Digital Wallet Marketing Strategies to Boost Engagement

The Digital Wallet Revolution: Market Opportunities Unveiled

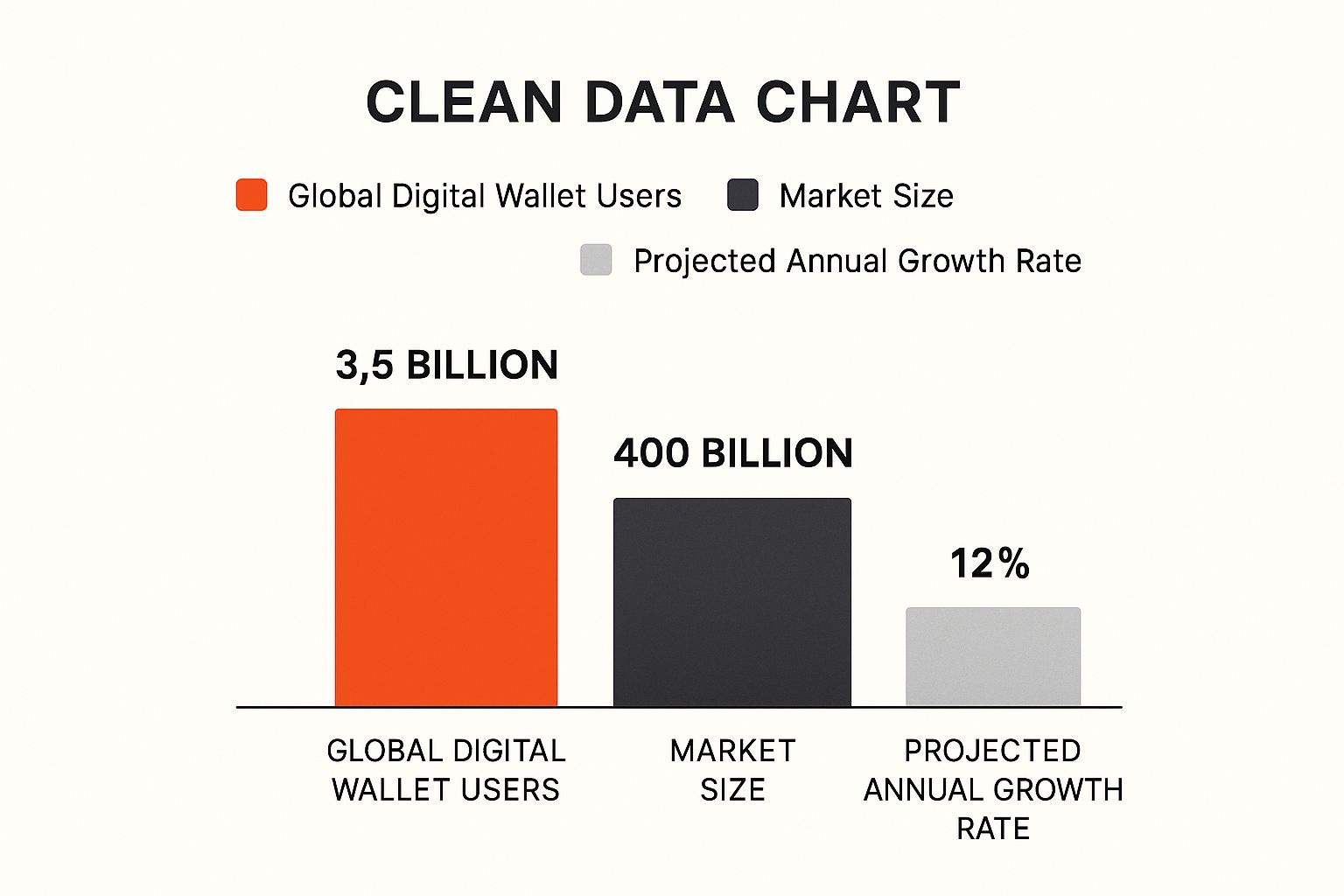

The infographic above highlights key data about the growing digital wallet market. It shows the number of users worldwide, the current market size, and the projected growth rate. In 2023, there are 3.5 billion digital wallet users globally, contributing to a market size of $400 billion USD. This impressive reach is expected to expand further with a projected annual growth rate of 12%. This surge in adoption creates exciting opportunities for businesses ready to adapt to this changing payment landscape.

Understanding the Growth Drivers

What's behind this rapid expansion? A major factor is the change in consumer behavior, specifically a growing preference for contactless payments and more personalized experiences. Consumers value the speed and convenience of digital wallets. The added security features and rewards programs are also attractive incentives. Furthermore, the integration of digital wallets with other services, such as loyalty programs and in-app purchases, adds to their appeal.

The Expanding Market Landscape

This isn't just a temporary trend. The global digital wallet market is poised for substantial growth. Projections indicate it will reach $8.29 trillion by 2025. By 2030, that figure is expected to more than double to around $19.68 trillion, showcasing a compound annual growth rate (CAGR) of 18.88%. This growth encompasses a wide range of services beyond just payments, including money transfers, bill payments, and entertainment bookings. You can find more insights into this growth at digital wallet market growth. This expansion presents significant opportunities for businesses using digital wallet marketing.

To illustrate this growth trajectory, let's look at the following table:

Digital Wallet Market Growth Projections

| Year | Market Size (in trillions) | Annual Growth Rate | Key Growth Drivers |

|---|---|---|---|

| 2023 | $0.4 | 12% | Increasing demand for contactless payments, personalized experiences, and integration with other services |

| 2025 | $8.29 | Continued expansion of services offered, including money transfers, bill payments, and entertainment bookings | |

| 2030 | $19.68 | 18.88% (CAGR) | Further adoption of digital wallets as a primary payment method globally |

This table showcases the significant growth projected for the digital wallet market, driven by evolving consumer behavior and an expanding range of services.

Capitalizing on the Digital Shift

This transition towards digital payments offers businesses a vital chance to connect with customers in new ways. Digital wallet marketing empowers brands to target specific customer segments, personalize offers, and track campaign performance with greater accuracy. This personalized approach helps build stronger customer relationships, increase brand loyalty, and ultimately drive sales.

Leveraging Digital Wallets for Enhanced Customer Engagement

Businesses that embrace digital wallet marketing can enjoy several key advantages:

- Targeted Promotions: Send customized offers and promotions directly to customers' digital wallets.

- Enhanced Loyalty Programs: Integrate loyalty programs with digital wallets for seamless reward redemption.

- Streamlined Checkout Process: Provide a faster and more convenient checkout experience, minimizing friction and abandoned carts.

- Data-Driven Insights: Collect valuable data on customer behavior and preferences to improve future marketing campaigns.

By implementing these strategies, businesses can not only enhance customer engagement but also stay ahead of the competition. This proactive approach helps brands harness the potential of the digital wallet revolution and discover new avenues for growth.

Decoding Digital Wallet User Psychology

Understanding the psychology of digital wallet adoption is key to effective digital wallet marketing. It's not simply about the technology itself; it's about understanding consumer motivations. This means recognizing the interplay of convenience, security, and the allure of rewards. For instance, the simplicity of tapping a phone to pay, compared to searching for a physical card, is a major draw for many.

Beyond Convenience: The Security Factor

While convenience is a primary driver, security concerns can hinder adoption. Many users hesitate to entrust digital platforms with their financial data. Therefore, digital wallet marketers must emphasize security measures, clearly explaining how user information is protected. Building this trust is paramount for wider acceptance. Features like biometric authentication and fraud detection can further alleviate these concerns.

The Power of Rewards and Incentives

Reward systems are essential for attracting and retaining digital wallet users. Think of them as digitized loyalty programs, seamlessly integrated into the payment experience. Cashback offers, exclusive discounts, and points systems can encourage usage and foster brand loyalty. Understanding user spending habits is crucial here. By analyzing transaction data, marketers can personalize rewards, maximizing their impact.

Understanding User Segmentation

Digital wallet users are not a uniform group. They have diverse motivations, spending habits, and preferences. This requires marketers to segment users beyond basic demographics. Some users prioritize security, while others value convenience or rewards. Understanding these nuances enables targeted campaigns that resonate with specific user personas. You might be interested in: How to Master Customer Loyalty.

Spending Patterns and Brand Loyalty

Digital wallet users often display different spending patterns than those using traditional payment methods. Digital wallet transactions are becoming increasingly significant in global payment flows. In 2023, these transactions reached $9 trillion globally and are projected to exceed $16 trillion by 2028. Furthermore, digital wallet users tend to spend 12.8% more than debit card users and 51.1% more than cash users. Learn more about these digital wallet statistics. This highlights the potential marketing value for businesses focusing on digital wallet customers. This difference in spending behavior creates opportunities for targeted promotions and personalized offers.

Targeting the Adoption Journey

Finally, it's important to acknowledge that users are at different stages of the digital wallet adoption journey. Some are early adopters, embracing new technologies readily. Others are more cautious, needing more information and reassurance. Consequently, digital wallet marketing strategies must address the specific needs and concerns of each segment, guiding them through the adoption process and encouraging long-term engagement.

Standing Out in the Digital Wallet Battleground

The digital wallet market is more competitive than ever. How can your digital wallet rise above the rest and gain market share? The answer lies in differentiation: creating a unique value proposition that truly connects with your target audience. This could range from enhanced security measures to a highly rewarding incentive program. It’s about pinpointing what makes your wallet distinct.

Identifying Your Niche: Competitive Analysis

A critical first step is performing a thorough competitive analysis. This means closely examining the strengths and weaknesses of your competitors. Consider these key aspects:

- Security Features: How strong are their security protocols?

- Convenience Elements: How smooth is the user experience?

- Rewards Structures: How enticing are their incentive programs?

- Specialized Functionality: What unique features do they offer?

By understanding the competitive landscape, you can identify opportunities to set your digital wallet apart. This could involve addressing unmet user needs or enhancing existing features to provide a better experience.

Carving Out Your Market Position

Once you understand the competition, you can begin to define your digital wallet marketing strategy. This involves identifying your target audience and tailoring a message that resonates with their specific needs. For example, if you are targeting security-conscious users, emphasize your robust security features. If your target demographic is younger, highlight the social elements of your wallet and attractive reward systems. Successful digital wallets often concentrate on particular user groups rather than trying to appeal to everyone.

Case Studies: Learning from the Best (and the Rest)

Real-world examples offer invaluable insights. Both successes and failures provide essential lessons. For instance, Apple Pay's impressive growth demonstrates the impact of a seamless user experience. Its market share is projected to handle roughly 10% of global card transactions by early 2025, double its previous share. This growth underscores the increasing acceptance of digital wallets, although traditional cards remain dominant. Digital wallets, however, are expected to represent over 20% of online payments by 2024. Learn more about this trend in the Clearly Payments Blog. On the other hand, digital wallets that have struggled often lacked a defined value proposition or failed to communicate their benefits effectively.

Practical Frameworks for Competitive Analysis

Here’s a practical framework for conducting competitive analyses specific to digital wallets:

- Monitor Acquisition Tactics: How are competitors attracting new users?

- Track Promotional Calendars: What promotions are they running, and when?

- Analyze Feature Rollouts: What new features are they introducing, and how are they positioning them?

Staying informed about your competitors allows you to adapt your digital wallet marketing strategy effectively.

Developing a Winning Value Proposition

Ultimately, success in the digital wallet market hinges on a compelling value proposition. This means identifying a real unmet need and offering a solution that truly resonates with your target audience. This could involve providing innovative features, a superior user experience, or a more rewarding rewards program. It also requires clearly communicating this value proposition through targeted marketing efforts.

To understand how different digital wallet providers approach this, let's examine a comparison table:

Digital Wallet Market Leaders Comparison

The following table examines the key features, market share, and marketing approaches of major digital wallet providers to identify successful strategies and competitive advantages.

| Digital Wallet Provider | Market Share (Example) | Primary Target Audience (Example) | Key Marketing Strategies (Example) | Unique Value Proposition (Example) |

|---|---|---|---|---|

| Apple Pay | 10% | Tech-savvy consumers, iPhone users | Integration with Apple ecosystem, emphasis on security and convenience | Seamless user experience within the Apple ecosystem |

| Google Pay/Wallet | 7% | Android users, users seeking integration with Google services | Focus on versatility and broad device compatibility, integration with Google services | Cross-platform compatibility, integration with Google services |

| PayPal | 15% | Online shoppers, users seeking established brand and buyer protection | Focus on security and buyer protection, extensive merchant acceptance | Established brand, buyer protection features |

| Venmo | 5% | Younger demographics, users seeking social payment experience | Peer-to-peer transactions, social sharing features | Social payment experience, user-friendly interface |

| Cash App | 3% | Users seeking financial tools and investment options | Focus on financial services beyond payments, peer-to-peer transactions | Integrated financial tools and investment options |

This table provides illustrative examples; actual market share figures can vary. The goal is to demonstrate how analyzing competitors can clarify your own digital wallet’s unique strengths, which is essential for effective digital wallet marketing.

Acquisition Tactics That Actually Drive Downloads

Driving downloads for your digital wallet requires a deep understanding of user motivation. It’s not enough to simply promote your product; you need to analyze successful acquisition campaigns and identify the channels that deliver high-quality users at a sustainable cost. This involves understanding user psychology and developing targeted strategies.

Incentivizing Downloads: Rewards That Resonate

Incentive programs are a powerful tool in digital wallet marketing. These programs might include signup bonuses or referral rewards. However, the key to success lies in strategic structuring. Data analysis, using tools like Google Analytics, can reveal which incentive approaches yield the best ROI. For instance, tiered rewards based on usage can encourage continued engagement.

Referral programs can also tap into existing user networks for organic growth. A small reward for both the referrer and the new user can significantly boost downloads. This leverages the power of word-of-mouth marketing and creates a sense of community around your wallet.

The Power of Partnerships: Creating Natural Adoption Pathways

Strategic partnerships offer natural pathways for digital wallet adoption. By teaming up with retailers and service providers, you gain access to new user bases. This might involve offering exclusive discounts for using the wallet at partner locations.

For example, partnering with a popular coffee chain to offer a discount on the first purchase made with the wallet can be a strong incentive. Such partnerships create mutually beneficial relationships, driving traffic and increasing transactions for both the wallet provider and the retailer.

Onboarding: From Download to Active User

A frictionless onboarding experience is crucial for converting downloads into active users. The onboarding process should be quick, intuitive, and clearly explain the wallet’s benefits. Addressing security concerns upfront is also paramount.

Instead of complex technical jargon, explain security measures in plain language. Highlight security features, such as two-factor authentication and biometric logins, to build trust and demonstrate how the wallet protects user information.

Channel Optimization: Reaching the Right Audience

Choosing the right acquisition channels is essential. Different channels may resonate better with specific demographics. For example, social media campaigns targeting younger audiences could focus on the social aspects of the wallet.

Alternatively, email marketing campaigns for a more mature audience might highlight security and convenience. Analyzing data from past campaigns can inform future channel allocation, optimizing your digital wallet marketing spend.

Tailoring Strategies to Budget and Business Model

Effective acquisition tactics should align with your budget and business model. A startup with limited resources might prioritize organic growth strategies like referral programs and social media engagement.

Larger companies with more substantial budgets could invest in paid advertising across multiple channels. Understanding your target audience and tailoring your strategies accordingly are key to driving downloads and building a loyal user base. For businesses looking to enhance customer experience and drive repeat sales, Toki offers customizable digital wallet passes that integrate seamlessly with Apple and Google Wallet. Learn more about implementing digital wallet passes at Toki's website.

Turning One-Time Users Into Digital Wallet Advocates

Acquiring new users is essential, but true success lies in keeping them engaged. This is especially challenging in the competitive world of digital wallets. This section explores data-driven retention strategies to combat app abandonment, a common problem for many digital wallets.

Analyzing Transaction Patterns to Identify At-Risk Users

Understanding transaction patterns can reveal which users are likely to leave your platform. This means looking beyond how often users make transactions and examining the types of transactions, their value, and the time between them. For example, a sudden drop in transaction value or a long period of inactivity could indicate a user's declining interest. This knowledge allows for proactive intervention.

Targeted Re-Engagement Campaigns That Work

Once you’ve identified at-risk users, targeted re-engagement campaigns can effectively recapture their interest. Personalize these campaigns based on individual user history and preferences. This could involve offering tailored incentives, such as discounts at favorite stores or cashback rewards for specific purchases. Reminding users about your digital wallet's security and convenience can also reinforce its value.

Notifications: Maintaining Presence Without Being Intrusive

Notifications are a powerful tool, but they can also be a nuisance. While they remind users about your wallet, too many irrelevant notifications can become intrusive, leading users to disable them altogether. The key is finding the right balance. Send timely, relevant notifications that offer real value. Notifications about exclusive deals at nearby stores or reminders for upcoming bill payments can be helpful and encourage engagement.

Habit-Forming Features: Making Your Wallet Indispensable

Successful digital wallets integrate seamlessly into users' daily routines. This can include features like automatic bill payments, budgeting tools, or personalized spending insights. By becoming an essential tool for managing finances, users are less likely to switch to competitors. You might be interested in: How to Promote Your Loyalty Program to Your Customers.

Personalized Offers: Leveraging Transaction Data for Increased Usage

Leading digital wallet marketers use transaction data to create personalized offers that boost usage and transaction values. By analyzing a user's purchase history, you can pinpoint their preferred merchants and offer targeted discounts or rewards. This not only promotes repeat business but also fosters customer loyalty. This data-driven strategy ensures that offers are relevant and engaging, maximizing their impact.

Measuring Long-Term Engagement: KPIs for Success

Track key performance indicators (KPIs) to ensure your digital wallet marketing strategy is effective. Go beyond simple download numbers and focus on metrics like:

- Active users: The number of users regularly engaging with the wallet.

- Transaction frequency: How often users conduct transactions.

- Transaction value: The average amount spent per transaction.

- Customer lifetime value: The total revenue generated by each user over their relationship with your platform.

By monitoring these KPIs across different user segments, you'll gain valuable insights into your retention strategies' effectiveness and identify areas for improvement. This data-driven approach allows for continuous optimization and maximizes long-term user engagement.

Leveraging Digital Wallet Data for Marketing Mastery

Digital wallets offer a treasure trove of information about consumer behavior. However, using this data effectively requires a well-defined strategy. This section explores how marketers are ethically using transaction data to craft highly targeted campaigns that outperform generic marketing efforts. This involves understanding how to collect and interpret the data while respecting privacy standards.

Building Comprehensive User Profiles

Digital wallet marketing relies heavily on understanding the customer. By analyzing spending patterns, merchant preferences, and payment behaviors, marketers can build detailed user profiles. For example, if a customer frequently uses their digital wallet for coffee purchases, this suggests a potential interest in loyalty programs offered by coffee shops.

This allows businesses to present personalized offers and promotions, increasing customer engagement. This granular data can also reveal broader trends. For instance, if a significant number of users make frequent small purchases, a business might consider offering micro-rewards or discounts tailored to this behavior.

This creates a positive feedback loop, encouraging more transactions and fostering customer loyalty. However, maintaining strict privacy standards throughout this process is paramount. Transparency and responsible data handling are crucial for building and maintaining user trust.

Clearly communicating your data privacy policies and ensuring compliance with relevant regulations are essential for ethical digital wallet marketing.

Advanced Segmentation Techniques for Digital Wallet Users

Beyond basic demographics, marketers can segment digital wallet users based on their behavior within the wallet ecosystem. This could involve grouping users by transaction frequency, average transaction value, preferred merchants, or usage of specific features within the wallet.

This level of granularity allows for highly targeted campaigns. For example, businesses could segment users who frequently use coupons or discounts and send them targeted promotions related to their favorite stores.

Alternatively, for security-conscious users, marketing messages could emphasize the safety features of the digital wallet. This personalized approach strengthens the effectiveness of marketing campaigns.

Predictive Analytics: Anticipating User Needs

Predictive analytics elevates digital wallet marketing to the next level. By analyzing past behavior, businesses can anticipate user needs and tailor messaging accordingly. This could involve suggesting relevant products or services before the user even realizes the need.

For instance, if a user regularly purchases movie tickets through their digital wallet, a business could predict when they might be looking for tickets again and send them personalized offers or promotions. This proactive approach can significantly increase conversion rates and customer satisfaction. For more insights into predictive analytics, check out this guide on How to Master Customer Lifetime Value in Ecommerce.

Real-Time Analytics and Dynamic Marketing Adjustments

Real-time analytics allows for dynamic adjustments to digital wallet marketing campaigns. This enables businesses to respond instantly to changing user behavior and market trends. If a particular promotion isn't performing well, it can be quickly modified or replaced with a different offer.

This agility is essential for optimizing campaign performance and maximizing ROI. By continually analyzing data and adjusting strategy, businesses can ensure their campaigns are always relevant and effective. This responsive approach keeps marketing aligned with user behavior and ensures maximum impact. This continuous optimization creates campaigns that adapt to user behavior, resulting in stronger engagement and improved results.

Future-Proofing Your Digital Wallet Marketing Strategy

The digital payments world is constantly changing. To stay ahead, your digital wallet marketing strategy needs to be adaptable and future-focused. This means understanding emerging trends and getting ready for what's next in digital finance.

Embracing Emerging Technologies

New technologies are reshaping how we think about digital wallets. Blockchain integration offers more secure and transparent transactions. Blockchain is gaining traction for the security advantages that it offers to consumers and companies. Cryptocurrency support creates new possibilities for payments and investments, with new digital currencies entering the market all the time. Embedded finance, where financial services are integrated into non-financial platforms, creates seamless payment experiences. These are just a few of the exciting developments shaping the future of digital wallets.

Imagine ordering groceries online and paying directly through the grocery store's app using an embedded digital wallet. This streamlined experience is more convenient for customers and opens doors for personalized offers and loyalty programs.

The Rise of Super-Apps

Digital wallets are evolving beyond simple payment tools. They're becoming super-apps, integrating a range of services into a single platform. These services might include shopping, travel booking, food delivery, and much more. Marketing strategies need to adapt to this changing landscape, focusing on the broader ecosystem of services available. This means understanding how these services interact and positioning the digital wallet as a central hub for managing daily life.

Biometrics and Identity Management: Building Trust

Advances in biometric authentication and identity management are enhancing security. However, they also require changes to security messaging. Marketers need to clearly communicate the benefits of these advanced security features and build trust with users. Explaining the increased security and ease of use provided by features like facial recognition and fingerprint scanning can address user concerns and drive adoption.

Maintaining Marketing Agility

To stay current in this ever-evolving environment, digital wallet marketing needs to be nimble. This involves a few key strategies:

- Technology Monitoring: Keep up with new technologies and trends through ongoing research and industry involvement.

- Scenario-Based Planning: Create campaigns that can flex and adapt to different potential market shifts and changing consumer needs.

- Flexible Creative Assets: Develop marketing materials that can be easily adjusted for different platforms and user interfaces.

This proactive approach ensures your digital wallet marketing stays relevant and effective as the world of digital payments continues to change. It's also essential to have a team that embraces change and can quickly adapt to new information. This requires continual training and a culture that values innovation.

Practical Frameworks for Future-Proofing

One smart approach to maintaining agility is modular design in marketing campaigns. By creating separate, interchangeable parts for your campaigns, you can easily adapt to new technologies and user preferences. For example, a promotional offer can be quickly tweaked to include new rewards or payment options without having to redo the entire campaign.

Another useful technique is A/B testing different marketing strategies. This allows you to see which strategies are most effective and what resonates with your target audience. By constantly testing and refining your digital wallet marketing efforts, you remain adaptable and maximize impact. This data-driven approach ensures you’re always optimizing for performance and staying ahead of the curve.

Are you ready to boost customer loyalty and repeat sales? Toki is an all-in-one platform designed for Shopify and other e-commerce businesses to build lasting customer relationships. With customizable digital wallet passes that work seamlessly with Apple Wallet and Google Wallet, Toki helps create memorable shopping experiences. Visit Toki's website today to learn more.