Your Customer Acquisition Cost Calculator Guide

A customer acquisition cost calculator is a surprisingly simple tool that takes all your messy sales and marketing expenses and boils them down into one, powerful number. It answers a single, crucial question: How much are you actually spending to win one new customer? Getting that answer right is the bedrock of any predictable growth plan.

Why CAC Is Your Most Important Growth Metric

Before we get into the nuts and bolts of the formula, let's be clear on why Customer Acquisition Cost (CAC) is such a game-changer. Think of it as the ultimate health check for your entire marketing engine. It forces you to look past vanity metrics like clicks and impressions and focus on what actually drives the business forward: profitable growth.

Knowing your CAC gives you the power to:

- Justify your marketing budget with hard numbers, not just hunches.

- Pinpoint your most profitable channels so you can double down on what’s working.

- Spot and plug budget leaks from campaigns that aren't pulling their weight.

The Rising Stakes of Customer Acquisition

CAC has gone from a "nice-to-know" metric to a "must-know" one, especially as digital ad costs have shot through the roof. It’s not your imagination—in some industries, acquisition costs have jumped by over 222% in the last decade. Efficiency isn't just a buzzword anymore; it's a requirement for survival.

Companies that meticulously track and optimize their CAC can pivot and adapt to these market shifts. Those who are just guessing are getting left in the dust. You can learn more about the evolving importance of this metric and how to calculate it properly.

Your CAC isn't just another number on a dashboard—it's the compass for your entire growth strategy. It tells you if your business model is sustainable and whether your marketing efforts are a genuine investment or just a sunk cost.

Turning Raw Data Into Smart Decisions

To get a meaningful number from any customer acquisition cost calculator, you need to feed it clean, accurate data. Garbage in, garbage out, as they say. Getting this right is non-negotiable.

Here’s a quick look at the essential data you’ll need to pull together before you can get a reliable calculation.

Key Inputs for Your Customer Acquisition Cost Calculator

A summary of the essential data points you need to collect for an accurate CAC calculation.

| Data Category | Specific Examples | Why It Matters |

|---|---|---|

| Marketing Costs | Ad spend, social media campaigns, content creation, agency fees. | These are the direct expenses you incur to reach potential new customers. |

| Sales Costs | Team salaries, commissions, CRM software, sales tools. | This covers the people and technology required to turn a lead into a paying customer. |

| New Customers | The total number of new paying customers acquired in that period. | This is the denominator in your CAC formula; it's the result of all your spending. |

By tracking these components with care, you can be confident that the number your calculator spits out is one you can actually trust.

With this single metric in hand, you can finally answer critical questions like, "Which of our marketing channels delivers the best ROI?" or "Can we really afford to scale our paid ad campaigns?" A firm grasp on your CAC is the first step toward building a truly profitable growth engine.

Getting Your Numbers Straight for an Accurate CAC

Any customer acquisition cost calculator is only as good as the data you put into it. It’s the classic "garbage in, garbage out" scenario. A number that's even slightly off might not feel like a disaster, but it can ripple out, leading to bad budget decisions and squandered opportunities for growth.

To get a number you can actually rely on, you need to be meticulous. The first step is to lock down a specific time period for your analysis—whether that’s a single month, a quarter, or a full year. This is non-negotiable, as it ensures you’re comparing apples to apples when you start pulling data from your various systems, like your ad platforms, CRM, and accounting software.

Unpacking Your Total Marketing Costs

So, what exactly goes into the "cost" part of CAC? A common mistake I see is businesses only counting their direct ad spend. This will always give you a misleadingly low CAC and a false sense of confidence in your profitability.

For a true picture, you have to account for every single dollar spent on marketing.

- Paid Advertising: This is the easy one. It’s all your spending on platforms like Google Ads, Meta (Facebook/Instagram), LinkedIn, and any other channels where you pay for placement.

- Team Salaries: Don't forget the people! The salaries and benefits for your marketing team are a massive, and often overlooked, part of your acquisition investment.

- Software and Tools: Add up the subscriptions for your entire marketing stack. This includes your CRM, email marketing platform, SEO tools, and any analytics software.

- Content and Creative: Did you hire a freelance writer? Pay for a video shoot? Work with a graphic designer or a full-blown agency? All those costs need to be in the mix.

Once you add it all up, you get a much more honest view of what it really costs to market your business. You might be surprised to find that over half of your total marketing budget is tied up in people and tools, not just the ad campaigns themselves.

Tallying Up All Your Sales Expenses

Just like with marketing, your sales costs are more than just one line item. To get a truly blended CAC, you need to capture the full investment your sales team makes to turn a warm lead into a paying customer.

Make sure your calculation includes:

- Salaries and Commissions: This covers the base pay for your sales reps, plus any commissions or performance bonuses they earned during your chosen time frame.

- Sales Tools: Tally up the cost of software that your sales team depends on, like lead generation platforms or sales enablement tools.

- Overhead and Travel: Factor in any client dinners, travel expenses, or other costs associated with closing deals.

An accurate CAC requires looking beyond the ad budget. It’s a holistic view of every resource—people, tools, and creative—that you invest in growth. Overlooking even one component can skew your entire strategy.

For e-commerce brands especially, pulling all this data together can feel like a huge task. To make life easier, you might want to look into dedicated ecommerce analytics tools that can centralize your spending and customer data in one place.

Once you’ve gathered all these figures and feel confident in them, you’re finally ready. You can now plug them into the calculator and get a number you can actually trust.

Making the CAC Formula Work for You

Alright, you've done the hard work of gathering your sales and marketing costs. Now it's time to put those numbers into action. The actual math behind calculating your customer acquisition cost is surprisingly simple, but the insight it gives you into the health of your business is massive.

The formula itself is clean: Total Sales & Marketing Costs / Number of New Customers Acquired = CAC.

That’s it. This one number tells you exactly how much you had to spend to win over each new customer in a given period. No more guesswork—just a clear, hard metric to guide your strategy.

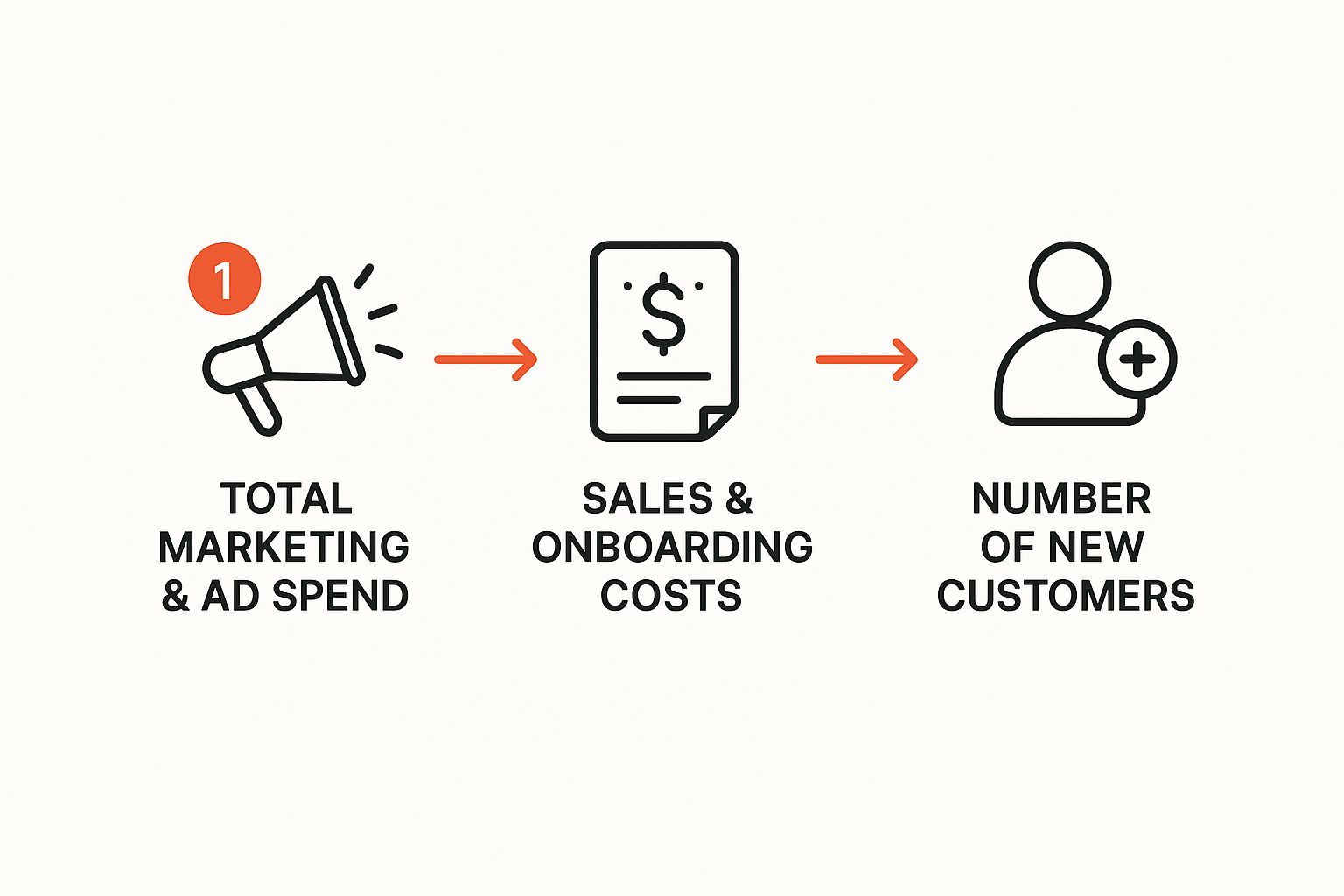

This infographic does a great job of showing how all your different expenses feed into one side of the equation, while your new customer count feeds into the other, ultimately giving you that final CAC figure.

It’s a powerful visual because it shows the direct relationship between your investment and your results. You can immediately see how tweaking either your spending or your conversion rate will impact your cost per customer.

A Quick E-commerce Example

Let's walk through a real-world scenario to make this concrete. Imagine a direct-to-consumer e-commerce brand calculating its CAC for the last quarter. They’ve kept meticulous records of their spending.

- Total Ad Spend: $25,000 (across all their paid social and search campaigns)

- Team Salaries: $10,000 (the portion allocated to marketing and sales staff)

- Software and Tools: $5,000 (for their CRM, email marketing platform, analytics, etc.)

- New Customers Acquired: 160

First, we'll tally up all the costs to find the total acquisition spend: $25,000 + $10,000 + $5,000 = $40,000.

Now, let's plug that into our formula: $40,000 / 160 new customers = $250 CAC.

The result is crystal clear. This brand spent, on average, $250 to acquire each new customer last quarter. This isn't just a number to file away; it's a critical benchmark that should inform every marketing decision they make going forward.

Why CAC Is Only Half the Story

Calculating your CAC is a fantastic first step, but that number doesn't live in a vacuum. To truly understand its meaning, you need to compare it against another crucial metric: Customer Lifetime Value (LTV). LTV is the total revenue you can reasonably expect from a single customer over their entire relationship with your brand.

A widely accepted industry benchmark is that your LTV should be at least three times your CAC. This is often called the 3:1 LTV to CAC ratio.

A 3:1 ratio is a strong indicator of a healthy, sustainable business. It means for every dollar you invest to get a customer, you're earning three dollars back over time. This balance proves you're building a profitable growth engine, not just pouring money into a leaky bucket to attract customers who don't stick around.

Looking ahead, companies worldwide are increasingly relying on tools like customer acquisition cost calculators to fine-tune their marketing efficiency. The LTV to CAC relationship is especially critical, with the consensus being that CAC should stay below one-third of LTV for sustainable growth. If you want to dive deeper, you can discover more insights about CAC on improvado.io.

What Your CAC Result Is Actually Telling You

https://www.youtube.com/embed/VQqnT6xV-xk

So, you’ve plugged your numbers into a customer acquisition cost calculator and have a final figure. Great. But what does that number—whether it's $50 or $500—really mean?

Think of your CAC as more than just a metric; it's a diagnostic tool. It tells a story about your business's health, the efficiency of your marketing, and ultimately, your long-term sustainability. The real work starts now: interpreting that story.

A "good" CAC is completely relative. For a B2B SaaS company selling enterprise contracts, a $250 CAC could be a fantastic result. But for an e-commerce store selling $40 t-shirts, that same number is a five-alarm fire. Context is everything.

Is Your CAC Too High?

Seeing a high CAC can be unsettling, but it’s actually a valuable signal. It’s pointing directly to a weak spot in your sales and marketing engine. Instead of panicking, it's time to put on your detective hat.

An inflated CAC is often a symptom of a deeper issue, like:

- Misaligned Ad Spend: Are you throwing money at the wrong audience on social media or bidding on keywords that just don't convert?

- A Leaky Funnel: Maybe your ads are great, but your landing page is confusing, or your checkout process has too much friction. Low conversion rates will kill your CAC.

- A Bloated Sales Cycle: Is your sales team investing too much time and too many resources to land a single customer? Every extra demo and follow-up call adds to the cost.

By digging into these areas, you can pinpoint exactly where your acquisition engine is breaking down and start making targeted fixes.

Your CAC isn’t just an expense line. It’s a direct reflection of how well your entire go-to-market strategy is working. A high CAC is a clear sign to optimize your channels, not just throw more money at them.

What an Extremely Low CAC Can Mean

On the flip side, an incredibly low CAC isn't automatically a sign of victory. Sure, it can mean you've found a goldmine—an untapped market or a hyper-efficient channel. If that's the case, congratulations.

But it can also be a warning sign that you're being too timid. A rock-bottom CAC might mean you aren't spending enough to reach your full audience. You could be leaving a massive amount of growth on the table by playing it too safe.

The goal isn't to get the lowest CAC possible. The goal is to find the most profitable CAC.

Finding Your Place: Industry Benchmarks

To give you a better sense of where you stand, it's helpful to look at what's considered "normal" in other industries. Remember, these are just averages—your mileage will vary based on your specific business model, target audience, and market maturity.

Industry Benchmark Customer Acquisition Costs

| Industry | Average CAC Range | Key Acquisition Channels |

|---|---|---|

| SaaS | $150 - $400+ | Content Marketing, SEO, Paid Search, Sales Teams |

| E-commerce | $25 - $100 | Social Media Ads, Influencer Marketing, PPC |

| Fintech | $100 - $300 | Affiliate Marketing, Paid Search, Content Partnerships |

| Travel | $50 - $150 | SEO, Price Comparison Sites, Email Marketing |

| Education | $100 - $350 | Webinars, Paid Social, Content Marketing, SEO |

This table helps illustrate just how much CAC can fluctuate. An e-commerce brand would be alarmed by a $250 CAC, but for a SaaS company, it might be right on target. You can discover more insights about industry CAC benchmarks on usermaven.com to get a deeper dive.

Ultimately, your CAC becomes most powerful when you look at it alongside its partner metric: Customer Lifetime Value (LTV). A high CAC can be perfectly sustainable if your customers stick around and keep spending money. Focusing on retention often makes your initial acquisition spend much more justifiable. To learn more, check out our guide on how to increase customer lifetime value and build a healthier, more scalable business.

Actionable Strategies to Lower Your CAC

Knowing your Customer Acquisition Cost (CAC) is a great first step, but the real magic happens when you start actively driving that number down. Lowering your CAC isn't about gutting your marketing budget. It’s about making every dollar you spend work smarter, turning wasted spend into real momentum.

One of the quickest wins is to obsess over conversion rate optimization (CRO). Let's run a quick scenario. Say you spend $1,000 on a campaign that brings 1,000 visitors to your landing page. If you convert 2% of them, you’ve got 20 new customers at a CAC of $50 each. Not bad.

But what if you A/B test that landing page? You tweak the headline, change the button color, and remove a few clunky form fields. Suddenly, your conversion rate jumps to 4%. With the exact same ad spend and traffic, you now have 40 customers. Your CAC just dropped to $25. You literally halved your cost without spending another dime on ads.

Refine Your Ad Targeting

Another powerful way to lower CAC is to get laser-focused on who sees your ads. Casting a wide net with generic campaigns is a fast way to burn through your budget with little to show for it. It's time to dig into your analytics.

Pinpoint the specific demographics, interests, and behaviors of your best, highest-value customers. Use that data to build hyper-targeted audiences for your paid campaigns on platforms like Facebook or Google. By cutting out the spend on clicks from people who were never going to buy, you can pour your budget into prospects who are actually ready to convert. This kind of precision directly slashes your cost per acquisition.

Lowering CAC is not about doing less marketing—it’s about doing more effective marketing. Every optimization, from a better landing page to smarter ad targeting, compounds over time to build a more efficient growth engine.

Launch a Powerful Referral Program

Don't forget about one of the most cost-effective acquisition channels out there: your existing customers. Happy customers are your best salespeople, and a solid referral program can turn casual word-of-mouth into a predictable growth machine with an incredibly low CAC.

Think about it. Instead of paying top dollar for cold traffic, you’re simply rewarding loyal customers for bringing in warm leads—people who are already inclined to trust you. This creates a powerful cycle of low-cost, high-quality customer acquisition. If you're ready to explore this, you can learn more about building a referral program that gets results.

Invest in Long-Term Organic Growth

Paid ads get you results now, but that traffic disappears the second you stop paying. For truly sustainable growth, you need to invest in content marketing and SEO.

Creating genuinely helpful blog posts, guides, and videos that solve your audience's problems will attract high-intent organic traffic around the clock. Yes, the upfront investment in time and resources can feel significant. But a single great piece of content can generate leads for years. Over time, the CAC for your organic channels can fall to a tiny fraction of what you pay for ads, building a much more resilient and profitable business in the long run.

Your Top CAC Calculator Questions, Answered

Even with a great calculator in hand, some practical questions always come up. Honestly, getting these details right is what turns CAC from a number you just report into a number you can actually use to make smart decisions. Let's dig into the questions I hear most often.

How Often Should I Be Running These Numbers?

The honest answer? It really depends on your sales cycle.

For most e-commerce or SaaS businesses, a monthly calculation is the sweet spot. This cadence is frequent enough to see how that new ad campaign is performing or to spot worrying trends before they get out of hand. It helps you stay agile without overreacting to a single bad day.

That said, you absolutely need to look at this on a quarterly basis, too. A quarterly view smooths out the monthly bumps and gives you a more stable, big-picture look at your acquisition engine. This is the number you'll want for bigger strategic planning, like setting the budget for the next quarter. The most important thing is just to be consistent. Pick a schedule and stick to it so your comparisons are always apples-to-apples.

What are the Big "Gotchas" When Using a CAC Calculator?

I've seen a few common mistakes trip people up, but the biggest one by far is undercounting costs. It’s so easy to just plug in your ad spend and call it a day, but that gives you a dangerously misleading number.

You have to be disciplined about including everything. Did you forget the salaries for your marketing and sales folks? What about the cost of your CRM, your email marketing platform, or that freelance designer you hired? All of it counts.

Another classic mistake is lumping in returning customers with new ones. Your Customer Acquisition Cost is about, well, acquiring new customers. If you include sales from existing customers in your calculation, you'll artificially deflate your CAC and might completely miss that your new customer pipeline is in trouble.

A truly accurate CAC is an all-in calculation. It must reflect every dollar—from ad campaigns to team salaries—invested in winning a new customer. Partial data leads to flawed strategies and wasted budget.

Should I Calculate One "Blended" CAC or Break It Down by Channel?

You need both. It's not an either/or situation; they tell you different, equally important stories about your business.

-

Blended CAC is your 30,000-foot view. It gives you the overall health of your acquisition efforts and is absolutely essential for high-level financial planning and understanding your baseline profitability.

-

Channel-Specific CAC is where the magic happens. This is your ground-level, tactical view. When you know it costs you $50 to get a customer from Google Ads but only $15 through your affiliate program, you've struck gold.

This is the kind of insight that lets you make real, impactful changes. It shows you exactly where to double down and where to pull back, which is one of the fastest ways to lower your overall blended CAC and grow more efficiently.

Ready to turn casual shoppers into brand champions? Toki empowers you to build powerful referral, affiliate, and loyalty programs that drive down your CAC and boost customer lifetime value. Start building lasting customer relationships today.