance guest experience, streamline operations |

| Healthcare | Appointment reminders, insurance cards | Reduce no-shows, improve patient communication |

| Transportation | Boarding passes, transit tickets | Improve efficiency, provide real-time updates |

| Entertainment | Concert tickets, season passes | Increase engagement, create post-event marketing |

| Services | Gym memberships, library cards | Simplify access, reduce administrative overhead |

These examples are just the beginning. From digital business cards with profile images to healthcare passes for accessing online patient portals, the applications are growing every day. The core idea is always the same: wallet passes offer a secure, convenient, and direct way to connect with your audience and solve real-world problems, one digital pass at a time.

Best Practices for a Winning Wallet Pass Strategy

Think of a wallet pass not as a simple digital card, but as a direct line of communication with your customer—a conversation that stays open. A winning strategy goes way beyond just digitizing a piece of plastic. It's about creating an experience that feels genuinely valuable and timely.

When you get it right, you're not just handing over another digital file. You're earning a permanent spot on your customer's most personal device. That's prime real estate, and holding onto it means being thoughtful and consistently delivering on your brand's promise.

Design Passes Customers Are Proud to Save

First impressions are everything. Your wallet pass's design is its digital handshake, and a cluttered, off-brand pass feels cheap and untrustworthy. That's a surefire way to get deleted. The goal is to design something that looks and feels like a natural part of your brand.

- Keep it clean and clear. Key info like your logo, the pass title, and the main benefit ("15% OFF," "500 Points") should be obvious at a glance.

- Stay true to your brand. Stick with your official brand colors, fonts, and logos. Consistency builds trust and makes your pass instantly recognizable.

- Test on both platforms. Apple and Google Wallet have subtle differences in how they display passes. Always check how your design looks on both to avoid any awkward formatting.

A well-designed pass feels less like a flimsy coupon and more like a premium membership card—something customers are actually happy to see in their digital wallet.

Create a Frictionless Installation Process

The moment a customer decides they want your pass is make-or-break. Any friction, confusion, or extra steps will send your abandonment rates through the roof. The whole process should feel instant and effortless.

A seamless installation is non-negotiable. If a customer has to wonder how to add your pass, you’ve already lost. It should take one or two taps, maximum.

Make it dead simple by putting your wallet passes where your customers already are. Add QR codes to in-store signage and receipts. Place a clear "Add to Wallet" button in your post-purchase emails or SMS confirmations. Every touchpoint should lead directly to the pass with zero hurdles.

Deliver Dynamic and Relevant Value

A static, unchanging wallet pass is a huge missed opportunity. The real magic happens when you use dynamic updates and smart notifications to turn it into a living, breathing channel that keeps your brand top-of-mind.

For instance, platforms like Google Wallet are always adding new features, like field update notifications. This lets you ping a customer when something specific changes, like their loyalty points balance crossing a reward threshold. It’s this direct line of communication that’s so powerful for building a strong loyalty program. If you're looking for more ideas, explore our detailed guide on how to create a loyalty program that boosts growth.

The strategy here is to deliver timely information that genuinely helps the customer, like a location-based reminder when they're near your store or a friendly heads-up about an offer that's about to expire.

This isn't just a niche tactic; it's aligning with a massive shift in consumer behavior. The digital wallet market is projected to swell to an incredible $19.7 trillion by 2030, fueled by the explosion of smartphones and contactless payments. This trend shows that digital wallets are becoming the central hub for how people shop and interact with brands. You can read more about the future of the digital wallet market on Knowledge Sourcing Intelligence.

Got Questions About Wallet Passes? We’ve Got Answers.

Jumping into any new marketing channel is bound to bring up a few questions. Even when the benefits seem obvious, it’s smart to dig into the details of security, functionality, and how you’ll actually track your success. Let's tackle the most common things business owners ask before they create their first wallet pass.

Think of this as the final check-in before you start building that direct, powerful connection with your customers. Once you've got these answers, you'll be ready to move forward with confidence.

Are Wallet Passes Actually Secure for My Customers?

This is usually the first question people ask, and for good reason. The answer is a resounding yes. Wallet passes are tucked away inside the secure, encrypted environments of Apple Wallet and Google Wallet—native apps built by two of the biggest tech companies in the world, with security as a core focus.

Here’s a key point that often brings a sigh of relief: wallet passes don’t store sensitive payment details like full credit card numbers. They work using unique tokens and identifiers for things like loyalty points, event tickets, or special offers. This makes them a far safer way to manage customer programs than physical cards that can be easily lost or stolen.

In fact, the technology is getting even smarter. Google Wallet is integrating features like Zero Knowledge Proof (ZKP), which can verify something like a person's age without ever revealing their birthdate or other personal data. It’s all about protecting user privacy.

You can offer these passes to your customers with peace of mind, knowing their information is protected by the powerful security systems already built into their phones.

What's the Real Difference Between a Wallet Pass and a Mobile App?

This is a great question because it gets right to the heart of user experience. The main difference comes down to one word: friction. A wallet pass lives inside an app that’s already on your customer's phone (Apple Wallet or Google Wallet). There’s nothing new to download from an app store. That small detail makes a huge difference and removes a major barrier for customers.

- Wallet Pass: Perfect for simple, direct actions. Think loyalty cards, coupons, event tickets, and membership IDs. They’re incredibly easy to save and pop up right on the lock screen when needed.

- Dedicated App: Offers a much wider world of features but comes with a bigger ask. The customer has to find it, download it, and give up precious space on their phone for it.

While a full-blown app is the right move for more complex needs, a wallet pass is the ultimate tool for creating a light-touch, persistent connection. It drives loyalty and repeat sales without asking for a big commitment from your customer.

How Do I Measure the ROI on a Wallet Pass Campaign?

Tracking the return on your investment with wallet passes is more straightforward than you might think. Unlike marketing efforts that can feel a bit fuzzy, passes generate clear, measurable data that you can link directly to your business goals.

Most third-party platforms that help you create passes also provide detailed analytics. From a simple dashboard, you can easily monitor your key metrics:

- The total number of passes your customers have installed.

- How many people are actually redeeming your coupons and offers.

- Whether pass holders are visiting your business more frequently.

- The overall lift in spending from customers who use a pass compared to those who don’t.

By keeping an eye on this data, you get a crystal-clear picture of what’s working. This allows you to fine-tune your strategy and make smart decisions to get even better results over time.

Ready to turn your customers into lifelong fans with loyalty programs and digital wallet passes they'll love? Toki provides all the tools you need to build lasting relationships and drive repeat sales. Get started with Toki today!