A Modern Playbook for Reducing Churn Rate in Ecommerce

When you get right down to it, cutting your churn rate is all about one thing: figuring out why customers are leaving and giving them great reasons to stick around. This isn't just playing defense. It’s a powerful growth strategy that focuses on getting the most value out of the customers you’ve already spent time and money to win over. By putting smart retention tactics in place, you can break free from the costly cycle of constantly chasing new customers and build a more profitable, sustainable business.

Understanding the Real Cost of Customer Churn

Before you can fix a leak, you have to know just how much it's costing you. Customer churn might seem like a simple percentage, but its true impact is a massive drain on your revenue, your marketing budget, and your ability to grow.

When a customer walks away, you're not just losing out on their next purchase. You're losing their entire future lifetime value.

This churn forces you into a hamster wheel of customer acquisition that's both exhausting and expensive. You find yourself spending more and more on ads, content, and outreach just to replace the customers who've left, which means you're basically running in place. This constant need to refill a leaky bucket keeps you from investing in the things that actually move your business forward.

The Staggering Reality of Ecommerce Churn

The scale of this problem is almost always bigger than merchants think. For ecommerce brands, churn is a huge structural drag on revenue. Average non-repeat rates hover somewhere between a painful 60–77%.

This is especially damaging when you realize that repeat buyers—who often make up just 20-25% of your active customers—can drive 50% or more of your total revenue. Losing them slices directly into your profit margins and forces you to spend even more on acquisition just to keep sales flat.

To really get a handle on the consequences and discover what works, it’s worth diving into proven strategies to reduce customer churn that directly address these costs and build real loyalty.

The Financial Leak Caused by Customer Churn

Let's break down what churn looks like in dollars and cents. The table below shows the annual cost for a hypothetical ecommerce store, highlighting how even a modest 10% reduction in churn can create a massive financial upside.

| Metric | Scenario A (60% Churn) | Scenario B (50% Churn) | Annual Impact |

|---|---|---|---|

| Starting Customers | 10,000 | 10,000 | - |

| Customers Lost | 6,000 | 5,000 | 1,000 Retained |

| Replacement Cost | $300,000 | $250,000 | $50,000 Saved |

| Revenue from Retained | $0 (from the 1k difference) | $600,000 | $600,000 Gained |

| Total Financial Swing | - | - | $650,000 |

As you can see, the total annual impact of a 10% churn reduction in this scenario is a staggering $650,000. The numbers don't lie.

This proves that lowering your churn rate isn't just about tweaking another metric on a dashboard. It’s one of the most powerful levers you can pull for long-term, sustainable profitability.

Pinpointing Why Customers Leave with Smart Analytics

You can't fix a problem you don't understand. Before you even think about building a retention strategy, you have to play detective inside your own business. It's about using analytics to uncover the real reasons customers walk away, because guesswork is just a fast track to wasted effort.

It all starts by looking past the basic churn rate formula. Sure, that number is a decent high-level health check, but it doesn't tell you who is leaving or why. To get insights you can actually act on, you need to dig into the metrics that tell the full story of your customer's journey.

Moving Beyond Surface-Level Metrics

To get a real feel for the health of your customer relationships, you need to focus on metrics that show engagement and value over time. Think of these data points as clues that can help you spot friction points and predict churn before it even happens.

I always recommend starting with these key metrics:

- Customer Lifetime Value (CLV): This is the total revenue you can reasonably expect from a single customer. If you see CLV dropping for a whole segment of customers, it’s a huge early warning sign.

- Repeat Purchase Rate: This one’s simple: what percentage of customers come back for a second buy? A low rate often points a finger at a rocky first-time experience or a weak follow-up.

- Purchase Frequency: How often does a customer buy from you? A sudden nosedive in frequency from a once-loyal customer is a major red flag that they're at risk.

- Time Between Purchases: By analyzing the average time it takes for customers to return, you can set a baseline. Anyone who drifts way past that average is a perfect candidate for a re-engagement campaign.

You can often find these analytics right inside your e-commerce platform, like Shopify's built-in dashboard. Of course, specialized tools can make this much easier. A platform like Toki, for instance, pulls all this data into one place, so you can easily spot trends and see how they connect to your loyalty program's performance.

By shifting focus from a single churn number to a collection of behavioral metrics, you move from reacting to customer loss to proactively nurturing customer loyalty.

Segmenting to Find At-Risk Customers

Here’s where the real magic happens: segmentation. Not all customers are the same, and their reasons for leaving will be different, too. When you group customers based on shared behaviors, you can spot patterns that were completely invisible before.

A great place to start is creating segments based on purchase history. For example, you could group customers into cohorts like "one-time buyers," "high-value repeat customers," or "customers who used a steep discount on their first order." The crucial next step is to analyze the churn rate within each of those groups.

Imagine you find that first-time buyers who don't make a second purchase within 90 days have an 80% chance of never returning. That insight is gold. It tells you exactly where to focus your energy: on engaging new customers inside that critical three-month window. This is what building an effective strategy for reducing churn rate is all about. If you want to dive deeper into user actions, you can explore our guide on what is behavioral analytics and its impact on retention.

A Real-World Analytics Breakthrough

Let me give you a practical example. A direct-to-consumer skincare brand saw its overall churn rate creeping up but was stumped as to why. They decided to dig into their email engagement data and compare it with purchase history in Shopify.

They created two simple segments: customers who opened their post-purchase educational emails, and those who didn't. What they found was a shock. Customers who ignored the email series—which had tips on getting the best results from the products—were three times more likely to churn after just one order.

That single insight changed everything. The product wasn't the problem; it was the lack of customer education after the sale. Armed with this knowledge, the brand completely revamped its onboarding email strategy, making the content more visual, engaging, and genuinely helpful. They even used Toki's segmentation tools to send targeted follow-ups to people who hadn't opened the initial emails, successfully re-engaging them and slashing their new-buyer churn rate.

Building Your Anti-Churn Playbook with Loyalty Programs

Alright, you've figured out why customers are heading for the exit. Now comes the fun part: giving them compelling reasons to stick around. This is where we shift from diagnosis to action, building a retention engine that fosters genuine, lasting loyalty.

The goal here isn't just to throw discounts at people and hope for the best. We're talking about designing experiences that make your customers feel seen, valued, and truly connected to your brand. A thoughtfully constructed loyalty program is your single most powerful tool for getting this done right.

The data backs this up. Across every major market, well-structured loyalty programs and paid memberships deliver measurable drops in churn and real boosts in purchase frequency. I've seen top-performing programs lift retention by double-digit percentages and significantly increase customer lifetime value, making them one of the highest-impact investments you can make.

Crafting Tiers That Create a Sense of Belonging

Tiered memberships are the bedrock of modern loyalty for a simple reason: they tap into our basic human desires for status and exclusivity. Instead of a one-size-fits-all program, tiers let you reward your best customers with progressively better perks, making them feel like they're part of an inner circle.

Where do brands go wrong? They make the tiers too confusing or the benefits too vague. The value in leveling up needs to be dead simple to understand.

- Bronze Tier (The Welcome Mat): This should be a breeze to achieve. Think basic point-earning on every purchase. The only goal is to get new customers hooked on the program from day one.

- Silver Tier (The Rising Stars): This is for your regulars, the customers showing real potential. Introduce more meaningful perks like early access to sales or a small birthday bonus.

- Gold Tier (The VIPs): Reserved for the absolute best, this tier needs to offer exclusive benefits that money can't buy. We're talking free shipping on all orders, first dibs on limited-edition products, or invites to special events.

Imagine a beauty brand offering its Gold members a spot in a "product testing" program, where they get to try new items before anyone else. This isn't just a great reward; it also generates priceless user feedback. With a platform like Toki, you can set this all on autopilot, moving customers up the ladder based on their spending or engagement.

Key Takeaway: By creating a clear path to exclusive access, tiered memberships turn repeat buying into a rewarding journey. Customers aren't just spending money; they're investing in their status with your brand.

Making Every Interaction Count with Points

A points-based system is the flexible foundation for any great loyalty program. It's easy for customers to grasp and gives you a way to incentivize engagement far beyond the checkout page. The trick is to get creative with how customers can both earn and spend their points.

Think about all the little things a happy customer does. You should be rewarding them for it.

- Creating an account

- Following you on social media

- Writing a product review

- Celebrating a birthday

This approach turns the customer experience into a bit of a game, making it genuinely fun to rack up points. And when it's time to cash in, don't just offer a single, boring discount. Give them a "rewards menu" with options like free products, branded merchandise, or even a donation to a charity. Choice makes the reward feel personal.

Turning Your Best Customers into Your Best Marketers

Referral programs are a secret weapon against churn. Why? Because when a customer successfully refers a friend, it reinforces their own decision to shop with you. It’s a powerful dose of validation that strengthens their bond with your brand.

The most effective referral programs are a two-way street. For example, the existing customer gets $20 in points when their friend makes a purchase, and the friend gets 20% off their first order. It's a true win-win that drives both retention and new customer acquisition.

As you build out this playbook, don't forget the first impression. Integrating an AI chatbot for customer support can be a game-changer. When referred customers land on your site with questions, instant, helpful answers ensure their experience is seamless from the start.

Ultimately, these programs weave a community around your brand. To dive deeper into the nuts and bolts, check out our guide on designing effective ecommerce rewards programs. By layering these tactics, you create a powerful defense against churn, turning your store from a place people buy from into a community they belong to.

Creating Stickier Relationships with Personalization

In a market flooded with options, a generic, one-size-fits-all customer experience is a fast track to churn. If you want to build relationships that actually last, you have to create a unified and deeply personal brand experience that follows your customers beyond your website. It’s all about making them feel seen and understood.

This means closing the gap between your digital storefront and your customer's real, day-to-day life. It's about designing touchpoints that are not just convenient, but consistently remind them of your brand's value, keeping you top-of-mind long after they've made a purchase.

Unifying the Online and Offline Experience

One of the most powerful ways to build a "sticky" brand is to weave your loyalty program into the tools your customers use every single day. Digital wallet passes for Apple Wallet and Google Wallet are a fantastic example of this.

Think about it. Instead of making someone log into your site just to check their points balance, a digital pass puts their loyalty status right on their phone. It becomes a constant, subtle reminder of the value they've built up with your brand.

With a platform like Toki, you can keep these passes updated automatically with new point balances, tier upgrades, or fresh offers. Picture this: a customer is walking past your brick-and-mortar store and gets a push notification directly from their wallet pass with a special in-store-only deal. That simple, elegant interaction connects their online loyalty to a real-world action, creating a single, cohesive brand world.

The goal is to make loyalty effortless. When your brand becomes an integrated part of their daily routine through their digital wallet, you’re no longer just another website they visit; you’re a brand they carry with them.

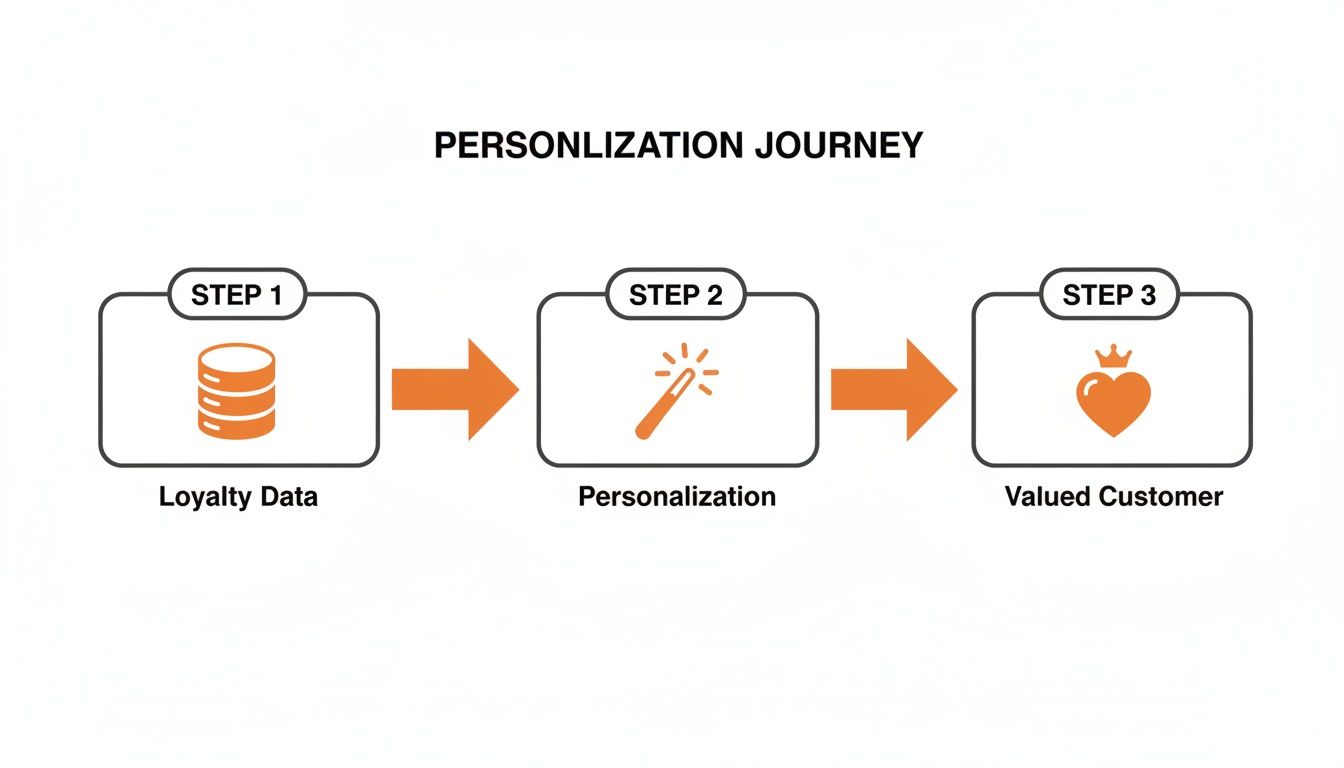

Using Loyalty Data for Real Personalization

The true magic of a loyalty program isn't just in the rewards; it's in the treasure trove of data it collects. Every point earned, every reward redeemed, and every tier they hit tells a story about your customer. This data is the fuel for personalization that actually resonates.

It's time to stop blasting out generic, site-wide discount codes. Use your loyalty data to create targeted, relevant offers that make each customer feel like you're talking directly to them. This is how your program evolves from a simple rewards system into a churn-busting machine.

Consider these highly personalized tactics:

- Tier-Based Exclusives: Give your Gold-tier members an exclusive "first look" at a new product before anyone else.

- Purchase History Targeting: If a customer regularly buys a specific item, surprise them with bonus points on their next purchase of that same product.

- Re-Engagement Nudges: For a customer who has gone quiet, send a friendly "We miss you!" offer with a small point bonus to draw them back in.

This kind of detail makes customers feel genuinely valued, which gives them very few reasons to even think about your competitors. Market research consistently backs this up, showing that brands delivering cohesive, personalized experiences see massive lifts in retention. Some analyses have found that omnichannel customers can spend up to 2.5x more than single-channel buyers, and retention rates can jump by double digits. You can dig deeper into how personalization drives ecommerce success to see the full picture.

By blending a unified omnichannel presence with data-driven personalization, you create an experience that’s incredibly difficult for others to copy. You're not just selling a product anymore; you're building a relationship that customers want to stick with, which is the ultimate defense against churn.

Measuring the Impact of Your Retention Strategy

A brilliant strategy is just a theory until you prove it works. Launching a retention program without a clear way to measure its success is like flying blind. This final part is all about building a data-driven feedback loop that connects your efforts directly to your bottom line, ensuring every tactic delivers a real return.

This process lets you show the financial impact of your work. Instead of just saying, "we think the loyalty program is working," you can confidently report that members of your VIP tier have a 35% higher customer lifetime value than non-members. That's the kind of language that gets everyone in the company excited about retention.

A Phased Rollout for Maximum Impact

Jumping into a complex, multi-layered retention strategy all at once can be overwhelming for your team and your customers. I’ve found that a phased approach is almost always better. It lets you build momentum, gather learnings at each stage, and ensure a smooth rollout.

Think of it as building your retention engine piece by piece, starting with a solid foundation.

-

Phase 1 - The Foundation (Months 1-2): Start with the basics. Launch a simple, easy-to-understand points-for-purchases system. The goal here is immediate engagement and data collection. You want to get customers into the habit of earning and seeing value right away.

-

Phase 2 - Deepening Engagement (Months 3-4): Now, introduce more ways to earn points beyond just buying things. Add rewards for writing reviews, following on social media, or referring friends. This expands the program from a transactional tool to an engagement hub.

-

Phase 3 - Building Exclusivity (Months 5-6): With several months of data, you're ready to launch your tiered membership system. You can set realistic entry thresholds for each tier and introduce exclusive perks that make your best customers feel truly special.

-

Phase 4 - Advanced Strategies (Month 7+): With a mature program, you can explore more advanced tactics like a paid membership tier or integrating digital wallet passes. These high-value initiatives are best saved for when your audience is already highly engaged with the core program.

Using a platform like Toki simplifies this roadmap. You can easily switch on different features as you move through each phase, ensuring the technology keeps pace with your strategy without any complex development work.

Testing Your Way to Better Retention

Your first idea is rarely your best one. The key to maximizing your program's effectiveness is continuous A/B testing—and not just for ad campaigns. It's a powerful tool for optimizing every aspect of your loyalty offers. Don't assume you know what will motivate your customers; let the data tell you.

Start by testing a single, clear variable. For instance, you could test two different welcome offers for new loyalty members:

- Offer A: 500 bonus points upon signup.

- Offer B: A 15% discount on their next purchase.

Run the test for a few weeks and see which offer leads to a higher second-purchase rate. The insights you gain are invaluable for refining your approach.

This simple process of transforming loyalty data into personalized actions is what makes customers feel seen and valued.

The journey is straightforward: collect loyalty data, use it to fuel personalization, and watch customers become more connected to your brand.

Key KPIs for Measuring Churn Reduction Success

To truly understand your program's impact, you have to track the right Key Performance Indicators (KPIs). Moving beyond just the overall churn rate gives you a much clearer picture of what's actually working. For a deeper dive, our guide on how to calculate your customer retention rate provides more detail on the core formulas.

Here's a breakdown of the essential metrics for evaluating your loyalty and retention initiatives.

| KPI | What It Measures | Ideal Trend |

|---|---|---|

| Loyalty Program Engagement Rate | The percentage of active customers who are also active in your loyalty program. | Increasing |

| Point Redemption Rate | The percentage of issued points that are actually redeemed for rewards. | Increasing |

| CLV of Members vs. Non-Members | The lifetime value of customers in your loyalty program compared to those who are not. | Growing Gap |

| Repeat Purchase Rate | The percentage of customers who have made more than one purchase. | Increasing |

| Time Between Purchases | The average number of days between purchases for a customer. | Decreasing |

By focusing on this specific set of KPIs, you can create a powerful dashboard that proves the ROI of your retention efforts. It shifts the conversation from "reducing churn" as an abstract goal to a series of concrete, measurable actions that directly contribute to business growth.

Common Questions About Reducing Churn Rate

Even with a great game plan, you're bound to run into questions when you start digging into customer churn. Shifting your focus to retention is a big move, and it's much easier to navigate when you have clear answers to the most common sticking points.

Let's walk through the questions I hear all the time from ecommerce founders and marketers. Getting these practical details straight will help you move from planning to executing with confidence.

What Is a Good Churn Rate for an Ecommerce Business?

This is the million-dollar question, but honestly, there's no single magic number. What's considered "good" depends entirely on your industry, business model, and what you sell. It’s like asking, "What's a good price for a car?"—it depends on whether you're looking at a used sedan or a new sports car.

For subscription-based brands, a monthly churn rate between 5-7% is a pretty standard benchmark. But for most traditional ecommerce stores, a better metric to track is your repeat customer rate.

A good repeat customer rate is a much better indicator of health than a generic churn percentage. Instead of chasing an industry-wide number, focus on improving your own baseline. If you're at 25% today, your real goal is to hit 30% next quarter. That kind of internal improvement is what actually fuels growth.

For most online stores, a repeat customer rate between 20-40% is a fantastic target. If you're hitting numbers higher than that, you're likely a leader in your space.

How Quickly Can I See Results from a New Loyalty Program?

You'll actually see two kinds of results on two different timelines. The initial buzz and engagement can show up almost immediately.

Within the first 30 days, you can start watching for early signs that the program is catching on. These are your leading indicators:

- Program Signup Rate: Are people actually joining?

- Initial Point Redemptions: Are new members using their welcome points or first rewards right away?

- Engagement with Non-Purchase Actions: Are customers earning points for things like social follows or writing reviews?

However, the deeper, bottom-line impact on metrics like your overall churn rate and customer lifetime value (CLV) takes longer to materialize. You'll want to give it at least 3 to 6 months to see a significant, measurable shift. That's enough time for customers to really see the value, change their buying habits, and make the repeat purchases that prove your program's ROI.

Is My Store Too Small to Focus on Customer Retention?

Absolutely not. In fact, it’s the other way around—the early days are the perfect time to build a rock-solid foundation for retention. When you're small, every single customer is crucial for your survival and growth.

Think about it: losing one of your first 100 customers hurts a lot more than losing one out of 10,000. Launching a simple, low-cost loyalty program early on is one of the highest-impact moves a new brand can make.

A basic points or referral program ensures your first wave of customers has an amazing experience. This doesn't just keep them coming back; it turns them into your very first brand advocates. These are the loyal fans who will help you get your next 1,000 customers through word-of-mouth. Starting early builds a culture of retention that grows right along with your business.

Ready to turn these ideas into action? With Toki, you can launch a powerful loyalty, rewards, and referral program in minutes, not months. Stop losing customers and start building a community that drives predictable, profitable growth. Explore how Toki can help you reduce churn today.