Customer Retention Cost Formula: Boost Profits Easily

Decoding the Customer Retention Cost Formula

Understanding your Customer Retention Cost (CRC) is crucial for sustainable business growth. This metric reveals how much you're spending to keep your existing customers happy and engaged, directly impacting your bottom line. It's a key element in evaluating the effectiveness of your loyalty programs, customer service initiatives, and overall customer experience.

Calculating CRC offers valuable insights into your business's financial health. Just as a fuel gauge is essential for a car, CRC is essential for understanding the sustainability of your customer relationships.

Breaking Down the Basics of CRC

Calculating CRC is surprisingly straightforward. The most basic formula involves dividing your total retention expenses by the number of active customers. This gives you the average cost of retaining a single customer over a specific period, such as a month or a year.

For example, if you spend $5,000 on retention initiatives and have 500 active customers, your CRC is $10 per customer. This snapshot of your current spending provides a baseline for further analysis.

Moving Beyond the Basic Formula

A more insightful approach involves calculating the average lifetime CRC per customer. This metric shows the long-term cost associated with retaining a customer throughout their entire relationship with your brand.

This is calculated by multiplying the average CRC per customer by the average customer lifetime. For example, if a company has a quarterly CRC per customer of $100 and an average customer lifetime of three years (12 quarters), the average lifetime CRC per customer would be $1,200. This forward-looking perspective helps you make strategic investments in customer loyalty and understand the long-term efficiency of your retention efforts. Explore this topic further.

Why Is CRC Different From Customer Acquisition Cost (CAC)?

While both CRC and CAC are vital metrics, they represent different stages of the customer journey. CAC focuses on the cost of acquiring new customers, while CRC focuses on the cost of retaining existing ones. Understanding the relationship between these two is crucial for optimizing your marketing spend.

A high CAC might necessitate a higher CRC if your acquisition strategy brings in customers who aren’t a good fit for your product or service. Conversely, a low CAC might allow you to invest more in CRC to solidify customer loyalty.

The Importance of Tracking Customer Retention Cost

Tracking CRC is about understanding the health of your customer relationships and the efficiency of your retention efforts. It helps you answer crucial questions: Are you overspending to keep customers who aren't generating enough revenue? Are your loyalty programs truly effective?

By closely monitoring and analyzing your CRC, you can identify areas for improvement, optimize your retention strategies, and ultimately boost your profitability. This data-driven approach fosters long-term customer loyalty and drives sustainable business growth.

Calculating Retention Costs That Actually Matter

Moving beyond a simple customer retention cost (CRC) formula is crucial for data-driven decisions. This means understanding the nuances of your retention economics, not just the average cost per customer. Consider the various factors influencing your retention spend, from customer success team salaries to loyalty program costs. This comprehensive perspective reveals the bigger picture and identifies areas for optimization.

Understanding What to Include (and Exclude) in Your Calculations

Calculating your CRC accurately requires understanding which expenses belong in the equation. Costs directly tied to retaining customers, like loyalty programs and customer success initiatives, are obvious inclusions. Other expenses, however, require careful consideration. Misattributing costs can skew calculations and lead to inaccurate conclusions. For more insights, check out this article on customer retention metrics.

Segmenting your retention costs is also essential. Breaking down costs by customer cohorts can reveal hidden improvement opportunities. You might find that retaining a specific segment is disproportionately expensive. This prompts investigation into the root causes and allows for strategic adjustments. This targeted approach leads to efficient resource allocation and maximizes the impact of retention efforts.

Visualizing the Impact of Retention

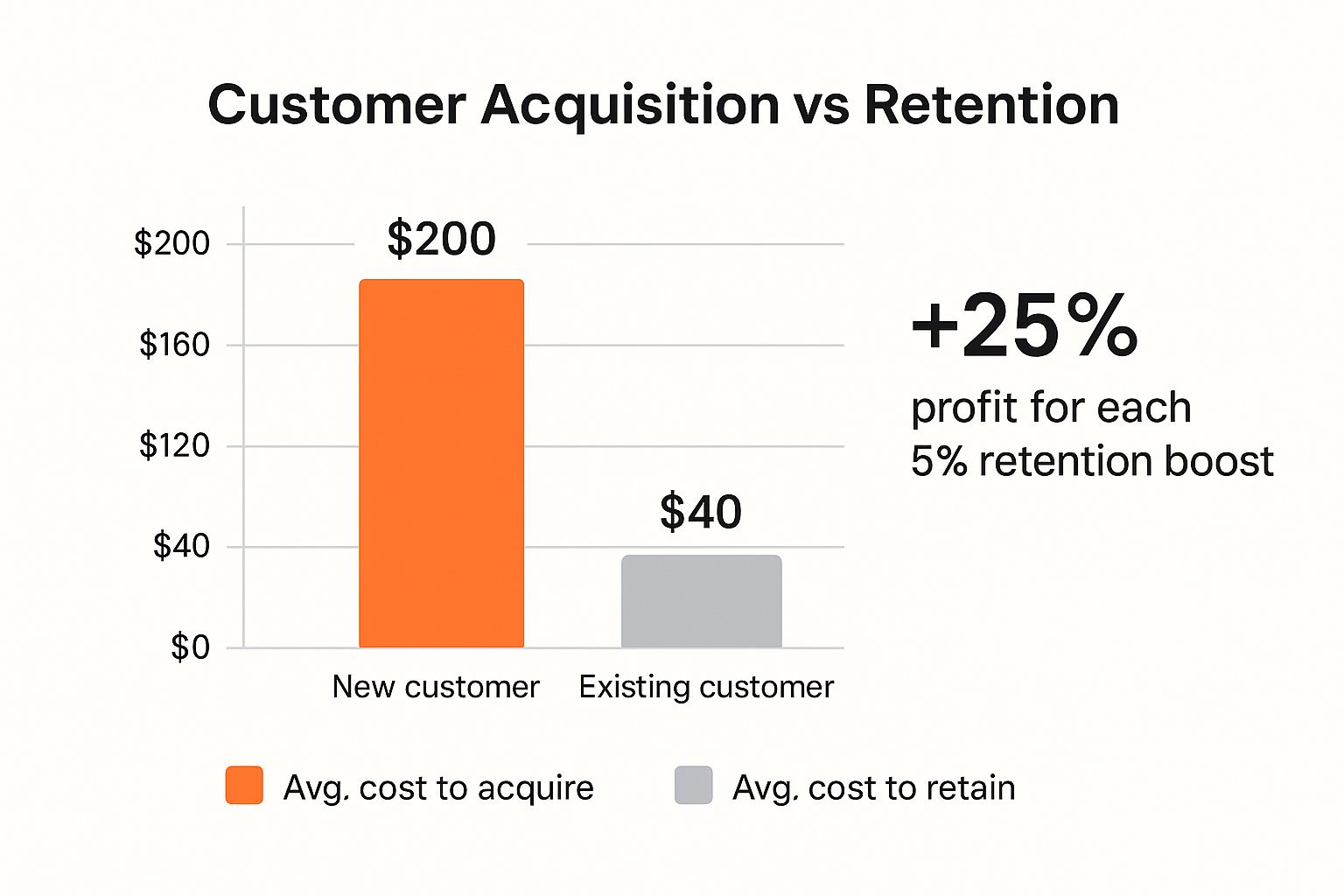

The following infographic compares the average cost of acquiring a new customer versus retaining an existing one. It highlights the potential profit gains from even minor retention improvements.

As shown, acquiring a new customer is significantly more expensive than retaining an existing one. This underscores the importance of prioritizing customer retention. Even small increases in retention can significantly boost profitability, highlighting the substantial ROI of focusing on customer loyalty.

Applying the Formula in Real-World Scenarios

CRC is a critical metric, especially in Software as a Service (SaaS), where new customer acquisition is often more costly than retention. For example, if a company spends $10,000 on retention for 100 active customers, the average CRC per customer is $100. Considering the average customer lifetime, if it's three years with a quarterly CRC of $100, the lifetime CRC becomes $1,200. Learn more about customer retention cost here. This long-term perspective helps justify investments in customer loyalty.

Understanding lifetime CRC is crucial for strategic investments and demonstrating the long-term value of retention. Accurately calculating and analyzing CRC provides a nuanced understanding of retention economics directly linked to business outcomes. This demonstrates how investments in customer loyalty contribute to a healthier bottom line.

To further illustrate different CRC calculation methods, let's examine the following table:

Customer Retention Cost Calculation Methods: This table compares different methods for calculating customer retention costs, highlighting when to use each approach and their respective advantages and limitations.

| Calculation Method | Formula | Best Used When | Advantages | Limitations |

|---|---|---|---|---|

| Simple Average | Total Retention Spend / Total Number of Customers | Quick overview needed | Easy to calculate | Doesn't account for varying customer segments |

| Segmented Average | Retention Spend per Segment / Number of Customers per Segment | Analyzing specific customer groups | Identifies high/low-cost segments | Requires detailed customer data |

| Lifetime Value (LTV) Based | Total Retention Spend / Customer Lifetime Value | Assessing long-term retention impact | Connects retention to revenue | Requires accurate LTV calculation |

This table summarizes different approaches for calculating CRC, highlighting the importance of choosing the right method for your specific needs. While the simple average provides a quick overview, segmented and LTV-based methods offer deeper insights for strategic decision-making. Consider your data availability and analytical goals when selecting a calculation method.

Balancing Retention Costs Against Lifetime Value

The true power of the customer retention cost formula becomes clear when considered alongside Customer Lifetime Value (CLV). These two metrics reveal the important balance between investing in customer retention and maximizing profitability. Understanding this relationship helps businesses achieve sustainable growth and make informed decisions about customer loyalty.

Finding the Sweet Spot Between Retention and Profitability

Successful businesses continually strive for the ideal balance between what they spend on retention and the profitability of their customers. This involves examining the CLV:CRC ratio, a vital metric demonstrating the return on investment from retention initiatives. Even minor changes in your retention strategies can significantly affect this ratio. For example, a well-designed loyalty program might increase CLV while keeping CRC steady, thereby improving the overall ratio.

You might be interested in: Strategies for Maximizing Customer Lifetime Value in Ecommerce

Forecasting the Impact of Retention Investments

Projecting how current retention spending will influence future profits is critical. Practical modeling methods can help forecast the long-term financial effects of your retention strategies. This allows you to justify expenses on customer loyalty programs, customer success teams, and other retention initiatives by showing their contribution to long-term revenue growth. This proactive approach ensures retention activities build a healthy bottom line, and not just short-term customer satisfaction.

One of the most significant aspects of CRC is its influence on CLV. Businesses that prioritize customer retention tend to see higher CLV figures. This is because satisfied customers are more likely to make repeat purchases. For example, if a company spends $500,000 on retention and retains 5,000 customers, the average retention cost is $100 per customer. This is often considerably less expensive than acquiring new customers. What’s more, retained customers frequently refer new business, effectively lowering marketing costs. This approach not only saves money but also increases revenue through repeat business and word-of-mouth referrals. Find more detailed statistics here: Customer Retention Cost.

Segmenting Your Retention Efforts for Maximum Impact

Different customer segments will respond differently to retention strategies. Analyzing these variations allows you to focus efforts where they’ll deliver the greatest return. This prevents overspending on less valuable customer relationships and ensures effective resource allocation. This targeted approach optimizes retention spending and maximizes the overall impact of your loyalty programs. Further segment analysis, based on individual CLV and CRC, can reveal hidden opportunities and pinpoint the most profitable retention activities. Using this data allows for personalized retention strategies, enhancing the return on your retention investment.

The Hidden Drivers of Your Retention Costs

Beyond the numbers in your customer retention cost formula, several crucial factors significantly impact your retention economics. These often overlooked elements include the quality of your product experience, the effectiveness of your customer service, and the strength of your customer success strategies. Addressing these foundational aspects can surprisingly impact your bottom line.

Product Experience: The Cornerstone of Retention

A seamless and enjoyable product experience is paramount for retaining customers. A product that consistently meets or exceeds customer expectations fosters loyalty and reduces the need for costly interventions. This translates to lower support costs and fewer resources dedicated to addressing customer issues.

Intuitive user interfaces, robust functionality, and regular updates can significantly improve customer satisfaction and, consequently, reduce churn.

Service Quality: Beyond Issue Resolution

While efficient issue resolution is essential, exceptional service goes further. Proactive support, personalized interactions, and readily available assistance build trust and demonstrate your commitment to customer success.

This can minimize the need for expensive reactive measures, such as discounts or free services, often employed to appease dissatisfied customers. For more strategies, check out this guide on eCommerce customer retention.

Customer Success Strategies: Proactive Engagement

Effective customer success strategies focus on proactive engagement and fostering long-term value. By guiding customers toward achieving their desired outcomes with your product or service, you create a positive feedback loop.

This strengthens loyalty, increases customer lifetime value, and reduces the likelihood of churn. Personalized onboarding, ongoing training, and proactive check-ins can significantly contribute to customer satisfaction and reduce the need for expensive recovery efforts.

Leveraging Technology for Personalized Retention

Technology plays a vital role in optimizing retention efforts. Tools that enable personalized communication, automated workflows, and data-driven insights can enhance the customer experience while reducing operational costs.

This targeted approach allows you to allocate resources efficiently and tailor retention strategies to specific customer segments, maximizing their impact and minimizing unnecessary spending. For instance, consider using a CRM to manage and analyze customer interactions.

To understand where your retention budget is being allocated, let's look at the typical breakdowns across different industries. The following table highlights the relative importance of various retention components.

Retention Cost Components by Industry

| Industry | Customer Success (%) | Loyalty Programs (%) | Product Improvements (%) | Customer Education (%) | Other (%) |

|---|---|---|---|---|---|

| SaaS | 40 | 25 | 20 | 10 | 5 |

| E-commerce | 20 | 40 | 15 | 5 | 20 |

| Financial Services | 30 | 15 | 25 | 20 | 10 |

| Healthcare | 50 | 10 | 20 | 15 | 5 |

| Telecommunications | 25 | 30 | 10 | 15 | 20 |

As this table illustrates, the allocation of resources for retention varies significantly by industry. SaaS businesses, for example, heavily invest in Customer Success, while E-commerce prioritizes Loyalty Programs. Understanding these industry benchmarks can help you assess the effectiveness of your current retention spending.

Operational Inefficiencies: The Silent Cost Inflator

Hidden inefficiencies within your operations can silently inflate your retention expenses. Streamlining workflows, automating repetitive tasks, and optimizing internal processes can free up resources and improve overall efficiency.

This, in turn, lowers your customer retention cost formula inputs while simultaneously enhancing customer satisfaction by delivering faster and more effective service. Addressing these often-overlooked areas can yield significant cost savings and improve the overall effectiveness of your retention efforts.

Transforming Your Retention Economics Through Strategy

Optimizing your customer retention cost formula isn't simply about calculations. It's about building strong customer loyalty while also seeing improvements to your bottom line. This requires moving beyond theory and into practical, proven strategies.

Segmentation: The Key to Personalized Retention

One powerful strategy is customer segmentation, tailoring retention programs to specific groups. This personalized approach addresses individual needs and preferences. For example, high-value customers might appreciate exclusive perks and dedicated support. Newer customers, on the other hand, may benefit from targeted onboarding and educational materials. This not only boosts customer satisfaction but also focuses resources for maximum impact. It's like tailoring a suit – a personalized approach yields the best fit and satisfaction.

Proactive Customer Success: Preventing Churn Before It Happens

Proactive customer success initiatives are essential for optimizing retention economics. By addressing potential problems before they become major issues, you avoid costly recovery efforts. This might involve regular check-ins, personalized training, or proactive support based on customer behavior. Investing in proactive measures can significantly reduce churn and lower your overall customer retention cost.

Automation: Maximizing ROI for Retention Teams

Strategic automation can greatly enhance your retention team's performance. Automating repetitive tasks like email follow-ups, onboarding, and reports frees your team to focus on building relationships and handling complex customer needs. This not only boosts productivity but also maximizes the ROI of your retention efforts. Think of a factory automating its assembly line: increased output with the same number of workers, lowering per-unit costs. Automating retention tasks similarly lowers the per-customer cost.

Data-Driven Early Warning Systems: Prioritizing High-Risk Relationships

Data-driven early warning systems help identify at-risk customers before they churn. By analyzing customer behavior, engagement, and other data points, you can pinpoint customers showing signs of dissatisfaction. This allows for proactive intervention with targeted support or incentives, potentially saving valuable relationships. Much like a doctor uses diagnostic tests to identify potential health issues early, data analysis helps identify at-risk customers.

Evaluating Retention Initiatives: Focusing on ROI and Implementation

When evaluating retention initiatives, consider both potential ROI and implementation complexity. Prioritize high-ROI initiatives that are easy to implement. Complex initiatives with lower potential returns may need more evaluation or lower priority. This framework helps focus on effective strategies and avoids wasting resources on low-impact initiatives. This balanced approach maximizes ROI and streamlines the implementation of new retention programs. Toki, a loyalty platform designed for e-commerce, enables tracking customer behavior and segmenting customers for targeted retention efforts, optimizing your customer retention cost formula. Learn more about optimizing your retention strategies by visiting Toki's loyalty platform.

Avoiding the Costliest Retention Calculation Mistakes

Even seasoned businesses can sometimes stumble when calculating their customer retention cost (CRC). Overlooking key details can lead to inaccurate data and ultimately, poor financial decisions. Let's explore some of the most common, and costly, mistakes to avoid.

The Danger of Inconsistent Measurement

Imagine a scientist trying to perform an experiment using both inches and centimeters – the results would be chaotic. Similarly, using inconsistent measurements when calculating your CRC can lead to flawed insights. Switching between monthly and annual analysis, or inconsistently categorizing expenses, can significantly skew your results. This makes comparisons meaningless and hides the true cost of retention. Standardizing your measurements, including clearly defined categories and consistent timeframes, is essential for accurate analysis.

Why Cost-Cutting Can Backfire

While keeping costs under control is vital for any business, aggressively cutting corners with your retention strategies can be detrimental. For example, reducing customer support staff might initially seem like a smart way to save money. However, it can lead to longer wait times, frustrated customers, and ultimately, increased churn. This then forces you to spend more on acquiring new customers to replace the ones you lost. This short-sighted approach often ends up being more expensive in the long run.

The Pitfall of Treating All Customers Equally

Not all customers are created equal. Some contribute significantly to your bottom line, while others barely break even. Treating all customers the same in your retention efforts is inefficient. Think of it like a gardener watering weeds and flowers equally – the weeds thrive, but valuable resources are wasted. Similarly, investing heavily in retaining low-value customers diverts resources away from high-value relationships. Customer segmentation, based on their value, allows you to tailor your retention strategies and maximize your ROI.

Recognizing Misalignment With Business Objectives

Sometimes, the issue isn't the CRC calculation itself, but how it aligns with your overall business goals. A company focused on rapid growth, for example, might prioritize new customer acquisition over retaining existing ones, even if retention is more cost-effective long term. This misalignment can create unsustainable growth and hinder long-term profitability. Your retention strategy should always complement your broader business objectives. Using a balanced scorecard, which considers both financial and relationship metrics, can help ensure this alignment.

The Importance of a Balanced Perspective

While the CRC formula provides valuable insights, it's essential to see the bigger picture. A high CRC isn't necessarily bad if the customer lifetime value (CLV) is substantially higher. Understanding the relationship between CRC, CLV, and other key metrics gives you a holistic view of your retention economics. This balanced perspective empowers you to make data-driven decisions and maximize long-term profitability. Toki, a loyalty platform designed for e-commerce businesses, helps track customer behavior, segment customers, and personalize retention efforts, optimizing your CRC and maximizing CLV. Explore how Toki can transform your retention strategy by visiting Toki's loyalty platform.