How to Increase Customer Lifetime Value: Key Strategies

Why Your Business Lives or Dies by Customer Lifetime Value

Here's an uncomfortable truth many business owners eventually face: you might be leaving a significant amount of revenue on the table. Why? Because you might not have a solid grasp of what each customer is worth over their entire relationship with your brand. Customer Lifetime Value (CLV) isn’t just another metric to mention in meetings; it’s the number that tells you if your business is built for long-term growth or a slow decline.

It’s the secret behind why some of the biggest names in business make decisions that seem counterintuitive at first glance. Think about Netflix. They might spend hundreds of dollars to bring in a new subscriber, a cost that would make most small business owners nervous. Yet, they do it confidently because they have a crystal-clear understanding of their CLV. They know that a subscriber who sticks around for years will generate thousands in revenue, making the initial acquisition cost a smart investment.

The Real-World Math Behind Customer Value

At its core, Customer Lifetime Value (CLV) measures the total revenue a customer is expected to generate for your business. The calculation itself is pretty simple. To find your CLV, you multiply three key factors: average purchase value, purchase frequency, and the average customer lifespan.

Let's use a local coffee shop as an example. Say the average order is $7. A loyal customer stops by twice a week (104 times a year) and continues this habit for three years. Their CLV would be $7 x 104 x 3 = $2,184. Suddenly, offering that free birthday latte seems like a very small price to pay for such a valuable relationship. To see how this applies specifically to online stores, you can explore what Customer Lifetime Value (CLV) means in a Shopify context. Getting this basic calculation down is the first step toward building a more robust business strategy. For a more detailed breakdown, you can discover more insights about CLV calculations on Shopify.com.

What Does CLV Look Like Across Different Sectors?

A "good" CLV isn't a one-size-fits-all number. It varies wildly depending on your industry, business model, and pricing. A high-volume, low-margin ecommerce store will have a completely different CLV profile than a high-touch B2B software company.

To help you see how this plays out in the real world, here is a table comparing CLV calculations across a few different business types.

| Industry | Average Purchase Value | Purchase Frequency (Annual) | Customer Lifespan (Years) | CLV |

|---|---|---|---|---|

| Retail (Fashion) | $75 | 4 | 3 | $900 |

| SaaS (B2B) | $2,400 (annual plan) | 1 | 5 | $12,000 |

| Subscription Box | $25 (monthly) | 12 | 1.5 | $450 |

| Coffee Shop | $7 | 104 (twice a week) | 3 | $2,184 |

This comparison shows that models with recurring revenue, like SaaS, often lead to a much higher CLV. However, even a low-cost, high-frequency business like a coffee shop can build substantial value over time.

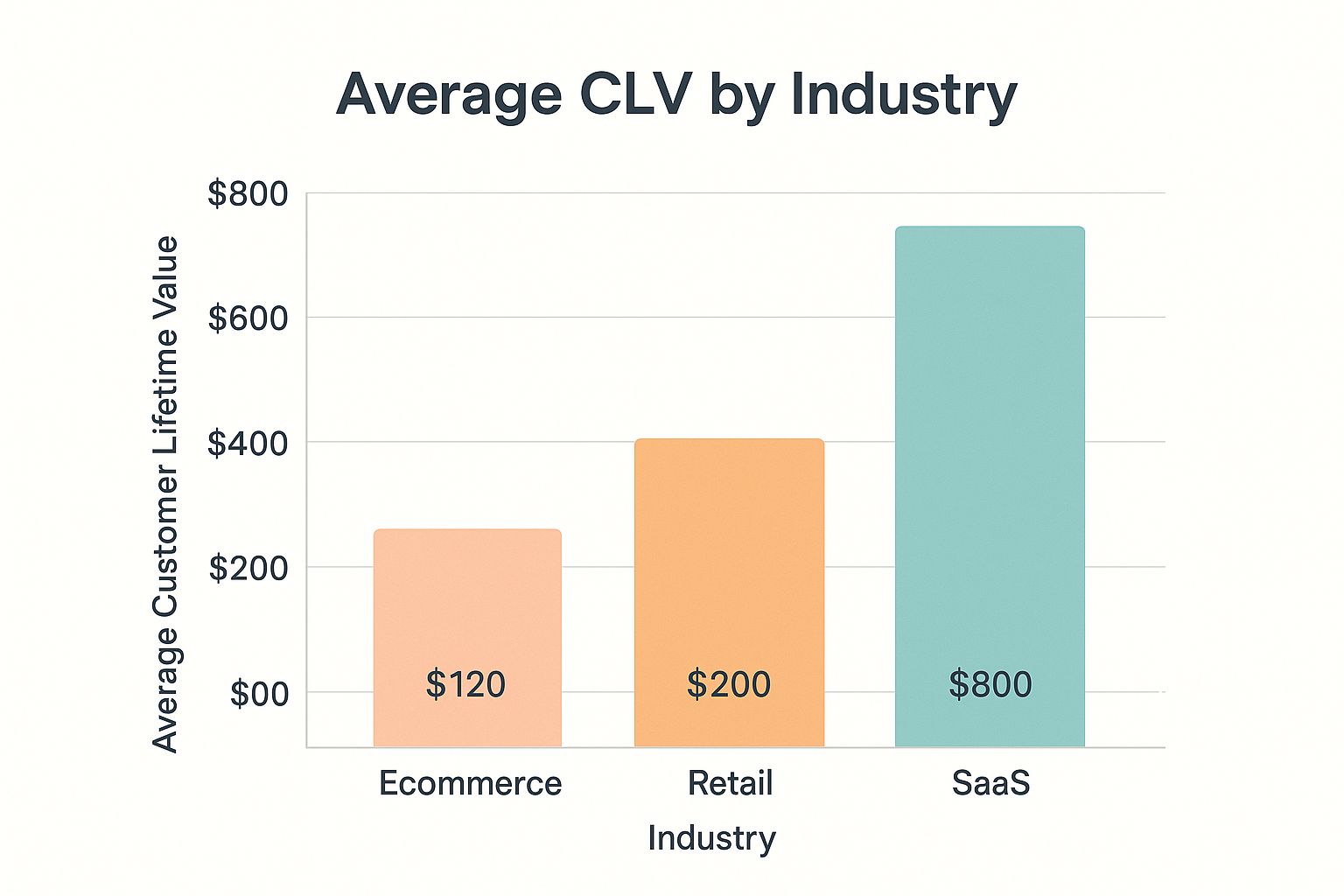

To further illustrate this, the infographic below shows the average customer lifetime value across a few key industries.

The data clearly shows that subscription-based models like SaaS tend to generate significantly higher lifetime value, highlighting the power of recurring revenue. When you know your industry's benchmark and your own CLV, you can start making smarter decisions about everything from marketing spend to product development. This understanding is foundational before we can even begin discussing how to increase customer lifetime value effectively.

The Make-or-Break Relationship Between What You Spend and What You Earn

Many businesses are playing a dangerous game without even knowing it. They're pouring money into marketing without a clear idea of whether they'll ever see that money again. This balance between what it costs to get a new customer (Customer Acquisition Cost, or CAC) and what that customer spends over their entire relationship with you (LTV) is the ultimate stress test for your business model. Get it right, and you've found the key to sustainable growth. Get it wrong, and you might just be funding an expensive hobby.

Many businesses are playing a dangerous game without even knowing it. They're pouring money into marketing without a clear idea of whether they'll ever see that money again. This balance between what it costs to get a new customer (Customer Acquisition Cost, or CAC) and what that customer spends over their entire relationship with you (LTV) is the ultimate stress test for your business model. Get it right, and you've found the key to sustainable growth. Get it wrong, and you might just be funding an expensive hobby.

This isn’t about slashing your budget; it’s about spending smarter to attract customers who will actually stick around. The relationship between Customer Lifetime Value (LTV) and CAC is a fundamental measure of your business's health and marketing effectiveness. This is often simplified into the LTV:CAC ratio, which directly compares the total revenue from a customer to the cost of acquiring them. A widely accepted benchmark is an LTV:CAC ratio of 3:1. This means for every dollar you spend bringing a customer in, you should ideally get three dollars back in lifetime revenue. If you want to dive deeper into why this metric is so essential, you can explore detailed insights on the importance of customer lifetime value.

Why the 3:1 Ratio Isn't a Universal Law

While a 3:1 ratio is a solid target, it's definitely not a one-size-fits-all rule. The "right" ratio for your business hinges on your specific profit margins and operating expenses. For instance, a software-as-a-service (SaaS) company with hefty 80% profit margins could be perfectly healthy with a 2:1 ratio. They can afford to spend more on acquisition because a larger chunk of each sale is pure profit.

On the other hand, an e-commerce shop selling physical products might have margins closer to 20%. For that business, a 3:1 ratio could actually signal a loss once you account for the cost of goods, shipping, and other overhead. They might need a ratio closer to 5:1 just to break even and turn a profit. The main takeaway is that you have to know your own numbers to figure out what a healthy ratio looks like for you.

Practical Ways to Improve Your LTV:CAC Ratio

Improving your LTV:CAC ratio isn't always about cutting your marketing budget. In fact, blindly reducing ad spend can often do more harm than good. The real goal is to make every marketing dollar you spend work much harder.

A common drain on this ratio is inefficient ad spend on platforms like Google and Facebook, where acquisition costs are continually on the rise. To make sure your marketing dollars are actually boosting your CLV, you need to put them into channels and tools that deliver tangible results. For example, managing social media can be a huge time and money sink if it's not done efficiently. Using a service for affordable and effective social media scheduling can free up both budget and team bandwidth for more impactful activities.

Here are a few other practical ways to get a better return:

- Refine Your Targeting: Instead of casting a wide net, dig into the data from your best customers. Use this information to build lookalike audiences that mirror the traits of your most valuable, high-LTV customers.

- Boost Conversion Rates: Even a small lift in your website's conversion rate can significantly lower your CAC. A/B test your landing pages, streamline your checkout flow, and ensure your site is lightning-fast and works flawlessly on mobile devices.

- Focus on Organic Channels: Put real effort into SEO and content marketing. While it's a longer game, acquiring customers through organic search has a $0 media cost. Over time, this can dramatically improve your LTV:CAC ratio and build a more resilient business.

Turning Existing Customers Into Your Most Profitable Growth Engine

It’s tempting to get caught up in the chase for new customers. That thrill of a new lead or a first-time purchase can feel like the ultimate business win. But while you're pouring resources into acquisition, you might be overlooking your most valuable asset: your current customers. The reality is, many businesses are sitting on a goldmine of untapped revenue from people who have already chosen them.

Shifting your focus from acquisition to retention isn't just a "nice-to-have"—it's the backbone of a sustainable business. Giants like Amazon and Apple don't just cross their fingers and hope for loyalty; they build systems around it with incredible dedication. They know that converting an existing customer into a repeat buyer is far more efficient than constantly hunting for new ones. This is where you'll find the real power to grow your bottom line.

The Compounding Power of Small Retention Wins

Keeping customers around longer has a massive effect on your business. It's not just about getting one more sale; it creates a chain reaction that strengthens your entire financial model. Data shows a direct and powerful link between retention and profitability. In fact, a mere 5% increase in customer retention can boost profits by anywhere from 25% to 95%. This happens because retaining a customer directly impacts two key parts of the CLV formula: how often they buy and how long they stay with your brand. If you want to dive deeper into the numbers, you can explore more about CLV calculations for B2C brands.

Think of it like compound interest for your company. A retained customer doesn't just buy from you again. They often spend more over time, become less sensitive to price changes, and usually cost less to serve. They're already familiar with your products and trust your quality, so they need less hand-holding. This creates a positive feedback loop that makes your business stronger from the inside out.

To see how specific actions can influence CLV, let's look at a breakdown of common retention strategies and their expected impact.

| Retention Strategy | Impact on Purchase Frequency | Impact on Customer Lifespan | Expected CLV Increase |

|---|---|---|---|

| Personalized Campaigns | High | Moderate | 15-25% |

| Loyalty Programs | High | High | 20-40% |

| Proactive Customer Service | Moderate | High | 10-20% |

| Feedback Implementation | Low | High | 5-15% |

| Surprise & Delight | Moderate | Moderate | 10-25% |

As the table shows, a well-rounded approach that combines different strategies can significantly lift your CLV. Loyalty programs, for instance, are great for encouraging both repeat purchases and long-term commitment.

From Occasional Buyer to Brand Evangelist

Knowing that retention is important is one thing, but actually making it happen is another challenge. The secret is to understand the key moments that decide whether a customer stays or leaves. It's rarely one big event but a series of small experiences that either build or break their trust. Your goal is to turn occasional buyers into true brand evangelists who not only stick around but also tell others about you.

First, you need to spot the early warning signs that a customer might be at risk of churning. Are they buying less often? Have they stopped logging into their account or opening your emails? These are all red flags. Taking action on these signals is one of the most direct ways to increase customer lifetime value.

Here are a few practical strategies to re-engage at-risk customers and build stronger loyalty:

- Personalized "We Miss You" Campaigns: Don't just send a generic discount code. Use their purchase history to offer a deal on a product they've bought before or a category they've browsed. A message like, "Hey, we noticed it's been a while! Your favorite coffee blend is back in stock, and here's 15% off to welcome you back," feels personal and is much more effective.

- Feedback-Driven Improvements: Actively ask for feedback, especially from customers whose engagement has dropped. Ask them directly: "What can we do better?" When you act on their suggestions and let them know you made a change because of their input, you can rebuild the relationship in a powerful way.

- Surprise and Delight: Small, unexpected gestures can leave a huge emotional impact. A handwritten thank-you note in their next order, a surprise freebie, or early access to a new product can turn a fading customer into a lifelong fan. These are the moments people remember and share, creating a ripple effect of positive word-of-mouth.

Creating Loyalty Programs That Actually Pay for Themselves

Just about every brand has a loyalty program these days, but let's be honest—most of them feel like an afterthought. They're often expensive mistakes that hand out discounts without actually changing customer behavior. A program that genuinely drives growth is different from one that just bleeds profit. The secret is understanding the deep-seated psychological triggers that motivate your customers to spend more and stay longer, not just buy again.

A truly effective program doesn’t just reward transactions; it rewards profitable behaviors. It nudges customers to move from occasional buyers to brand advocates. The difference is subtle but powerful. Instead of just offering points for every dollar spent, successful programs build a sense of progress, exclusivity, and belonging that keeps customers emotionally invested.

Beyond Points: Designing for Psychological Engagement

The most common loyalty model is the simple points-for-purchase system. While it's easy to understand, it often fails to create real loyalty because the rewards feel distant and transactional. To build a program with a strong ROI, you need to think more like a game designer and less like an accountant. Research shows that 80% of companies with a loyalty program report a positive return on their investment, but the top-performing ones all share a common thread: they make the experience engaging.

Consider Starbucks Rewards. It's a masterclass in gamification. Customers earn "Stars" not just for buying coffee, but for completing specific challenges, ordering on certain days, or trying new products.

This screenshot of the Starbucks Rewards interface shows how they visualize progress and present various ways to earn, making it feel more like a game than a simple rewards program. The key insight here is that the journey to the reward is just as important as the reward itself, keeping users actively engaged with the brand.

Choosing the Right Loyalty Model for Your Business

Not every business should copy Starbucks. The right loyalty model depends entirely on your business type, your profit margins, and your customer's mindset. There are several effective models to consider, each with its own strengths. For a deeper dive into what works, you can explore some great loyalty program best practices to see which might fit your brand.

Here’s a quick comparison of popular loyalty models to help you decide:

| Loyalty Model | Best For | Key Benefit | Potential Pitfall |

|---|---|---|---|

| Tiered Program | Brands with a wide range of customer spending. | Creates aspiration; makes top customers feel exclusive. | Middle tiers can feel stagnant if not designed well. |

| Paid Membership | Businesses that can offer significant, ongoing value. | Generates recurring revenue and locks in loyalty. | High barrier to entry; value proposition must be very strong. |

| Value-Based | Mission-driven brands with a strong community. | Builds deep emotional connection with the brand. | Can be difficult to scale and measure direct ROI. |

| Gamified Points | Businesses with high purchase frequency. | Keeps customers engaged between purchases. | Can become complex and confusing if over-designed. |

For example, a fashion retailer might thrive with a tiered program (e.g., Bronze, Silver, Gold) that offers increasing levels of perks like early access to sales and personal styling sessions. This model encourages customers to spend more to unlock the next level of status. Meanwhile, a direct-to-consumer (DTC) brand selling supplements might find a paid membership program, like Amazon Prime, more effective. For a monthly or annual fee, members could get free shipping, a standing discount, and access to exclusive wellness content. This creates a predictable revenue stream while making customers feel like insiders who get premium value.

Ultimately, the goal is to design a program where the cost of the rewards is significantly outweighed by the increase in purchase frequency, average order value, and customer lifespan. It’s a delicate balance, but when you get it right, your loyalty program transforms from a cost center into one of your most powerful and predictable growth engines.

Making Every Customer Feel Like Your Only Customer

Let's be honest: generic, one-size-fits-all marketing is a fast track to a low CLV. Today’s customers don't just appreciate personalized experiences; they expect them. They want to feel like you get their unique tastes and can anticipate what they’ll need next. This is a huge opportunity for smart businesses to grow revenue by shifting from broad messages to individual conversations.

Let's be honest: generic, one-size-fits-all marketing is a fast track to a low CLV. Today’s customers don't just appreciate personalized experiences; they expect them. They want to feel like you get their unique tastes and can anticipate what they’ll need next. This is a huge opportunity for smart businesses to grow revenue by shifting from broad messages to individual conversations.

When you use customer data well, you can create personalized interactions that significantly boost how often customers buy and how much they spend. It’s the difference between a brand that shouts at a crowd and one that whispers a helpful suggestion just to you. This personal touch builds a deep sense of satisfaction that directly leads to long-term loyalty and a higher lifetime value. Nailing personalization is a key strategy for how to increase customer lifetime value.

Beyond Demographics: Practical Segmentation Strategies

Real personalization starts with smart segmentation that goes way beyond basic details like age or location. While that information is a decent starting point, the real magic happens when you group customers based on their actions and interests. This lets you tailor your communication so it feels genuinely helpful, not intrusive.

Try segmenting your customers based on these behavioral patterns:

- Purchase History: Group customers by the types of products they buy. Someone who only purchases running shoes needs a different conversation than someone who buys yoga mats and protein powder.

- Purchase Frequency: Treat your frequent buyers differently than your occasional shoppers. Your message to a weekly regular should be completely different from a "we miss you" campaign sent to someone who hasn't bought in six months.

- Engagement Level: Create segments for customers who constantly open your emails, visit your site, or interact on social media, separating them from those who are less engaged.

Recommendation Engines That Actually Work

A recommendation engine is one of the best personalization tools out there, but only if it's done right. A Yotpo survey found that 53.9% of customers define personalization as a brand suggesting products based on their past purchases. This shows that people want recommendations that prove you understand their style.

For example, think about how a SaaS company could approach this. Instead of a generic "You might also like..." pop-up, it could analyze a user's feature adoption. If a customer is heavily using a project management tool but has never touched the time-tracking feature, a personalized in-app message could show how integrating time tracking would improve their workflow. This isn't just a cross-sell; it’s a value-add that solves a real problem, making the customer’s experience better and increasing their reliance on the platform.

Personalization Without Being Creepy

There's a fine line between helpful customization and creepy over-monitoring, and the key is a mix of transparency and value. People are usually willing to share data if they believe it will lead to a better experience. For example, getting an email when an item you looked at is back in stock feels helpful. Getting an email the second you leave that product page feels aggressive.

Always make building trust your top priority. Be open about what data you are collecting and how you are using it to make their experience better. When you show customers you're using their information to serve them—with more relevant offers, smarter recommendations, and helpful content—you earn their loyalty. This trust is the foundation for a high CLV, turning a one-time buyer into a lifelong advocate for your brand.

Using Numbers to Drive Real Revenue Growth

Turning raw data into actual revenue isn't about having the most impressive charts; it’s about asking the right questions. Without a clear strategy, your analytics dashboard is just expensive digital clutter. The secret is to focus on specific metrics that predict customer behavior and guide decisions that boost your bottom line.

This means building a dashboard focused on how to increase customer lifetime value, not just tracking surface-level numbers. Some metrics need daily attention, while others are better for monthly check-ins. Your Average Order Value (AOV) and conversion rate, for instance, are like daily health checks. In contrast, your customer retention rate is best reviewed monthly to spot meaningful trends. Learning to calculate this is a foundational step, and you can explore the customer retention rate formula to get a firm handle on it.

Building Your Actionable CLV Dashboard

Vanity metrics like social media likes or website traffic are exciting, but they don't pay the bills. An effective Customer Lifetime Value (CLV) dashboard zeroes in on the numbers directly tied to revenue. To truly understand the financial impact of your customers, it's essential to know how to calculate Customer Lifetime Value. Once you have that figured out, your dashboard should prominently feature:

- Customer Acquisition Cost (CAC): How much are you spending to bring a new customer through the door?

- Average Purchase Value (APV): What's the typical amount a customer spends in a single order?

- Purchase Frequency (PF): How often do your customers return to make another purchase?

- Customer Churn Rate: At what rate are you losing customers over a specific period?

Tracking these core metrics gives you an immediate pulse on the health of your customer relationships. If your CAC is creeping up while your Purchase Frequency is dipping, you've got an early warning that your CLV is in trouble.

From Data to Decisions: Cohort and Predictive Analysis

Advanced analytics can seem intimidating, but they offer powerful ways to get ahead of the curve. Cohort analysis is a fantastic place to start. This approach involves grouping customers who joined during the same timeframe (like a "January 2024 Cohort") and then tracking their behavior over time. This helps you see if changes you've made—like launching a new loyalty program in March—actually improved retention for newer customers compared to older groups.

For example, take a look at this cohort chart from Google Analytics visualizing user retention.

This chart clearly shows that user retention plummets after the first day. This highlights a critical window where you need to re-engage new users to improve their long-term value.

Predictive analytics takes this a step further. By analyzing the habits of your current best customers, you can build a model that helps you spot future VIPs early on. For example, you might discover that customers who use a specific product feature within their first week are 80% more likely to become loyal, high-spending users. This insight is pure gold. It allows you to create targeted onboarding campaigns that encourage this key behavior, proactively boosting the lifetime value of new customers before your competitors even know what's happening.

Your Action Plan for Sustainable CLV Growth

Growing customer lifetime value (CLV) isn't about throwing random tactics at the wall and seeing what sticks. It's about making smart choices, executing them consistently, and turning them into reliable, profit-generating habits for your business. Let's move past the theory and build a practical roadmap based on where your business is right now.

Prioritize Based on Impact and Effort

To get started, you’ll want to focus on the low-hanging fruit. I’m talking about the initiatives that give you quick wins without draining your resources. This approach builds momentum and makes it easier to get your team excited about the bigger projects down the line.

-

Immediate Actions (Low Effort, High Impact): A great first move is to segment your customers. Pinpoint your high-value VIPs and your at-risk customers. For your VIPs, something as simple as a personalized thank-you email or an exclusive sneak peek at a new product can go a long way in reinforcing their loyalty. For those at-risk customers, a friendly "we miss you" campaign paired with a special discount can often be enough to bring them back into the fold.

-

Long-Term Strategies (High Effort, High Impact): These are the foundational projects that will pay dividends for years. Think about rolling out a tiered loyalty program or creating a solid feedback loop where customer suggestions directly influence your product roadmap. These initiatives take more planning, but they create lasting improvements that boost CLV across the board.

Overcoming Common Obstacles

As you start putting your plan into action, you’ll inevitably run into a few hurdles. Knowing what they are ahead of time makes them much easier to handle.

One of the most common challenges is budget constraints. Let's say you want to launch a full-blown loyalty program, but you're struggling to secure the funding. Don't give up—start smaller. You could implement a basic points-for-purchase system with minimal upfront cost. Once it starts proving its ROI, you'll have a much stronger case for future investment. Our guide on increasing customer lifetime value has more practical tips for getting off the ground.

Another potential roadblock is team resistance. To get everyone on board, you need to show them what's in it for them. Explain to your support team how proactive service reduces churn, making their jobs easier. Show your marketing team how personalized campaigns lead to more repeat purchases and better results. When CLV stops being an abstract metric and becomes a tangible, shared goal, your entire team becomes a powerful force for sustainable growth.

Ready to turn these actions into automated, profitable habits? Toki is an all-in-one loyalty platform that makes it easy to launch tiered memberships, referral programs, and engaging reward systems. Explore how Toki can help you build lasting customer relationships and drive repeat sales today.