How to Reduce Customer Churn: Proven Strategies to Retain Customers

To get a real handle on customer churn, you need to stop thinking about it as just plugging leaks. The secret is a proactive approach built around creating fantastic customer experiences, communicating smartly, and actually using the data you collect. It's about getting ahead of problems before a customer even thinks about walking away.

Why Churn Reduction Is Your Top Growth Lever

Most businesses treat customer retention like a defensive game—a necessary chore to stop the bleeding. But the smartest companies flip this idea on its head. They see that actively working to reduce churn is actually their most powerful engine for growth.

Once you make that mental shift, everything changes. Every single action you take to keep a customer becomes a direct investment in your company's financial future. You're not just saving one account; you're building a more stable, predictable, and profitable business from the ground up.

The Staggering Cost of Doing Nothing

Let's be clear: ignoring churn isn't a neutral decision. It's an incredibly expensive one. The financial sting of a lost customer goes way beyond that initial drop in revenue. Think about the ripple effect—you lose out on future recurring payments, potential upsells, and the kind of powerful word-of-mouth marketing you just can't buy.

The data tells a stark story. In the U.S. alone, businesses hemorrhage roughly $136.8 billion every year from customer churn that could have been prevented. A massive 67% of consumers will jump ship to a competitor right after a single bad customer experience, which shows just how tight the link between service and loyalty really is. To get a better grip on these fundamentals, it's worth taking a deeper look into understanding customer retention.

A whopping 59% of customers will ditch a brand after a few bad interactions, and 17% will leave after just one. That doesn't leave much room for error.

Shifting from Defense to Offense

When you start treating churn reduction as a growth strategy, you naturally begin investing more in the entire customer journey. Instead of just reacting to complaints, you build systems that help customers succeed and feel valued from the moment they sign up. A big part of this is knowing why customers leave in the first place. You can get a head start by learning how to address the most common reasons for customer churn.

This "offensive" mindset is all about:

- Flawless Onboarding: Making sure new customers get that "aha!" moment and see real value right away.

- Proactive Check-ins: Reaching out with helpful tips or to see how things are going before they have to ask for help.

- Building a Community: Fostering a sense of belonging that makes your brand more than just a product or service.

- Personalized Touches: Using what you know about your customers to make them feel uniquely seen and appreciated.

To put it all together, a strong churn reduction framework isn't just a single tactic but a combination of core strategies working in unison.

Core Pillars of a Modern Churn Reduction Strategy

Here's a high-level look at the essential strategies that build a powerful and effective framework for reducing customer churn. These pillars represent the shift from reactive fixes to proactive, relationship-building efforts.

| Strategy Pillar | Primary Goal | Key Actions |

|---|---|---|

| Data-Driven Insights | To understand why and when customers leave. | Track churn rates, conduct cohort analysis, and run customer surveys. |

| Proactive Engagement | To add value and solve problems before they escalate. | Implement a stellar onboarding process, send proactive tips, and offer support. |

| Loyalty & Gamification | To incentivize continued business and create "stickiness." | Develop a tiered rewards program, offer exclusive perks, and use game-like mechanics. |

| Personalization | To make every customer feel valued and understood. | Use customer data for tailored recommendations, personalized communication, and custom offers. |

By weaving these pillars into your overall business strategy, you move beyond simply trying to stop customers from leaving. You start building a business that customers genuinely don't want to leave.

How to Actually Measure and Understand Your Churn

You can't fix a leaky bucket until you know where the holes are. The same is true for customer churn. If you don't know the full story behind why customers are leaving, any attempt to stop them is just a shot in the dark. The first real step toward a strategy that works is moving beyond a simple, company-wide churn rate and becoming a bit of a data detective.

A top-level churn rate is a decent starting point, but it hides all the important details. The real "aha!" moments come from digging deeper. This means breaking down, or segmenting, your churn data to uncover the patterns hiding just below the surface.

Find the Story Within Your Data

Let’s say you run an e-commerce brand and see a 5% monthly churn rate. On its own, that number might not set off major alarm bells. But what happens when you start segmenting?

You might find that customers who came from your paid ad campaigns are churning at 10%, while those who found you through organic search are only leaving at a 2% clip. That one insight completely changes where you put your energy. Suddenly, you have a clear signal that there's a problem with either your ad targeting or the expectations your campaigns are setting.

Here are a few powerful ways I’ve seen companies successfully segment their churn data:

- By Customer Cohort: Group customers by the month or quarter they signed up. This is a classic for a reason—it shows you if your churn is getting better or worse over time. You might spot that a specific onboarding class is less sticky, pointing to a product change or marketing campaign that didn't land well.

- By Subscription Tier: If you run a SaaS or membership business, this is non-negotiable. Analyze churn for each pricing plan. You might discover your entry-level plan has sky-high churn because it’s missing a key feature, or that your top-tier customers are leaving because they don't see enough value for the high price tag.

- By Acquisition Channel: Just like in the example above, tracking churn based on how customers found you (paid ads, organic search, social media, referrals) is crucial. It tells you the real, long-term value of each channel, not just the initial conversion.

The Critical Difference: Voluntary vs. Involuntary Churn

It's also absolutely essential to separate the two main types of churn. Why? Because they demand completely different solutions.

Voluntary churn is what most people think of—a customer actively decides to cancel their subscription. Maybe they're unhappy, found a better alternative, or their needs have simply changed. This is the kind of churn you fight with loyalty programs, better customer support, and product improvements.

Involuntary churn, on the other hand, is when a customer leaves without meaning to. It’s almost always due to a failed payment, an expired credit card, or some other administrative hiccup. It's a silent killer because these customers didn't actually want to leave.

This distinction is especially important in the subscription economy. For B2B SaaS companies, the average monthly churn rate hovers around 3.5%, and you'd be surprised how much of that can be involuntary. When your business model is built on predictable recurring revenue, letting customers slip away because of a simple payment failure is a massive unforced error. You can explore some more benchmarks and insights on SaaS retention from Pendo.io to see how you stack up.

My Key Takeaway: Stop treating all churn as one and the same. Separating why customers leave (voluntary vs. involuntary) and who is leaving (segmentation) is the only way to apply the right fix to the right problem.

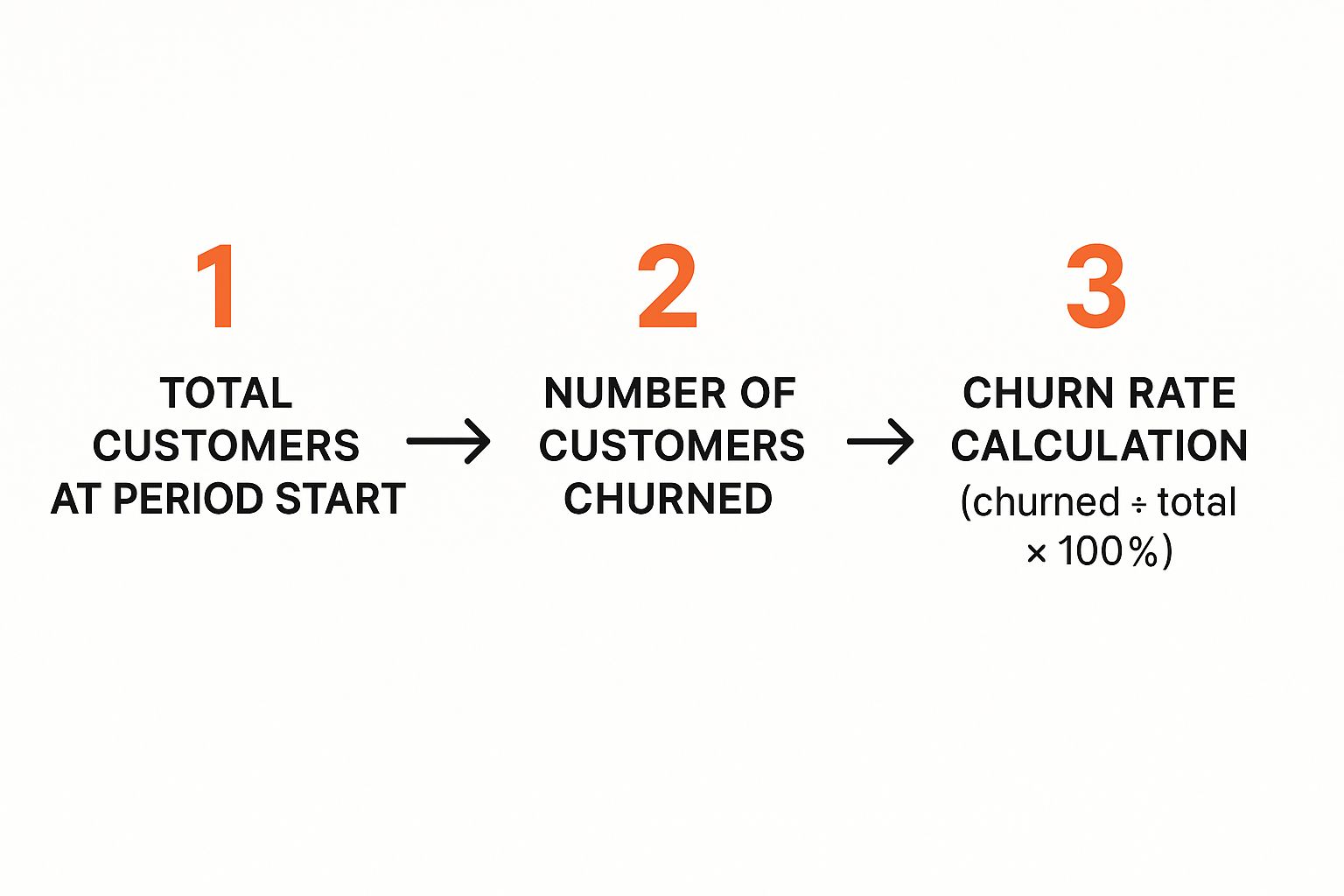

The infographic below shows the basic calculation for your overall churn rate. Think of this as the foundational metric you'll be segmenting.

This simple formula gives you your baseline. The real work—and the real results—begins when you apply this same calculation to each specific customer segment to finally find your biggest problem areas.

Building Loyalty That Goes Beyond Discounts

Let's be honest: a well-timed discount can grab someone's attention. But it's a quick fix, not a lasting solution for keeping customers around. If your relationship is built only on price, you'll lose them the moment a competitor offers a better deal.

True loyalty runs much deeper. It's forged through genuine connection, recognition, and the feeling of being part of something special. The real goal is to make customers want to stay with you, no matter what shiny object the competition dangles. It’s about shifting from transactional rewards to experiences that make your customers feel seen and valued. A 10% off coupon is forgettable. Feeling like a VIP in an exclusive community? That sticks.

Create an Emotional Hook with Gamification

So, how do you build that connection? One of the most powerful tools I've seen in action is gamification. This isn't about turning your store into a video game, but about borrowing game-like elements—points, badges, leaderboards—to make the customer experience more engaging and fun.

Think about the satisfaction of completing a challenge or unlocking an achievement. By weaving that psychology into your loyalty program, you tap into powerful motivators that keep people coming back. Suddenly, they aren't just buying something; they're making progress and participating in a journey with your brand.

Here are a few simple ways to get started with gamification:

- Progress Badges: Award digital badges for milestones. Did they make their fifth purchase? Leave a helpful review? Refer a friend? Acknowledge it.

- Tiered Memberships: Create levels like Bronze, Silver, and Gold. As customers spend more, they unlock better perks, giving them a clear incentive to climb the ladder.

- Leaderboards: For your most engaged customers, a leaderboard showing top point-earners can spark some friendly competition and drive even deeper involvement.

These mechanics work because they tap into our basic human desires for achievement, status, and recognition. It makes customers feel genuinely invested in your brand's ecosystem.

Make Rewards Personal and Meaningful

A generic reward says very little. A personalized one, on the other hand, tells a customer, "We see you." Instead of blasting everyone with the same offer, dig into your customer data to craft rewards that actually mean something to them.

A personalized reward based on a customer’s past purchases is infinitely more powerful than a generic one. It shows you're paying attention to them as an individual, not just a number.

For instance, if you know a customer frequently buys your dark roast coffee, surprise them with a free bag or an exclusive first taste of a new blend. That's a memorable moment—a "wow" experience that a competitor's blanket discount simply can't match. Building this kind of loyalty goes beyond just discounts, but it's always smart to explore proven methods for keeping people engaged. For a different perspective, you can even look at how institutions use student retention strategies for ideas that can be adapted to your customer base.

Foster a True Sense of Community

At the end of the day, your strongest defense against churn is a thriving community. When customers feel like they belong to a group of like-minded people, your brand becomes a part of their identity. That's a bond that's incredibly difficult to break.

You can start building this community through a few different avenues:

- Exclusive Spaces: Create a private Facebook group or Discord server where members can share tips, ask for advice, and connect with each other.

- Members-Only Content: Give your loyal customers exclusive access to valuable content like in-depth tutorials, expert webinars, or a first look at new products.

- Events: Host virtual or even small in-person events that bring your community together, solidifying their connection to you and each other.

Putting these programs into place does take some strategic thought. For a more detailed roadmap, our guide on loyalty program best practices can help you get started. By focusing on creating connection over just offering discounts, you build a brand fortress that competitors will find nearly impossible to breach.

Don't Wait for the "Goodbye" Email: A Guide to Proactive Support

The best way to deal with churn is to make sure it never becomes a real option for your customer. This means ditching the old "fire-fighting" support model where you just wait for problems to pop up. The real game-changer is a proactive mindset, where your team is always looking ahead, anticipating needs, and clearing roadblocks before the customer even hits them.

If you're waiting for a customer to complain, you've already waited too long. The magic is in spotting the subtle changes in their behavior—the digital breadcrumbs that signal they might be drifting away. These are your early warning signs, and acting on them is fundamental to reducing customer churn.

Learning to Read the Warning Signs

So, what exactly are you looking for? An at-risk customer rarely waves a giant red flag. Instead, it’s usually a series of small, quiet signals that, when pieced together, tell a story of disengagement. By tracking these cues, you can step in with a personal, helpful touch before a small annoyance snowballs into a cancellation request.

Keep an eye out for these common tells:

- A Dip in Product Usage: Is a once-daily user now logging in only once a week? This is a classic sign that they're getting less value from your platform.

- A Spike in Support Tickets: If one customer suddenly starts flooding your support desk, it’s a clear indicator of growing frustration.

- Poor Survey Feedback: Low scores on an NPS or CSAT survey aren't just data points; they're direct pleas for help.

- Ignoring Valuable Features: If a customer is still only using the most basic functions months after signing up, they probably don't realize the full power of what they're paying for.

Monitoring these signals lets you shift from simply reacting to problems to actively guiding your customers toward success.

Turning a Red Flag into a Conversation

Once you spot one of these signals, your response needs to feel human, not like an automated alert. This is where you can truly make a difference. Let's say your system flags a user who hasn't logged into their account in over two weeks.

Instead of a generic "We miss you!" email that gets ignored, a personalized note from a customer success manager can work wonders.

Here’s an example of a proactive outreach email:

Subject: Checking in - Everything okay with your [Product Name] account?

Hi [Customer Name],

I was just looking at your account and noticed you haven't been active in a couple of weeks. I wanted to personally reach out and see if you've hit any snags or if there's anything I can help with.

A lot of our users find [specific feature] really helpful for [achieving a goal], and I'd be happy to show you how it works if you're interested.

Just let me know if you’d be open to a quick chat.

All the best,

[Your Name] Customer Success Manager

This simple email transforms a potential churn risk into a positive, helpful interaction. It's this level of service quality that builds loyalty—in fact, 60% of customers point to good service as a key reason they stick around. Better yet, customers who have positive experiences with a brand tend to spend 140% more.

Email remains the go-to for these conversations, used by 89% of businesses to nurture their customer relationships. You can find more eye-opening statistics about customer retention on Exploding Topics.

Ultimately, proactive support is about solving problems your customers don't even know they have yet. That's how you stop churn and start building a base of true brand advocates.

Using AI and Analytics to Predict Customer Churn

Moving from a reactive to a proactive support model is a great first step. But what if you could get ahead of the problem before any red flags even pop up? This is exactly where modern analytics and artificial intelligence are changing the game, turning churn reduction from a guessing game into a data-driven science.

Instead of just watching engagement metrics and hoping for the best, you can make your customer data work for you. Predictive models sift through thousands of data points to pinpoint customers who are starting to drift away, giving you a crucial window to intervene when it will make the most difference.

How Predictive Churn Models Work

At its heart, a predictive churn model is just an algorithm that learns from your own history. It looks at the behavior of all the customers who have left in the past and identifies the common threads and subtle patterns. It then uses those patterns to flag current customers who are starting to act the same way.

Think of it as an incredibly smart early warning system. The model crunches all kinds of signals to generate a churn risk score for every single customer. This score gives you a clear probability of how likely someone is to cancel their subscription or stop buying from you soon.

What kind of data fuels these models? It’s a mix of things you’re probably already tracking:

- Engagement Metrics: A dip in login frequency, less time spent in your app, or ignoring key features they used to love.

- Purchase History: A sudden drop in average order value, buying less frequently, or switching from premium to basic products.

- Support Interactions: A recent spike in support tickets or a string of low satisfaction scores after their issues are resolved.

By weaving all these data points together, AI can uncover correlations that a human analyst could easily miss. It gives you a powerful head start on your retention efforts. If you want to get into the nitty-gritty of how this works, our guide on how to use machine learning to improve customer loyalty breaks it down further.

Making AI-Powered Insights Actionable

A churn risk score is fantastic, but the real magic happens when you act on it. Knowing who might leave allows you to laser-focus your retention efforts where they'll have the biggest impact.

Instead of launching broad, generic win-back campaigns, you can segment your outreach based on risk. A high-value customer with a high churn score needs a different approach than a low-value user who is also at risk.

For instance, a top-tier customer whose churn score suddenly spikes might get a personal phone call from a dedicated account manager. For a group of medium-risk users, you might trigger an automated email sequence that showcases new features you think they'll find valuable.

The good news is you don’t need a massive data science team to get started. Many modern CRMs and specialized churn prediction tools have this technology built right in. These platforms can automate everything from renewal reminders to personalized retention offers, translating complex data into simple, actionable steps that directly fight churn. This targeted approach means you’re not just fighting churn, but you’re fighting it smartly.

Answering Your Top Questions About Churn

Even with a solid game plan, you're bound to run into some specific questions once you start digging into customer churn. Let's tackle some of the most common hurdles I see businesses face when they put their retention strategies into practice.

What Is a Good Customer Churn Rate, Really?

This is the million-dollar question, and the honest answer is: it depends. There’s no magic number that works for everyone. An acceptable churn rate shifts dramatically based on your industry, business model, and even how mature your company is.

For a typical B2B SaaS company, a monthly churn rate under 5% is often seen as a healthy benchmark. But if you’re a direct-to-consumer e-commerce brand, seeing an annual churn rate between 20-30% might be completely normal.

The most important thing isn't hitting some arbitrary industry standard. It's about consistently tracking your own churn rate, figuring out what’s causing it, and taking deliberate steps to bring it down. The real win is seeing that number consistently trend downward over time.

How Quickly Will I Actually See Results?

How fast you'll see a drop in churn really comes down to the tactics you're deploying. Some moves can deliver a quick boost, while others are more of a long-term play.

- Quick Wins (Think Weeks to Months): Things like launching a targeted win-back campaign for recently lapsed customers or smoothing out a clunky onboarding process can show a noticeable impact pretty fast, sometimes within just a few weeks.

- Strategic Impact (Months to a Year): Bigger, more fundamental changes require patience. Building a vibrant user community from scratch or completely overhauling your pricing model are strategic investments. They take longer to gain momentum but often result in much stickier, long-term loyalty.

My best advice? Don't get discouraged if things don't change overnight. Kick things off with a few high-impact, quick wins to build momentum while you lay the groundwork for the bigger strategies that will pay off down the road.

Should We Focus on Reducing Churn or Getting New Customers?

It's a classic growth dilemma, but the answer isn't "one or the other." You absolutely need a balanced approach. While bringing in new customers is the fuel for expansion, focusing on retention is almost always the more profitable move.

The numbers don't lie: acquiring a new customer can be 5 to 7 times more expensive than keeping an existing one. That's a staggering difference. By investing in churn reduction, you're directly boosting your revenue and stability with a much smaller financial hit. A healthy business does both, but you should never chase new logos at the expense of the customers who already trust you.

What's the Difference Between Logo Churn and Revenue Churn?

It’s absolutely critical to track both of these metrics because they tell you two very different—and equally important—stories about the health of your business.

-

Logo Churn is straightforward. It’s the number of customers (or "logos") you lose. If you start the month with 100 customers and 5 leave, your logo churn is 5%.

-

Revenue Churn tracks the actual dollar amount of monthly recurring revenue (MRR) you lose from those cancellations.

Let’s imagine you lose those five customers. Four were on a basic $20/month plan, but the fifth was an enterprise client paying $2,000/month. Your logo churn is still a seemingly small 5%, but your revenue churn would be a massive blow. Tracking both helps you see the true financial impact and prioritize saving your most valuable accounts.

How Does Customer Segmentation Help Reduce Churn?

Segmentation is your secret weapon for making your retention efforts count. Not all customers are the same, and they shouldn't be treated that way. By grouping them into meaningful segments, you can stop guessing and start tailoring your actions with precision.

You can create segments like:

- High-Risk Customers: These are the users who are fading away—their engagement is low, or they've left some unhappy feedback. They need proactive outreach, maybe a special offer or a personal check-in from your success team.

- New Customers: This group is in a critical make-or-break period. Your entire focus should be on a flawless onboarding experience that shows them the value of your product right out of the gate.

- Power Users: These are your champions. The goal here is to keep them delighted with exclusive perks, early access to new features, and opportunities to become true advocates for your brand.

When you personalize your approach for each segment, your efforts become exponentially more effective.

Ready to turn churn from a problem into a growth opportunity and build a legion of loyal fans? Toki gives you all the tools you need, from tiered memberships and engaging gamification to the powerful analytics that tie it all together. See how our all-in-one loyalty platform can transform your customer relationships and boost your bottom line. Discover how Toki can help!